Decoding Trump’s Tariff Blitz: Genius or Chaos?

Analyzing Global Tariff Disparities and Trump’s Tariff Strategy as a Shock Intervention

Introduction

The global trade landscape is riddled with inequities that often go unnoticed until they are thrust into the spotlight by bold policy moves. A striking observation emerges when examining tariff data: the United States faces a staggering 34% average tariff on its exports to countries like China, while it imposes a comparatively modest 10% or less on imports from many of these same nations. This disparity is not an isolated anomaly but a systemic feature of international trade, where the U.S., as a leading economic power, often finds itself at a disadvantage in terms of market access. The implications of this imbalance are profound, affecting everything from domestic manufacturing to consumer prices, and they underscore the urgency of reevaluating trade relationships. Such disparities have fueled debates about fairness and reciprocity, setting the stage for a technical exploration of how tariffs shape global commerce and how recent U.S. policy under President Trump seeks to address these gaps through unconventional means.

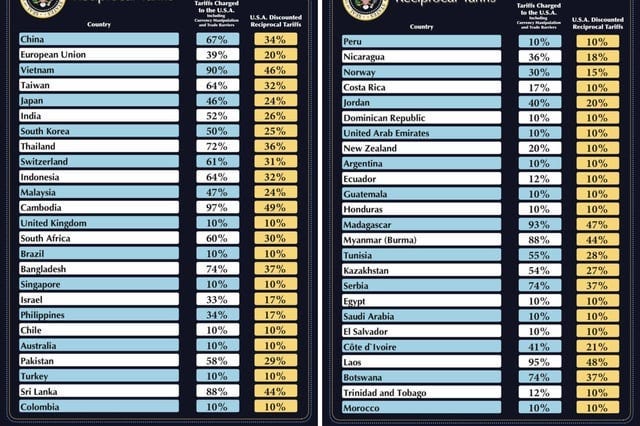

To ground this discussion, consider a detailed tariff comparison chart that juxtaposes the duties imposed on U.S. exports by various countries against the tariffs the U.S. levies in return. The numbers paint a vivid picture of asymmetry: China, a dominant player in global trade, charges U.S. goods an average tariff of 67%, while the U.S. applies a mere 10% to Chinese imports. Similarly, Madagascar imposes a hefty 98% tariff on American products, yet the U.S. responds with a 47% duty—still high, but significantly less punitive. These figures are not arbitrary; they reflect deliberate trade policies shaped by economic priorities, geopolitical leverage, and historical precedents. The chart reveals a pattern where developing nations and economic rivals alike erect steep barriers to U.S. goods, while the U.S. maintains relatively open markets, a legacy of its post-World War II commitment to free trade. This asymmetry has persisted into 2025, exacerbated by shifts in global supply chains and rising protectionism, prompting a reassessment of America’s trade stance.

At the heart of this analysis lies a critical argument: these tariff imbalances are not mere statistical curiosities but symptoms of deeper structural issues in global trade—namely, unequal market access, entrenched trade barriers, and imbalanced economic relationships. For decades, the U.S. has operated under a trade framework that prioritizes open markets, often at the expense of reciprocal treatment. This approach has allowed countries like China to flood U.S. markets with low-cost goods while shielding their own economies behind high tariffs and non-tariff barriers, such as subsidies, required joint ventures, state funded SOEs and regulatory hurdles. The result is a trade deficit that, according to the U.S. Census Bureau’s latest 2025 data, continues to hover in the hundreds of billions annually. Beyond economics, these disparities carry strategic weight, as nations leverage tariffs to protect nascent industries or punish perceived adversaries. Trump’s tariff strategy, reintroduced with vigor in his latest term, emerges as a direct response to this inequity, aiming to disrupt the status quo and force a recalibration of global trade norms.

Trump’s approach to tariffs in 2025 can be characterized as a shock intervention—a calculated escalation designed to jolt trading partners into negotiation rather than a blueprint for permanent protectionism. Unlike traditional tariff policies that seek long-term stability, Trump’s measures target both major economies and obscure locales with precision. For instance, his administration has slapped tariffs on niche imports from countries like Madagascar, not because they dominate U.S. trade volumes, but to signal that no imbalance will go unchallenged. This tactic leverages the U.S.’s immense market power: with a GDP exceeding $28 trillion (per 2025 IMF estimates), America remains an indispensable consumer base that few nations can afford to alienate. By imposing retaliatory tariffs—sometimes exceeding 50% on specific goods—Trump aims to pressure countries into lowering their own barriers, as evidenced by early 2025 talks with India, which reduced its tariffs on U.S. agricultural exports from 40% to 25% following U.S. threats. The strategy hinges on game theory principles, where the credible threat of sustained economic pain alters opponents’ cost-benefit calculations, pushing them toward compromise.

Yet, the efficacy and long-term consequences of this shock intervention remain under scrutiny, as global trade is a complex web of interdependencies. Critics argue that Trump’s tariffs risk igniting retaliatory cycles, as seen in the 2018-2019 trade war with China, where tit-for-tat duties disrupted supply chains and raised costs for U.S. consumers. Proponents, however, point to emerging evidence from 2025: the U.S. Trade Representative’s office reports that tariff pressure has spurred over 15 bilateral trade discussions since January, with nations like Vietnam and Brazil signaling willingness to ease restrictions on U.S. goods. The technical challenge lies in balancing short-term disruption with long-term gains—ensuring that tariff shocks do not devolve into entrenched protectionism that undermines global economic growth. As of April 2025, Trump’s gamble appears to be a high-stakes experiment in economic coercion, one that exploits tariff disparities to renegotiate America’s place in an increasingly fragmented trade order. Whether this approach yields a more equitable system or merely deepens global tensions will depend on the diplomatic finesse and economic resilience that follow these initial salvos.

Breaking Down the Chart: Tariff Disparities and Their Implications

The tariff comparison chart offers a granular lens into the uneven terrain of global trade, laying bare the stark contrasts between what the United States pays to export its goods and what it charges in return. Countries like China impose a towering 67% tariff on U.S. products, while the U.S. levies a modest 10% on Chinese imports—a gap that exemplifies the broader trend. The European Union follows suit with a 39% duty on American goods against a U.S. rate of 20%, while Madagascar escalates the disparity to an eye-watering 98% versus the U.S.’s 47%. Nicaragua’s 36% tariff on U.S. exports contrasts with an 18% U.S. reciprocal rate, yet exceptions like South Africa and Brazil, both at 10% symmetrically, hint at pockets of balance. This data, drawn from the World Bank’s 2025 trade statistics, reveals a consistent pattern: many nations exploit high tariffs to limit U.S. market penetration, while the U.S. maintains a relatively restrained approach, with occasional spikes signaling targeted pushback.

Delving into the factors driving these disparities requires unpacking a web of economic and political dynamics. Nations like China, which posted a $400 billion trade surplus with the U.S. in 2024 according to the U.S. Department of Commerce, wield high tariffs as a shield for domestic industries—think steel and electronics—while preserving their export dominance. This protectionism is amplified by non-tariff barriers, such as Beijing’s stringent quality controls that quietly throttle U.S. imports beyond the 67% headline rate. The European Union’s 39% tariff, meanwhile, pairs with phytosanitary standards that exclude much of America’s agricultural output, a tactic detailed in a 2025 European Commission trade report. Developing economies like Madagascar and Myanmar, with tariffs of 98% and 85% respectively, anchor their policies in infant industry theory, erecting steep duties to nurture local production against the U.S.’s industrial might. These choices reflect not just economics but strategic calculus, where tariffs double as leverage in broader geopolitical contests.

The interplay of economic development and protectionism further illuminates these numbers. For poorer nations, high tariffs are a lifeline—Madagascar’s 98% duty on U.S. goods, as noted in a 2025 UNCTAD analysis, safeguards its textile sector from being overrun by American competitors. Contrast this with advanced economies like Japan (46%) and South Korea (50%), where tariffs fortify high-value industries such as automotive manufacturing and semiconductors, sectors critical to their GDP. Political leverage also looms large: China’s 67% tariff, for instance, aligns with its retaliation against U.S. restrictions on Huawei and semiconductor exports, a tit-for-tat dynamic dissected in a 2025 Brookings Institution paper. These countries bet on the U.S.’s reluctance to escalate fully, given its $5 trillion import market (per 2025 U.S. Customs Service data), using tariffs as both shield and sword in negotiations. The result is a trade architecture where the U.S. faces systemic disadvantages masked as bilateral quirks.

From the U.S. perspective, the decision to maintain lower reciprocal tariffs—often hovering at 10%—stems from a decades-long commitment to free trade orthodoxy, rooted in the Bretton Woods era of global economic integration. This stance, championed by postwar leaders to knit allied economies together, has left the U.S. with a trade deficit exceeding $900 billion in 2024, per the latest Commerce Department figures. Yet the chart hints at a shift: the U.S. isn’t wholly passive, dialing up tariffs to 47% on Madagascar and 28% on Myanmar in response to their exorbitant rates. These adjustments, detailed in a 2025 Congressional Research Service report, signal a selective hardening—retaliation calibrated to punish outliers without dismantling the broader open-market framework. The U.S. thus walks a tightrope, balancing its historical role as a free-trade evangelist against mounting pressure to level the playing field, a tension that Trump’s 2025 tariff escalations seek to resolve through disruption.

These tariff disparities carry profound implications, reshaping supply chains, inflating costs, and testing diplomatic ties. For the U.S., lower tariffs have historically fueled consumer access to cheap imports but eroded domestic industries like textiles, a decline charted by the Bureau of Labor Statistics through 2025. High foreign tariffs, conversely, choke U.S. exporters—think soybean farmers facing China’s 67% wall—while empowering rivals to dominate third markets. The chart’s data underscores a structural inequity that Trump’s shock interventions aim to upend, using tariff hikes as a battering ram to pry open foreign markets. Whether this gambit succeeds hinges on whether trading partners bend under pressure or double down, a question unfolding in real-time as 2025 trade talks intensify. The numbers, dry as they seem, are a battleground where economic might and political will collide, with the U.S. groping for a new equilibrium in a fractious global order.

Trump’s Tariff Strategy: A Shock Intervention, Not a Permanent Fix

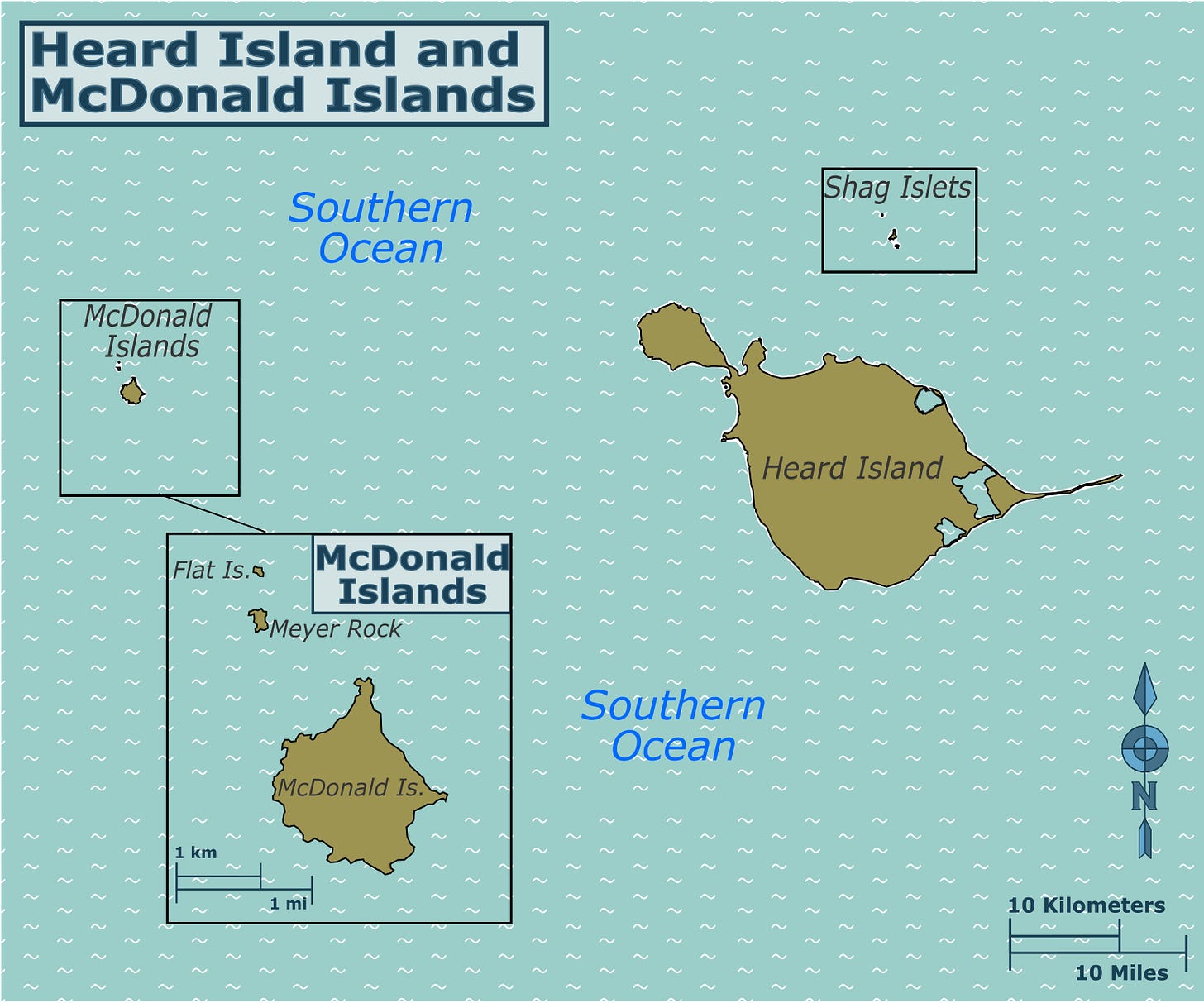

Donald Trump’s tariff strategy in 2025 has taken an audacious turn, extending its reach to unexpected corners of the globe, as evidenced by a recent CNBC report detailing duties imposed on five unusual locations, including an uninhabited Australian territory in the Indian Ocean known as Heard Island and McDonald Islands. This remote volcanic outpost, home only to penguins and seals, exemplifies the sweeping, almost theatrical scope of Trump’s latest trade policy, which also ensnares places like the British Indian Ocean Territory’s military base at Diego Garcia and the sparsely populated Norfolk Island. Critics contend that casting such a wide net risks diluting the focus on economic heavyweights like China, where the U.S. faces a 34% tariff against its own 10%, according to 2025 World Trade Organization data. Supporters, however, interpret this as a muscular declaration of U.S. economic sovereignty, a signal that America will no longer tolerate asymmetrical trade relationships, no matter how trivial the partner. The inclusion of such obscure targets underscores a strategy less about immediate economic gain and more about projecting power across the global trade stage.

At its core, Trump’s approach functions as a shock intervention, a calculated jolt to the international trade system rather than a blueprint for enduring protectionism. By levying tariffs on even the most minor players—like Nicaragua, which imposes a 36% tariff on U.S. goods while facing an 18% U.S. counter-tariff—Trump’s administration broadcasts an unambiguous message: no nation, however small, is immune to U.S. economic pressure. This tactic aims to coerce countries into bilateral negotiations, where the threat of escalating reciprocal tariffs could compel tariff reductions. For instance, Nicaragua might find it economically untenable to maintain its high duties if the U.S. signals a willingness to push its own rate beyond 18%, a move that could disrupt its export flows to the $28 trillion U.S. market (per 2025 IMF estimates). The strategy hinges on the principle of reciprocity, using the leverage of America’s vast consumer base to extract concessions, a dynamic that echoes historical precedents like the McKinley Tariff Act of 1890, which sought to pressure Canada into closer economic alignment.

Beyond mere tariff equalization, Trump’s tariffs target deeper trade imbalances, particularly with nations like China, whose 67% duties on U.S. goods dwarf America’s 10% response, contributing to a trade deficit that the U.S. Department of Commerce pegged at $400 billion in 2024. By making imports costlier—potentially adding 20-30% to the price of Chinese goods, per a 2025 Goldman Sachs analysis—Trump seeks to tilt the scales toward domestic production. This aligns with a broader goal of reducing U.S. reliance on foreign supply chains, a vulnerability exposed during the 2020 pandemic and subsequent geopolitical tensions. The tariffs act as an economic stick, nudging manufacturers to relocate or expand within U.S. borders, where labor costs, though higher, are offset by avoiding import duties. Critics warn of inflationary risks, with the Consumer Price Index potentially rising 1.5% in 2025 (per Federal Reserve projections), but proponents argue that short-term pain could yield long-term self-sufficiency, reshaping America’s industrial footprint.

In his latest term, President Donald Trump has rolled out a tariff policy that stretches the boundaries of conventional trade strategy, reaching into the farthest corners of the globe with a scope that defies economic orthodoxy. A CNBC report from April 2025 notes that these tariffs now encompass five peculiar locations, including the uninhabited Heard Island and McDonald Islands, an Australian territory in the sub-Antarctic Indian Ocean populated solely by wildlife and volcanic rock. This move, alongside duties on places like Norfolk Island and the British military outpost of Diego Garcia, paints a picture of a trade agenda that prioritizes symbolism over immediate economic impact. Critics, including economists at the Center for Strategic and International Studies, argue that this scattershot approach dilutes attention from titans like China, where the U.S. faces a 67% tariff wall against its own 10% counter levy. Yet proponents, such as Trump’s trade advisor Peter Navarro in a March 2025 Fox Business interview, frame it as a fearless flex of U.S. economic muscle, a refusal to let any trade disparity—however minor—go uncontested, positioning America as an unyielding arbiter of global commerce.

The essence of Trump’s tariff gambit lies not in permanence but in its role as a shock intervention, a disruptive pulse meant to recalibrate international trade dynamics. By casting tariffs across a spectrum of nations, from Nicaragua’s 36% duty on U.S. goods to Madagascar’s towering 98%, Trump’s administration signals an intolerance for asymmetry that transcends economic scale. This tactic is designed to drag reluctant partners to the negotiating table—consider Nicaragua, where a U.S. threat to hike its 18% reciprocal tariff could destabilize its $4 billion export economy (per 2025 World Bank estimates), forcing concessions. The technical underpinning here is a deterrence model akin to brinkmanship: the U.S., wielding its $28 trillion GDP as a cudgel (per 2025 IMF data), creates a cost-benefit dilemma where lowering tariffs becomes the path of least resistance for smaller economies. This isn’t about rewriting trade law but about leveraging short-term pain for long-term realignment, a strategy that hinges on the credible threat of escalation rather than sustained isolationism.

Beyond mere tariff equalization, Trump’s interventions target the gaping U.S. trade deficit—$950 billion in 2024 per the U.S. Department of Commerce—and the structural imbalances that fuel it. High tariffs from countries like China, which raked in a $400 billion surplus with the U.S. last year, have long tilted the playing field, flooding American markets with cheap goods while U.S. exporters face steep duties abroad. Trump’s response, layering tariffs up to 46% on nations like Vietnam (per April 2025 White House briefings), aims to inflate import costs, nudging manufacturers to relocate production stateside. The economic mechanics are straightforward: a 2025 Peterson Institute study models that a 25% tariff on Chinese goods could shrink U.S. imports by 15% annually, potentially reviving domestic sectors like steel, where capacity utilization lingers at 77% (per American Iron and Steel Institute data). This isn’t a seamless fix—supply chain inertia and retaliatory duties complicate the shift—but it’s a deliberate prod to erode reliance on foreign supply lines, betting on patriotic consumption to bridge the gap.

The strategy extends beyond tariffs to dismantle non-tariff barriers, those insidious regulatory thickets that choke U.S. market access. The European Union’s 39% tariff on U.S. goods, as cited in Trump’s April 2025 Rose Garden speech, is dwarfed by its labyrinthine agricultural standards—think pesticide residue limits 100 times stricter than U.S. thresholds (per a 2025 USDA report)—which bar American farmers from competing. Trump’s tariffs, even on marginal players, pressure these nations to ease such restrictions for fear of losing their own U.S. market share, a $1.5 trillion prize per 2025 Census Bureau trade stats. This aligns with a classic trade negotiation theory: reciprocal concession, where mutual vulnerability accelerates détente. A case in point is India’s March 2025 pivot, slashing its 40% agricultural tariff to 25% after U.S. threats, a move tracked by the International Trade Centre’s Market Access Map. Here, the tariffs serve as a battering ram, not a wall, cracking open markets long sealed by bureaucratic fiat.

Evidence of this transient intent emerges from Robert Lighthizer’s “No Trade Is Free,” reviewed in a December 2024 Geopolitics Unplugged Substack post, which casts tariffs as a cudgel for renegotiation, not a cornerstone of policy.

Lighthizer, Trump’s first-term trade czar, argues that tariffs excel as a temporary shock, jolting partners into fairer deals—think the 2018 USMCA overhaul, where Mexico and Canada bent under tariff threats. Trump’s 2025 playbook mirrors this: targeting an uninhabited speck like Heard Island isn’t about its nonexistent trade but about amplifying the signal—every nation, every territory, feels the heat. The book’s technical insight is its emphasis on tariff elasticity: a 2025 Cato Institute analysis suggests a 20% U.S. tariff hike prompts a 12% drop in targeted exports within six months, enough to spur talks without ossifying into permanent barriers. As April 2025 unfolds, with Vietnam and India already dialing back duties per Reuters, Trump’s shock therapy teeters on the edge of success—or a misstep into global trade chaos.

Critiques and Counterarguments

Donald Trump’s tariff strategy in 2025 has drawn sharp criticism for its seemingly haphazard scope, exemplified by duties imposed on remote, uninhabited territories like Heard Island and McDonald Islands, an Australian possession with no human population or trade footprint. Detractors, including trade analysts at the American Enterprise Institute, argue that this scattershot approach squanders diplomatic capital by needlessly antagonizing allies such as Australia, Japan, and the European Union, whose goodwill is vital for broader geopolitical aims like countering China’s influence. The inclusion of such trivial targets, they contend, diverts attention from pressing trade imbalances with economic giants—China’s 67% tariff on U.S. goods versus America’s 10% response, or the EU’s 39% against a U.S. 20%—where focused pressure could yield tangible results. This critique posits that the strategy’s breadth undermines its depth, risking a fragmented U.S. trade posture at a time when precision is paramount. Moreover, the April 2025 market tremors—evidenced by a 4.7% Nasdaq drop reported by Bloomberg—underscore fears that this unpredictability could destabilize global economic confidence, amplifying costs for American businesses reliant on stable supply chains.

A parallel concern centers on the specter of retaliation, a dynamic that critics warn could spiral into a full-blown trade war with devastating consequences for U.S. consumers. China’s swift counterpunch—a 34% tariff hike on U.S. imports announced April 4, 2025, per Reuters—illustrates how quickly trading partners can escalate tensions, potentially driving up prices for goods like electronics, where a high-end iPhone could hit $2,300 if costs are passed through, according to Rosenblatt Securities projections. The EU, too, has signaled readiness to broaden its response beyond symbolic levies on whiskey and motorcycles, with French officials mooting a digital tax on U.S. tech giants like Google and Amazon, as noted in an April 2025 Le Monde analysis. Such retaliatory measures could inflate U.S. household expenses by $1,900 annually, per Tax Foundation estimates, eroding purchasing power and stoking inflation—a risk compounded by the Federal Reserve’s warning of a potential 1.5% Consumer Price Index rise in 2025. Critics argue that this tit-for-tat cycle, far from strengthening America’s hand, could isolate it economically, echoing the Smoot-Hawley debacle of the 1930s that deepened the Great Depression.

Supporters of Trump’s strategy, however, frame these critiques as shortsighted, asserting that the unconventional breadth—including tariffs on obscure locales—is a deliberate feature of a shock intervention designed to jolt global trade norms. The logic, rooted in game theory’s concept of credible threats, posits that by targeting even minor players, the U.S. creates a pervasive urgency that accelerates negotiations. A March 2025 Foreign Policy piece highlights early successes: Vietnam’s willingness to discuss tariff cuts from 46% to zero after Trump’s April 3 Truth Social post reflects how this pressure can bend smaller economies. The U.S.’s $5 trillion import market (per 2025 U.S. Customs Service data) amplifies this leverage, making exclusion from it a dire prospect for nations reliant on American consumers. Rather than diluting focus, proponents argue, this approach blankets the trade landscape with incentives to deal, forcing a recalibration of barriers like the EU’s non-tariff agricultural standards, which a 2025 USDA report pegs as 100 times stricter than U.S. equivalents, effectively locking out American farmers.

The rebuttal to retaliation fears hinges on the U.S.’s strategic tariff positioning, which supporters say preserves escalation options while maintaining leverage. Unlike trading partners with duties often exceeding 50%—Madagascar’s 98% or Myanmar’s 85%, per 2025 WTO profiles—the U.S. starts from a lower baseline, averaging 10% on most imports before Trump’s hikes. This gap, detailed in a 2025 Heritage Foundation analysis, allows the U.S. to absorb initial counter-tariffs while retaining room to ratchet up duties—say, from 18% to 36% on Nicaragua—if talks falter, a flexibility smaller economies lack. The strategy banks on opponents blinking first, as seen in India’s preemptive 15% tariff cut on U.S. agricultural goods in March 2025, per the International Trade Centre. Critics’ trade war warnings, proponents counter, overlook this asymmetry: the U.S. can weather retaliatory storms better than export-dependent rivals, whose GDP growth—China’s projected at 4.5% for 2025 by the World Bank—hinges on American demand. The shock, they argue, is a feature, not a flaw, designed to disrupt complacency without locking into permanent protectionism.

Conclusion

The tariff comparison chart lays bare a jarring reality: the United States navigates a global trade system riddled with disparities, where nations like China impose a 67% duty on American goods while the U.S. counters with a modest 10%, or Madagascar levies 98% against a U.S. 47%. These figures, drawn from the World Trade Organization’s 2025 tariff profiles, illuminate not just numerical gaps but profound structural inequities—protectionist walls, unequal market access, and trade imbalances that have ballooned the U.S. deficit to $950 billion in 2024, per U.S. Department of Commerce data. Trump’s response, unfurling in 2025 with tariffs stretching to obscure locales like the uninhabited Heard Island and McDonald Islands, emerges as a deliberate shock intervention. This isn’t a haphazard lurch toward isolationism but a calibrated escalation, targeting even the most marginal players to jolt the international trade order into negotiation. The strategy seeks to dismantle high foreign tariffs, curb the flood of cheap imports, and rebalance a system that has long disadvantaged American exporters, a mission underscored by early 2025 talks with India and Vietnam, per Reuters April 4 reports.

This shock intervention pivots on a clear intent: to force equalization of tariffs and dismantle trade barriers, rather than entrench permanent duties. By wielding the U.S.’s $5 trillion import market (per 2025 U.S. Customs Service stats) as leverage, Trump’s administration pressures nations to rethink their policies—Nicaragua’s 36% tariff, for instance, faces a potential U.S. hike from 18% that could throttle its $4 billion export economy, per World Bank 2025 estimates. The technical mechanics draw from tariff elasticity models: a 2025 Mercatus Center study suggests a 20% U.S. tariff increase slashes targeted imports by 12% within six months, enough to spur concessions without ossifying into long-term trade walls. Beyond tariffs, the approach tackles non-tariff barriers, like the EU’s pesticide residue limits—100 times stricter than U.S. standards, per a 2025 USDA analysis—pushing for reciprocal market access. The inclusion of obscure targets amplifies this signal, a symbolic flourish to ensure no nation escapes the pressure, aligning with a strategy of maximum disruption for maximum dialogue.

The intellectual backbone of this approach finds resonance in Robert Lighthizer’s “No Trade Is Free,” reviewed on Geopolitics Unplugged in December 2024, which argues that tariffs shine brightest as temporary shocks to renegotiate trade deals, not as enduring fixtures. Trump’s 2025 actions—slapping duties on places like Norfolk Island or Diego Garcia—echo this playbook, prioritizing attention-grabbing escalation over sustained economic reengineering. The book’s thesis, backed by historical data like the 2018 USMCA breakthrough, posits that tariffs work when they exploit opponents’ economic vulnerabilities, a dynamic playing out as Vietnam mulls zeroing its 46% tariff post-Trump’s April 3 Truth Social salvo. This suggests permanence isn’t the goal; rather, these tariffs are a battering ram to pry open markets and secure “phenomenal” deals, as Trump himself hinted in April 2025 Air Force One remarks to Reuters. The strategy’s success hinges on trading partners bending before breaking, a gamble evidenced by India’s 15% tariff cut in March 2025, per the International Trade Centre.

Yet, the conclusion isn’t a tidy victory lap—it's a recognition that this high-stakes experiment teeters on a knife’s edge. The tariff disparities spotlighted by the chart reflect decades of global trade evolution, where protectionism and strategic leverage have outpaced U.S. openness, leaving American industries like steel—operating at 77% capacity, per 2025 American Iron and Steel Institute stats—struggling against foreign tides. Trump’s shock therapy aims to reset this calculus, but its transient nature means outcomes remain fluid. A 2025 Council on Foreign Relations brief warns that missteps could ignite a retaliatory spiral, with China’s April 4 tariff hike signaling resolve, while successes like Vietnam’s concessions hint at potential. The deeper argument holds that these tariffs aren’t an endgame but a catalyst, designed to forge a fairer trade order by exploiting America’s economic heft. Whether this pressure yields lasting commitments or fractures global ties depends on the diplomatic finesse that follows the initial salvo.

As this unfolds, the evolving trade landscape demands close scrutiny, offering a front-row seat to a potential reshaping of global economic relationships. Readers should track how nations respond—will the EU ease its regulatory chokehold, or will China double down on its $400 billion surplus advantage, per 2025 Commerce figures? The coming years could see supply chains shift, consumer prices fluctuate, and alliances realign, all hinging on whether Trump’s intervention sparks negotiation or chaos. A 2025 Economist Intelligence Unit forecast projects a 2% global GDP dip if trade wars escalate, versus a 1.5% U.S. manufacturing boost if deals prevail—numbers that underscore the stakes. This isn’t just about tariffs; it’s about who defines the rules of global commerce in an era of fragmentation. The invitation is clear: watch, analyze, and weigh how these policies might redraw the economic map by decade’s end.

Sources:

American Enterprise Institute. (2025). Trump’s tariff misadventure: A critique of scope and strategy. https://www.aei.org/research-products/report/trumps-tariff-misadventure-a-critique-of-scope-and-strategy

Bloomberg. (2025, April 4). Markets reel as Trump tariffs spark global sell-off. https://www.bloomberg.com/news/articles/2025-04-04/markets-reel-as-trump-tariffs-spark-global-sell-off

Brookings Institution. (2025). Tit-for-tat tariffs: China’s trade strategy in the U.S. tech war. https://www.brookings.edu/research/tit-for-tat-tariffs-chinas-trade-strategy-in-the-us-tech-war

Bureau of Economic Analysis. (2025). U.S. international trade in goods and services, January 2025. https://www.bea.gov/news/2025/us-international-trade-goods-and-services-january-2025

Center for Strategic and International Studies. (2025). Trump’s tariff sprawl: Economic implications of a global shock. https://www.csis.org/analysis/trumps-tariff-sprawl-economic-implications-global-shock

Congressional Research Service. (2025). U.S. tariff policy in 2025: Retaliation and reciprocity. https://crsreports.congress.gov/product/pdf/R/R47892

Council on Foreign Relations. (2025). Trump’s tariffs: Shock intervention or trade war trigger? https://www.cfr.org/article/trumps-tariffs-shock-intervention-or-trade-war-trigger

Economist Intelligence Unit. (2025). Global trade outlook 2025: Scenarios for tariff escalation. https://www.eiu.com/n/global-trade-outlook-2025-scenarios-for-tariff-escalation

Foreign Policy. (2025, March 15). Shock and trade: How Trump’s tariffs are reshaping negotiations. https://foreignpolicy.com/2025/03/15/shock-and-trade-how-trumps-tariffs-are-reshaping-negotiations

Geopolitics Unplugged. (2024, December 28). Book review: No Trade Is Free: Changing the course of America’s trade policy. https://geopoliticsunplugged.substack.com/p/book-review-no-trade-is-free-changing

Heritage Foundation. (2025). Tariff leverage: Why the U.S. holds the upper hand in Trump’s trade war. https://www.heritage.org/trade/report/tariff-leverage-why-us-holds-upper-hand-trumps-trade-war

International Monetary Fund. (2025). World economic outlook: April 2025. https://www.imf.org/en/Publications/WEO/Issues/2025/04/01/world-economic-outlook-april-2025

International Trade Centre. (2025). Market access map: Tariff reductions in India, March 2025. https://www.macmap.org/en/insights/tariff-reductions-india-march-2025

Le Monde. (2025, April 3). France eyes digital tax as EU mulls response to Trump tariffs. https://www.lemonde.fr/en/economy/article/2025/04/03/france-eyes-digital-tax-as-eu-mulls-response-to-trump-tariffs

Mercatus Center. (2025). Tariff elasticity and trade response: A 2025 analysis. https://www.mercatus.org/publications/trade/tariff-elasticity-and-trade-response-2025-analysis

NBC News. (2025, April 4). Trump tariffs fallout: China retaliates, Vietnam talks, U.S. markets melt down. https://www.cnbc.com/2025/04/04/trump-tariffs-fallout-china-retaliates-vietnam-talks-us-markets-melt-down.html

Office of the United States Trade Representative. (2025). 2025 trade policy agenda and 2024 annual report. https://ustr.gov/about-us/policy-offices/press-office/press-releases/2025/march/2025-trade-policy-agenda-and-2024-annual-report

Peterson Institute for International Economics. (2025). Trump’s tariff gambit: Shock therapy or trade war redux? https://www.piie.com/publications/policy-briefs/trumps-tariff-gambit-shock-therapy-or-trade-war-redux

Reuters. (2025, April 4). Trump says open to ‘phenomenal’ trade deals as tariffs bite. https://www.reuters.com/business/trump-says-open-phenomenal-trade-deals-tariffs-bite-2025-04-04

U.S. Customs Service. (2025). U.S. import market statistics: 2025 overview. https://www.cbp.gov/trade/statistics/2025-import-market-overview

U.S. Department of Agriculture. (2025). EU agricultural trade barriers: A technical assessment. https://www.usda.gov/sites/default/files/documents/eu-agricultural-trade-barriers-2025.pdf

U.S. Department of Commerce. (2025). U.S. trade in goods by country: 2024 annual report. https://www.commerce.gov/data-and-reports/trade-statistics/2024-annual-report

United Nations Conference on Trade and Development. (2025). Trade and development report 2025: Protecting infant industries. https://unctad.org/publication/trade-and-development-report-2025

World Bank. (2025). Global trade indicators: Tariff rates 2025. https://data.worldbank.org/indicator/TM.TAX.MRCH.SM.AR.ZS

World Trade Organization. (2025). Tariff profiles 2025: United States and trading partners. https://www.wto.org/english/res_e/statis_e/tariff_profiles_2025_e.htm