Biden Administration Doorknob moment for the LNG industry

The Double-Edged Sword of LNG: Economic Gains vs. Environmental Costs

TL;DR

Biden Administration and LNG: The Biden administration’s energy policies have drawn criticism from the LNG sector, particularly for perceived opposition to fossil fuels. A recent Department of Energy report on U.S. LNG exports acts as a "doorknob moment," providing a detailed analysis of economic, environmental, and geopolitical impacts.

Key Findings of the Report: LNG exports boost U.S. economic output and global energy security but increase domestic natural gas prices and greenhouse gas emissions. The report highlights disparities in regional price impacts, community burdens, and environmental risks, especially in areas near export facilities.

Criticisms and Reactions: Environmentalists praise the report’s focus on emissions and community effects, while industry advocates criticize its emphasis on negative environmental outcomes, arguing it downplays LNG's role in displacing dirtier fuels like coal and its economic benefits.

Global and Strategic Implications: The report underscores U.S. LNG's vital role in stabilizing global energy markets and strengthening geopolitical alliances, particularly in response to crises like Europe’s pivot from Russian gas. It notes Asia, especially China, as a major future LNG market.

Conclusion: The report highlights the balancing act between economic growth, energy security, and environmental concerns. While it serves as a crucial policy resource, it has ignited debates among stakeholders about how LNG fits into U.S. energy and environmental strategies.

And now for the Deep Dive…

Introduction

The Biden administration has made no qualms that it is not a friend to traditional fossil fuel based US energy. It has tried to ban US export licenses for liquefied natural gas (LNG) exports to be thwarted by federal courts. It has slow rolled or no rolled FERC approvals for projects.

A "doorknob moment" refers to a situation where someone shares crucial information or a significant disclosure at the very last minute of a conversation, often while literally reaching for the doorknob to leave, signifying that they waited until the end to reveal something important, usually due to hesitation or discomfort in bringing it up earlier.

And this most recent report by the U.S. Department of Energy can be argued as a doorknob moment by the Biden administration to US energy and in particular LNG exporting. Here is why.

Information

I actually read the entire report and all of the annexes. This will be a straight up analysis of what it actually says and not a summary of an interest group like the oil and gas lobby or Sierra Club or Greenpeace. Very few folks actually read the report and most folks even in the mainstream media end up being repeaters of hearsay. No matter your perspective or interest, this report is not a Henny Penny report or one that spells doom for one side or the other.

The "Energy, Economic, and Environmental Assessment of U.S. LNG Exports" is an attempt to provide a comprehensive evaluation of how U.S. LNG exports impact energy markets, economic systems, and environmental outcomes. The report, prepared for the U.S. Department of Energy, offers an updated perspective on domestic and global implications of LNG exports, incorporating factors such as energy security, greenhouse gas emissions, and community effects. It uses extensive modeling to explore various scenarios influenced by policy, technology, and market dynamics through 2050.

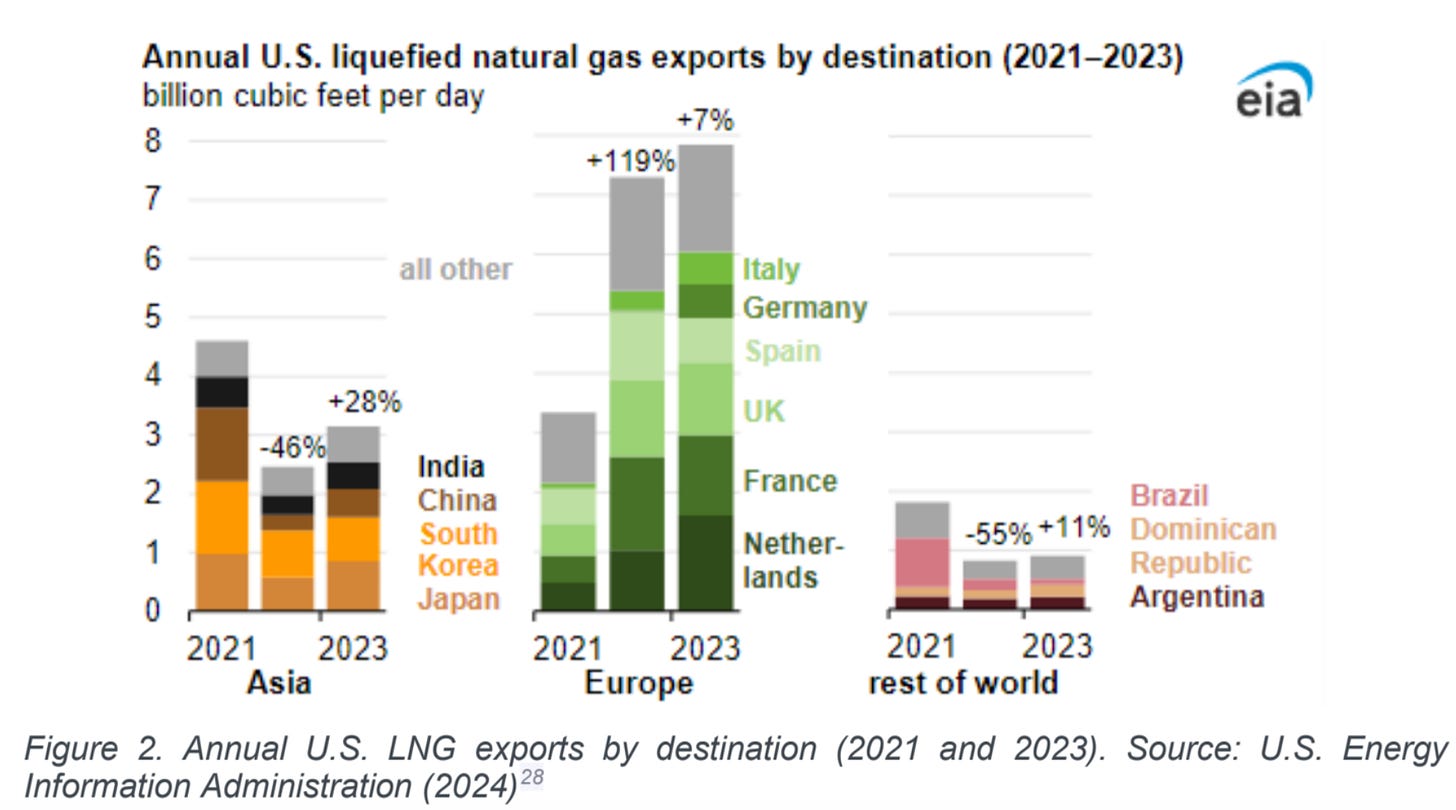

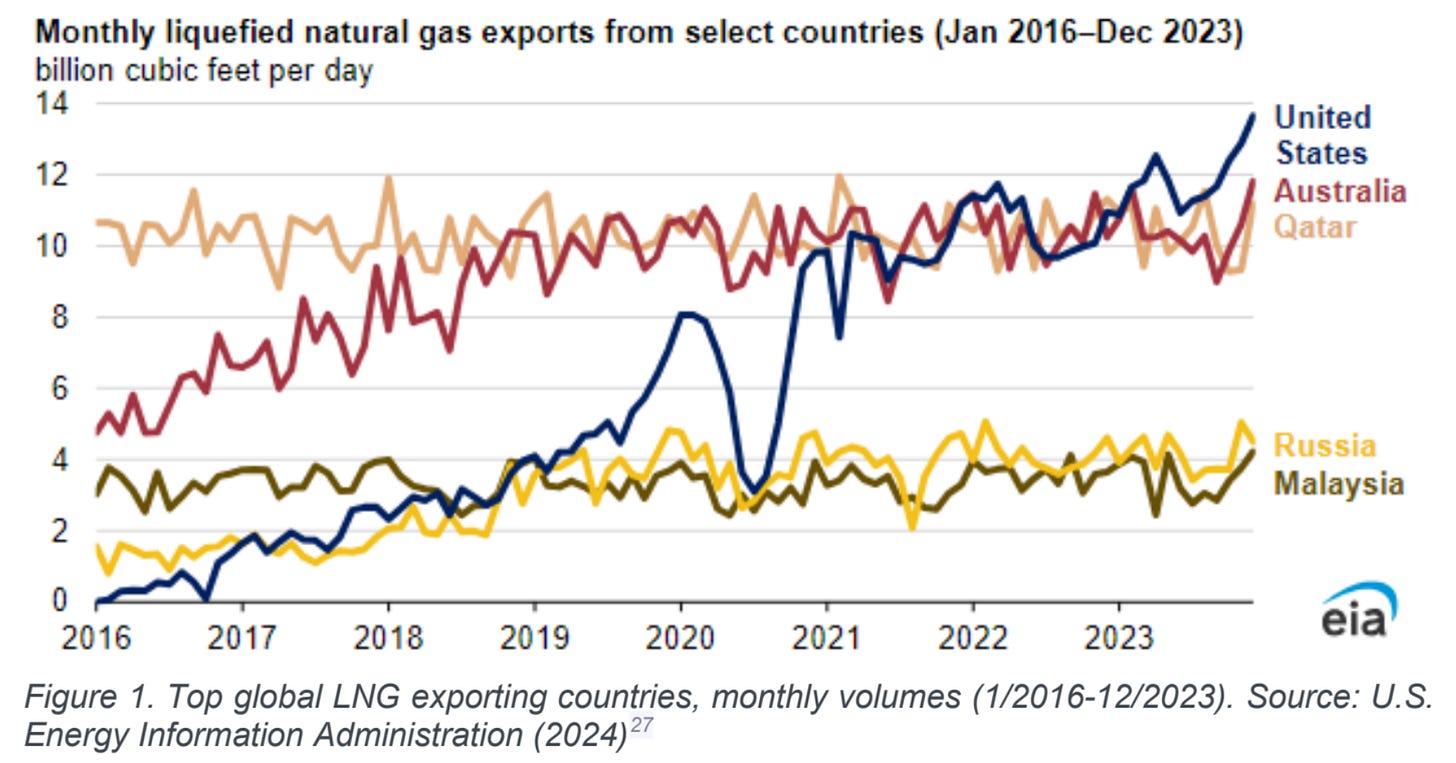

The assessment underscores the U.S.'s significant role in the global LNG market, highlighting the country's rise to the largest LNG exporter by 2023. This shift is attributed to the growth of LNG infrastructure and increased demand, particularly following disruptions caused by the Russian invasion of Ukraine. The study examines the interplay between U.S. LNG exports and domestic natural gas prices, noting regional disparities in price impacts. While the exportation enhances domestic gross industrial output and GDP, it also results in higher energy costs for consumers, particularly in regions close to export facilities. The report also reveals a complex relationship between U.S. exports and global energy security, with U.S. LNG providing stability and cost-competitive options for countries transitioning their energy portfolios.

The environmental analysis highlights that U.S. LNG exports contribute both directly and indirectly to global greenhouse gas emissions. The report uses a lifecycle approach to assess the emissions associated with LNG production, transport, and usage, emphasizing the consequential impacts on global energy systems. While LNG displaces higher-emission energy sources in some scenarios, its increased availability results in marginal global emissions growth in others. These environmental outcomes vary significantly across scenarios, depending on policy stringency and technology advancements, such as the deployment of carbon capture and storage (CCS).

Community and environmental effects of LNG export activities are also discussed, particularly in regions where natural gas is produced and exported. The report points out that marginalized and rural communities often bear a disproportionate share of the environmental risks associated with natural gas development. Impacts include air and water quality concerns, induced seismicity, and land use changes. However, natural gas production and export activities also bring economic benefits, such as job creation and local revenue generation, although these benefits are not evenly distributed among residents.

The study uses four modeling tools to simulate the outcomes of varying LNG export levels under different policy and technology scenarios. These include projections of global LNG demand, domestic energy prices, industrial output, and consequential greenhouse gas emissions. Additionally, the study provides a qualitative review of energy security implications and community effects, ensuring a holistic understanding of LNG export impacts. This multi-faceted analysis aims to inform the U.S. Department of Energy's decision-making on LNG export authorizations while balancing economic, environmental, and social considerations.

Background and Political Background of the Report

The "Energy, Economic, and Environmental Assessment of U.S. LNG Exports" report was commissioned by the U.S. Department of Energy's Office of Fossil Energy and Carbon Management (FECM) to provide a comprehensive update on the impacts of U.S. LNG exports. This study aims to inform the Department's public interest determination regarding the authorization of LNG exports to non-Free Trade Agreement (non-FTA) countries, as mandated by Section 3 of the Natural Gas Act. The primary purpose of the report is to evaluate how varying levels of U.S. LNG exports affect domestic economic conditions, energy prices, energy security, greenhouse gas emissions, and local environmental and community impacts.

The political background for this report is deeply rooted in the evolving dynamics of global energy markets and U.S. energy policy. Since the inception of significant U.S. LNG exports in 2016, the U.S. has emerged as the world's largest LNG exporter, particularly following geopolitical events like Russia's invasion of Ukraine in 2022, which led to a dramatic shift in global LNG trade patterns. This event underscored the strategic importance of U.S. LNG in enhancing energy security for Europe and other regions by providing a flexible supply alternative to Russian gas.

Moreover, the political landscape has been influenced by significant legislative changes such as the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA), which have promoted the deployment of clean energy technologies and altered the domestic energy policy framework. These laws reflect a broader national and international push towards decarbonization, influencing the demand for and supply of natural gas.

The report also emerges in a context where there is growing national attention on the environmental and social justice implications of expanding natural gas production and exports. This includes considerations of how such activities disproportionately impact communities of color, rural areas, and low-income populations, leading to federal executive orders focusing on environmental justice, climate justice, racial equity, and sustainability. Additionally, the study reflects the need to balance economic benefits with environmental concerns, capturing the complex dynamics of energy policy, climate change commitments, and technological advancements in the natural gas sector. This comprehensive analysis helps in navigating the intersection of energy policy, environmental impact, and economic activity in a politically charged and rapidly changing global energy landscape.

Supporters of the LNG industry argue that the report paints a negative picture of LNG exports, potentially confirming the Biden administration’s rationale for not approving new LNG export licenses in the recent past. They contend that the report's detailed examination of environmental impacts, particularly the consequential life cycle greenhouse gas (GHG) analysis, emphasizes the negative aspects of LNG, overshadowing its economic and energy security benefits. This focus on emissions and environmental degradation, they argue, could be used by environmental groups and policymakers to advocate against new export projects, thereby casting LNG in an unfavorable light.

Proponents of LNG also criticize the report for what they perceive as an overemphasis on scenarios where LNG exports lead to increased GHG emissions, suggesting that this framing might be politically motivated to align with anti-fossil fuel agendas. They assert that the report does not sufficiently highlight the role of LNG in displacing more carbon-intensive fuels like coal in international markets, which could have led to a more balanced view of its environmental impact. By focusing on potential increases in emissions, the report, according to these critics, could deter investments and policy support for expanding LNG infrastructure, which is crucial for maintaining U.S. influence in global energy markets.

Moreover, these critics argue that the report's discussion of community impacts, including the social and environmental justice issues related to LNG production and export sites, might be exploited to oppose new projects. They claim that the narrative around disproportionate burdens on communities of color and low-income areas could be politicized to slow down or halt the approval of new export licenses. This perspective sees the report as potentially providing ammunition for those who wish to restrict the growth of the LNG sector, arguing that it does not adequately recognize the economic benefits, job creation, and energy security enhancements that LNG exports bring to both domestic and international arenas.

Lastly, there's an argument from industry advocates that the report's scenario analyses, especially those with stringent climate policy assumptions, might be interpreted as discouraging further LNG exports. They believe that by not providing a more positive outlook for LNG under various policy environments, the report could lead to more conservative or restrictive government policies on export licensing, ultimately affecting the U.S.'s ability to leverage its natural gas resources for both economic gain and geopolitical influence.

The Key Findings

The report itself has four key findings: Domestic Natural Gas Supply and Economic Impacts, Energy Security, Greenhouse Gas Emissions, and Environmental and Community Effects.

Domestic Natural Gas Supply and Economic Impacts: The report concludes that the U.S. domestic natural gas supply is adequate to support increased LNG exports while still fulfilling domestic demand across all modeled scenarios. This holds true regardless of assumptions regarding U.S. oil and gas supply. However, increasing U.S. LNG exports leads to higher natural gas prices at the Henry Hub, with an estimated 31% increase in the 2050 price under the Defined Policies scenario, translating to about $0.03/MMBtu for every Bcf/d increase in exports above existing levels. Higher exports correlate with higher residential natural gas prices, although the impact varies by region with the Gulf Coast and Southwest regions experiencing the most significant price increases due to their proximity to LNG export facilities. Economically, higher LNG exports are associated with increased industrial output, particularly from the oil and gas extraction sector, contributing to a rise in gross domestic product (GDP) by 0.2% in 2050 under reference supply assumptions. However, this also leads to higher energy costs for the industrial sector, with cumulative increases in energy costs from 2020 to 2050.

More specifically, the study also examines how these domestic price changes affect various sectors. For instance, residential natural gas prices are projected to increase by 4% under reference supply conditions when exports reach Model Resolved levels. This increase is more pronounced in scenarios with lower domestic supply, where residential prices could rise by up to 7%. Industrial sectors see a rise in energy costs, with cumulative industrial energy costs increasing by $125 billion from 2020 to 2050 under reference supply assumptions due to higher natural gas prices. However, this rise in costs is offset somewhat by increased industrial output, particularly in oil and gas extraction, which sees a significant boost from export-related activities.

On the international front, the study notes that U.S. LNG, being destination-flexible, tends to follow global market demand, which can influence international LNG prices. The document highlights that while U.S. LNG contributes to global supply, its impact on international prices is complex due to various factors including geopolitical tensions, like the Russian invasion of Ukraine, which shifted LNG flows primarily towards Europe, thereby affecting regional price dynamics. In 2022, for example, European and Asian LNG prices experienced significant volatility due to these shifts. The study suggests that if U.S. LNG exports continue to grow, they could stabilize or reduce volatility in global LNG markets by providing additional supply flexibility, although this is contingent on global demand patterns and the competitive landscape with other LNG exporters like Qatar.

The projections also take into account the potential for price volatility due to the long-term nature of U.S. LNG contracts, which can insulate domestic prices from immediate global shocks but might expose them to broader market trends over time. With the U.S. becoming the largest exporter of LNG, its influence on global gas prices could increase, potentially benefiting or challenging different markets based on their energy strategy and reliance on imported LNG. However, the study does not delve into precise international price forecasts but indicates that the U.S.'s role in the global LNG market will be pivotal in shaping price trends, especially in regions like Asia where LNG import infrastructure is expanding rapidly.

Energy Security: The report highlights the role of U.S. LNG in global energy markets, noting that LNG has been increasingly used by countries to diversify their energy portfolios, thereby enhancing energy security. U.S. LNG is seen as cost-competitive and provides a stable supply due to long-term off-take contracts, which was particularly evident when Europe turned to U.S. LNG following the reduction in Russian gas supplies after the 2022 invasion of Ukraine. However, the report acknowledges that future demand for U.S. LNG is uncertain as global energy policies shift towards reducing fossil fuel use, particularly in Europe. Asia, particularly China, is expected to remain a significant market for U.S. LNG, with projections indicating that China could be the largest importer by 2050 in various scenarios. The flexible nature of U.S. LNG contracts, allowing for destination changes, has been crucial in responding to global market demands, although this flexibility can also lead to market volatility and supply uncertainties.

Greenhouse Gas Emissions: The report's analysis on greenhouse gas emissions focuses on a consequential life cycle approach rather than just attributing emissions directly to LNG. It finds that increasing U.S. LNG exports generally leads to higher global GHG emissions, driven by the displacement of other energy sources, including renewables, nuclear, or other fossil fuels without carbon capture and storage (CCS). In the Defined Policies scenario, an increase in U.S. LNG exports from existing levels to model-resolved levels results in an additional 0.08% in cumulative global services and a 0.05% increase in cumulative global GHG emissions by 2050. The intensity of these emissions varies across scenarios, influenced by global climate policies and technology availability. The report also introduces the concept of the social cost of greenhouse gases (SC-GHG) to monetize these impacts, showing significant economic costs associated with increased emissions from higher LNG exports.

Environmental and Community Effects: This section of the report discusses the myriad impacts of natural gas production, transportation, and export on local environments and communities. It acknowledges that increased production for export heightens upstream environmental impacts like water use, air pollution, and land use changes. There's a noted correlation between natural gas activities and induced seismicity, particularly from produced water disposal. From a community perspective, while natural gas development can spur economic growth through job creation and revenue, it also disproportionately affects communities of color and low-income areas with higher exposure to pollutants. The report highlights the need for further research on the community impacts of LNG export facilities, pointing out that in areas with existing heavy industry, like the Gulf Coast, the cumulative impact might be significant. It discusses both the beneficial economic effects and the detrimental environmental and quality of life impacts, including noise, light pollution, and social disruptions.

Methodology Used and Public Interest Criteria Used

All reports like this is a series of value judgments. And with value judgments people can and will reasonably and unreasonably disagree as to the priorities and the assignment of value to different criteria. It is the assignment of value and the relative prioritization of criteria that will drive the outcome of any report. Therefore, to be critical thinkers we must look at how the authors struggled with this to properly interpret their outcome.

This report employs a methodology to evaluate the multifaceted impacts of U.S. LNG exports. The study utilizes four distinct models for analysis: the Global Change Analysis Model (GCAM) from Pacific Northwest National Laboratory (PNNL), the National Energy Modeling System (NEMS) modified by OnLocation, Inc., the Household Energy Impact Distribution Model (HEIDM) developed by Industrial Economics, Incorporated (IEC), and a life cycle assessment (LCA) model from the National Energy Technology Laboratory (NETL). These models are used to assess a variety of policy, technology, and export level scenarios.

GCAM is initially used to project global demand for U.S. LNG and its greenhouse gas (GHG) emissions impacts under different global climate policies and technology availability assumptions. This global demand projection then feeds into NEMS to explore domestic impacts, including changes in natural gas prices, consumption patterns across economic sectors, and overall changes in GDP. HEIDM further details how these changes in energy prices affect U.S. households, providing insights into distributional economic effects. Finally, NETL's LCA model calculates the consequential life cycle GHG emissions associated with U.S. LNG exports, going beyond direct emissions to consider market-driven changes in energy use globally.

The methodology is guided by a set of public interest criteria that the U.S. Department of Energy (DOE) considers when reviewing applications for LNG export authorizations to non-Free Trade Agreement (FTA) countries under Section 3 of the Natural Gas Act. These criteria include:

The domestic need for the natural gas proposed for export, assessing whether the U.S. has sufficient supply for both domestic use and export.

The security of domestic natural gas supplies, evaluating whether export levels could threaten domestic energy security.

Consistency with DOE's policy of promoting market competition, by considering how exports might affect market dynamics both domestically and internationally.

Other factors bearing on the public interest, which include international impacts, such as global energy security, and environmental effects, particularly GHG emissions and local environmental impacts.

This approach allows the study to not only assess the economic implications of LNG exports but also to weigh these against environmental and energy security considerations. The study does not provide a single forecast but explores a range of scenarios to reflect the uncertainty in long-term energy markets and policy environments, thereby informing DOE's determination of whether LNG exports align with the public interest.

Problems with the method and criteria?

With no apologies this reports places a significant emphasis on environmental considerations, particularly greenhouse gas (GHG) emissions, in evaluating the impacts of LNG exports. This focus is evident in several aspects of the study's approach.

Firstly, the report employs a consequential life cycle GHG analysis through NETL's LCA model. This method goes beyond simply attributing direct emissions from production, liquefaction, and combustion of natural gas. Instead, it considers the broader implications of LNG exports on global energy markets—how increased availability of U.S. LNG might influence energy consumption patterns, displace other energy sources, and ultimately affect global GHG emissions. By assessing these market-driven effects, the study provides a more comprehensive view of the environmental impact, highlighting potential increases in global emissions due to LNG exports.

Secondly, the scenarios modeled in the GCAM explicitly explore different climate policy and technology availability conditions, which inherently includes considerations for GHG emissions. For instance, scenarios range from 'Defined Policies' to 'Net Zero 2050', each reflecting varying levels of ambition in global climate policies and the deployment of technologies like carbon capture and storage (CCS). This setup allows the study to analyze how U.S. LNG fits into a world increasingly focused on reducing carbon emissions, thereby making GHG implications a central part of the analysis.

Moreover, the public interest criteria used by DOE for evaluating LNG export applications include explicit consideration of environmental impacts. Among the factors bearing on the public interest, the report not only looks at the domestic need for gas and energy security but also evaluates the environmental consequences of exports. This includes assessing local environmental impacts like air and water pollution, land use changes, and induced seismicity, alongside global GHG emissions. The inclusion of such detailed environmental analysis in the public interest determination process underscores the weight given to these factors.

Additionally, the report's discussion on the Social Cost of Greenhouse Gases (SC-GHG) monetizes the environmental impact of increased emissions from LNG exports, providing a tangible economic metric for the environmental cost. This approach directly links environmental impact with economic valuation, ensuring that GHG emissions are not just noted but are also quantitatively factored into the assessment of LNG exports' desirability from a public interest perspective.

By placing a significant emphasis on the environmental impact, particularly greenhouse gas emissions, the "Energy, Economic, and Environmental Assessment of U.S. LNG Exports" could be seen as disproportionately highlighting negative aspects at the expense of recognizing the positive contributions of LNG exports. This approach might unfairly skew the narrative, potentially overshadowing several beneficial impacts that LNG exports have on the economy, energy security, and international relations.

Economically, LNG exports have been shown to stimulate growth in various sectors. The report acknowledges increases in industrial output, particularly in oil and gas extraction, leading to job creation and higher GDP. However, the detailed environmental analysis, including the consequential life cycle GHG assessment, might overshadow these economic benefits. By quantifying the environmental cost through metrics like the Social Cost of Greenhouse Gases (SC-GHG), the study might give the impression that these environmental costs are disproportionately high, potentially deterring further investment or policy support for expanding LNG infrastructure when economic benefits are not given equivalent weight in the discourse.

In terms of energy security, U.S. LNG has played a crucial role in stabilizing global energy markets, especially in times of geopolitical instability, like the European energy crisis following the Russian invasion of Ukraine. The flexibility of U.S. LNG contracts has allowed for quick responses to supply disruptions, enhancing the energy security of importing nations. However, the report's focus on emissions might lead to a policy environment where these security benefits are undervalued or ignored in favor of environmental concerns, potentially leading to a more volatile global energy market if LNG exports are curtailed.

Moreover, the report's emphasis on environmental impacts does not fully capture the strategic geopolitical advantages of LNG exports. The U.S. has used its LNG to forge stronger international alliances and influence global energy politics, providing alternatives to countries looking to diversify from more politically unstable suppliers. By focusing heavily on environmental implications, the study might inadvertently support arguments against LNG expansion, which could undermine these strategic benefits without sufficient counterbalance from the positive geopolitical impacts.

While it's crucial to address environmental concerns, the methodology's focus might lead to an unbalanced view where the environmental negatives are overly accentuated compared to the economic, security, and diplomatic positives. This could result in policy recommendations that overly restrict LNG exports based on environmental considerations alone, potentially at the cost of broader national interests like economic development and international energy stability. A more balanced approach might involve giving equal weight to these diverse impacts, recognizing that the transition to cleaner energy sources needs to consider the full spectrum of consequences, not just environmental ones.

The Reception to the Report

The reception to the "Energy, Economic, and Environmental Assessment of U.S. LNG Exports" report has varied significantly across different groups, reflecting a spectrum of interests and concerns.

Environmentalists have generally expressed a critical stance towards the report. Many have highlighted the document's findings on greenhouse gas emissions, pointing out that increased U.S. LNG exports could lead to higher global GHG emissions, particularly in scenarios where LNG displaces cleaner energy sources like renewables or nuclear power. There is a concern that this could undermine climate goals, especially given the projections of increased emissions intensity in certain scenarios. Environmental groups advocate for a more aggressive transition to renewable energy sources and often criticize the report for not emphasizing enough the environmental and community impacts, including air pollution, water usage, and induced seismicity associated with natural gas production and export.

The LNG industry, on the other hand, has likely welcomed the report's economic projections, which suggest that increased LNG exports could boost domestic economic output and employment, particularly in regions where LNG facilities are located. The industry might focus on the report's findings that show potential increases in GDP and industrial output due to expanded LNG exports. However, they might also use the report to counter environmental critiques by arguing that natural gas can serve as a bridge fuel in the transition to cleaner energy, citing the scenarios where LNG displaces more carbon-intensive fuels like coal in international markets. The industry could leverage the report's insights on energy security to advocate for further investments in LNG infrastructure, emphasizing U.S. LNG's role in stabilizing global energy supplies.

Internationally, the reception varies depending on the energy policies and needs of different countries. Nations heavily reliant on natural gas imports, particularly those in Europe post the Russian-Ukrainian conflict, might view the report positively, seeing U.S. LNG exports as a stabilizing force in global energy markets. Countries like China, identified in the report as the largest LNG importer, may find strategic value in the projections of continued LNG demand. However, countries with aggressive renewable energy targets or those concerned about energy costs might be wary of the report's implications, fearing higher and more volatile gas prices could hinder their decarbonization efforts or economic planning.

Other stakeholders, including policymakers, energy analysts, and local communities near LNG facilities, have mixed reactions. Policymakers might use the report to inform decisions on energy policy, trade agreements, and environmental regulations, weighing the economic benefits against environmental costs. Local communities, particularly those in areas like the Gulf Coast, might have divided opinions based on the potential economic benefits versus the environmental and quality-of-life impacts outlined in the report. Community groups advocating for environmental justice could find ammunition in the report's discussion on disproportionate impacts on marginalized communities, pushing for better regulatory oversight or compensation measures.

Overall, the report has sparked a broad debate, with each group interpreting its findings through the lens of their specific interests, whether they be environmental protection, economic development, or energy security.

Drill Baby Drill and Trump

Given President Trump's reduced priority for environmental concerns and his intense focus on promoting American energy, economic dominance, and resolving trade imbalances, the "Energy, Economic, and Environmental Assessment of U.S. LNG Exports" report still holds considerable significance. The report's economic and energy projections provide a strategic roadmap for enhancing U.S. energy dominance, which aligns well with Trump's policy agenda.

The report's analysis on how increased LNG exports could boost domestic economic output, particularly in the industrial sector, resonates with Trump's vision of revitalizing American industry. It details the potential for increased GDP and industrial activity, areas that Trump would likely prioritize to underscore American economic prowess and job creation. The insights into domestic price changes due to higher exports can guide policy to ensure that these benefits are maximized while managing any adverse effects on consumers.

Moreover, the report's global market analysis could be pivotal in Trump's strategy to address trade imbalances. By highlighting the U.S. as a leading exporter of LNG, the report offers a blueprint for leveraging LNG to improve America's trade position. Countries like China, which are already major importers of U.S. LNG, represent markets where the U.S. could negotiate better trade terms or reduce trade deficits. Trump's approach to trade has often involved pushing for more favorable deals, and increasing LNG exports could be a tool to achieve this, especially with nations that have significant trade surpluses with the U.S.

While the environmental aspects might not sway Trump's decisions, the economic and geopolitical benefits outlined in the report could be used to argue for policy actions that promote LNG exports without the usual environmental caveats. This could mean pushing for regulatory adjustments or international agreements that focus on economic and strategic advantages, such as securing long-term contracts or fostering alliances based on energy supply.

In essence, even if Trump disregards the environmental implications, the report's data on economic benefits and its strategic insights into global energy markets can serve as a guide for his administration to advance U.S. energy dominance, support American industries, and address trade imbalances through increased LNG exports. The report's value lies in its detailed analysis of how these exports can strengthen America's position on the world stage, aligning perfectly with Trump's America-first energy policy.

Conclusion

The "Energy, Economic, and Environmental Assessment of U.S. LNG Exports" underscores the complex interplay between economic, environmental, and geopolitical dimensions of U.S. LNG exports. It highlights the nation's emergence as a global energy leader, capable of influencing markets, enhancing energy security for allies, and driving domestic economic growth. However, the report also sheds light on the environmental and community challenges associated with LNG exports, particularly greenhouse gas emissions and localized impacts.

While proponents emphasize the economic and energy security benefits, critics argue that the environmental focus overshadows these positives, potentially shaping policies that restrain the LNG industry's growth. The varying reception to the report reflects the diverse interests of stakeholders, from policymakers and environmental advocates to industry leaders and local communities.

Ultimately, the report serves as a pivotal resource for decision-making, providing a nuanced understanding of LNG exports' multifaceted impacts. Balancing these economic opportunities with environmental and social responsibilities will require deliberate, informed policymaking to align LNG export strategies with both domestic priorities and global sustainability goals.

Sources:

U.S. Department of Energy. (2024, December). U.S. Department of Energy completes LNG study update, announces 60-day comment period. U.S. Department of Energy. https://www.energy.gov/articles/us-department-energy-completes-lng-study-update-announces-60-day-comment-period

U.S. Department of Energy, Office of Fossil Energy and Carbon Management. (n.d.). Docket Index. U.S. Department of Energy. https://fossil.energy.gov/app/docketindex/docket/index/30

U.S. Department of Energy. (2024, December). Energy, economic, and environmental assessment of U.S. LNG exports: Summary report [PDF]. U.S. Department of Energy. https://www.energy.gov/sites/default/files/2024-12/LNGUpdate_SummaryReport_Dec2024_230pm.pdf

U.S. Department of Energy. (2024, December). Energy, economic, and environmental assessment of U.S. LNG exports: Appendix A: Global energy and GHG assessment [PDF]. U.S. Department of Energy. https://energy.gov/sites/default/files/2024-12/LNGUpdate_AppendixA_Dec2024.pdf

U.S. Department of Energy. (2024, December). Energy, economic, and environmental assessment of U.S. LNG exports: Appendix B: Domestic energy, economic, and GHG assessment [PDF]. U.S. Department of Energy. https://energy.gov/sites/default/files/2024-12/LNGUpdate_AppendixB_Dec2024.pdf

U.S. Department of Energy. (2024, December). Energy, economic, and environmental assessment of U.S. LNG exports: Appendix C: Consequential greenhouse gas analysis [PDF]. U.S. Department of Energy. https://energy.gov/sites/default/files/2024-12/LNGUpdate_AppendixC_Dec2024.pdf

U.S. Department of Energy. (2024, December). Energy, economic, and environmental assessment of U.S. LNG exports: Appendix D: Addendum on environmental and community effects [PDF]. U.S. Department of Energy. https://energy.gov/sites/default/files/2024-12/LNGUpdate_AppendixD_Dec2024.pdf