From Pampas to Power: The Strategic Importance of Argentina's Vaca Muerta

Energy, Economy, and Geopolitics: The Vaca Muerta Triangle

TL;DR:

Introduction: Vaca Muerta is one of the largest shale formations globally, with the 2nd largest shale gas and 4th largest shale oil reserves. Key to Argentina's energy independence, with potential to become a major exporter by 2030 (1 million barrels/day production). Strategic for reducing Argentina's reliance on imports and stabilizing its economy.

Economic Implications: Could transform Argentina into a net energy exporter, boosting foreign reserves and GDP growth. Promises job creation in energy and ancillary sectors like logistics and construction. Infrastructure development, including pipelines and refineries, is crucial to maximize benefits. Potential for domestic fertilizer production using natural gas, supporting agriculture.

Geopolitical Dynamics: Enhances Argentina's regional influence in South America as an energy supplier. Attracts foreign investment and partnerships from global energy giants like Chevron and ExxonMobil. Balances relations with environmentally conscious nations amid global energy transition pressures. Risks include resource nationalism and potential geopolitical tensions over energy policies.

Challenges: Infrastructure gaps, such as limited pipelines, export terminals, and refineries. Environmental and social concerns, particularly from indigenous groups and anti-fracking activists. Political instability, including shifting regulations and nationalization risks, undermines investor confidence.

Technological Needs: Requires advanced fracking and water management technologies. Skilled workforce and technical training programs are critical to meet industry demands. Dependence on foreign expertise highlights need for technology transfer and local capacity building.

Global Energy Trends: Natural gas could serve as a transitional fuel in the global energy shift toward renewables. Oil demand volatility may affect long-term profitability; focus on value-added products like LNG and fertilizers is essential. Aligning development with sustainability goals could improve Argentina's standing in international markets.

Future Prospects: Full development could catalyze GDP growth (3-5% annually) and economic diversification. Potential geopolitical leverage as a reliable energy supplier in volatile global markets. Requires stable governance, consistent policies, and sustainable practices to unlock benefits.

Conclusion: Vaca Muerta represents a pivotal opportunity for Argentina to achieve energy independence, economic growth, and geopolitical influence. Success depends on overcoming political, environmental, and infrastructure challenges while leveraging global energy trends.

And now for the Deep Dive….

Introduction

The Vaca Muerta shale formation, nestled in the heart of Argentina's Neuquén Basin, stands as one of the world's most promising energy resources. Spanning an area comparable to the size of Belgium, this geological marvel is home to the second-largest shale gas reserves and the fourth-largest shale oil reserves globally. Its discovery and subsequent development have positioned Argentina on the cusp of a significant transformation in the global energy sector. As nations worldwide grapple with the dynamics of energy supply, security, and the push towards sustainability, Vaca Muerta emerges as a critical player, potentially altering the energy landscape not just for Argentina but for international markets as well.

This shale formation is more than just a deposit of hydrocarbons. It represents a strategic pivot for Argentina, which has historically been a nation grappling with economic volatility and energy deficits. The potential of Vaca Muerta to produce vast quantities of oil and gas offers a beacon of hope for a country eager to stabilize its economy and reduce its dependency on energy imports. With the capability to produce over a million barrels of oil per day by 2030, Vaca Muerta could fundamentally alter Argentina's energy balance, turning it from an importer to a potential exporter of energy resources, thereby enhancing its foreign exchange reserves and bolstering national economic stability.

The geopolitical implications of Vaca Muerta's development are profound. On one hand, it could shift the balance of power within South America, offering Argentina a new role as an energy exporter in a region traditionally dominated by oil giants like Brazil and Venezuela. On the other hand, the involvement of international energy companies, including majors like ExxonMobil, Chevron, and Shell, signifies Argentina's integration into the global energy market, attracting significant foreign investment and expertise. This not only aids in the technological advancement of Argentina's oil and gas sector but also strengthens diplomatic and economic ties with countries keen on securing alternative energy sources.

However, the path to realizing Vaca Muerta's full potential is fraught with challenges. Argentina's political landscape, characterized by frequent shifts between ideological poles, adds layers of uncertainty to long-term investment plans. Legal and regulatory frameworks have often been in flux, affecting investor confidence. Moreover, the infrastructure for transporting and exporting this newfound wealth, including pipelines and LNG facilities, requires substantial capital, which in turn depends on consistent policy support from the government. The strategic importance of Vaca Muerta, therefore, hinges not just on its geological wealth but on the robustness of Argentina's governance in managing such vast resources.

Economically, Vaca Muerta could be a game-changer for Argentina, providing not just revenue but also jobs and industrial development. The extraction process, known as hydraulic fracturing or fracking, demands a vast amount of labor, both skilled and unskilled, which could help mitigate high unemployment rates in the region. The economic ripple effects could extend beyond direct employment in the energy sector, fostering growth in ancillary industries like construction, logistics, and services. This could lead to a revitalization of local economies in the Patagonian region, where the shale formation is located, potentially transforming it from an agricultural backwater into a hub of industrial activity.

Yet, the environmental and social impacts of fracking in Vaca Muerta cannot be overlooked. The technique is contentious, with concerns about water usage, contamination, and seismic activity. Local communities, particularly indigenous populations, have voiced opposition due to the potential for environmental degradation and disruption of traditional ways of life. Balancing these concerns with the economic benefits of shale development is a critical issue for Argentina, one that could define the sustainability of its energy strategy. Public policy must address these environmental and social implications to ensure that the development of Vaca Muerta is not only economically beneficial but also socially responsible.

The global energy market's volatility, driven by geopolitical tensions, economic sanctions, and the global push towards renewable energy, adds another layer of complexity to Vaca Muerta's strategic importance. While the demand for fossil fuels is expected to plateau or even decline in the long term, the immediate future still sees a significant reliance on oil and gas, particularly with disruptions in traditional supply routes like the Middle East or Russia. Here, Vaca Muerta can play a crucial role in providing alternative supply options, potentially stabilizing global energy prices and ensuring energy security for countries looking to diversify their energy sources.

As we will dive deeply into, Vaca Muerta is not merely a geological formation but a cornerstone for Argentina's ambition to reshape its geopolitical and economic narrative. The potential to achieve energy self-sufficiency, become an exporter, and stimulate economic growth through this resource is immense. However, the realization of these benefits requires careful navigation of political, environmental, and economic challenges. If managed wisely, Vaca Muerta could herald a new era for Argentina, transforming it from the Pampas to a powerhouse in the global energy sector. The journey from potential to prosperity will demand strategic foresight, robust governance, and a commitment to sustainable practices, ensuring that this 'Dead Cow' becomes a source of life for Argentina's economic future.

Historical Context

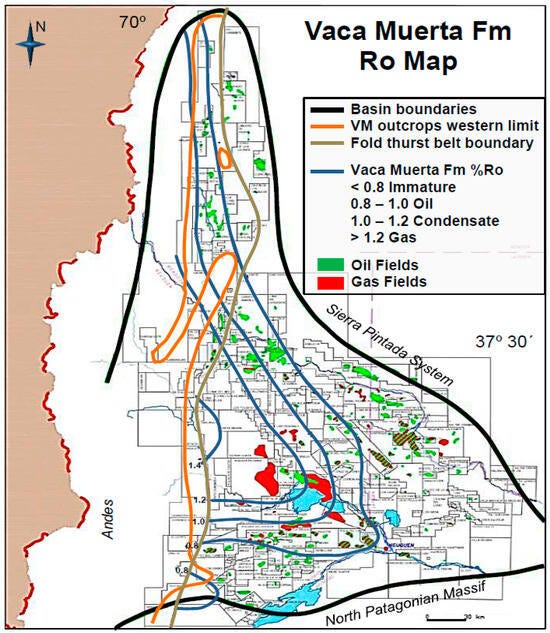

The story of Vaca Muerta begins in the early 20th century when geologists first noted the potential of the Neuquén Basin in Argentina. However, it wasn't until the late 20th century that the true scale of the shale formation's resources was understood. The discovery of Vaca Muerta, which translates to "Dead Cow" in Spanish, was the result of meticulous geological surveys that revealed an unprecedented wealth of hydrocarbons trapped in shale rock layers. Initial assessments pegged the formation as one of the largest unconventional oil and gas reserves globally, characterized by its high organic content and the presence of multiple layers of shale rich in both oil and natural gas. This geological uniqueness, with its thick, continuous shale deposits, made Vaca Muerta a prime candidate for hydraulic fracturing or fracking, a technique that would unlock this previously inaccessible resource.

The development of Vaca Muerta has been shaped significantly by Argentina's economic policies over the decades. Historically, Argentina's energy sector has seen periods of nationalization followed by openings to foreign investment. In the early stages of Vaca Muerta's exploration, the Argentine government's policies leaned towards state control, with YPF, the national oil company, taking a leading role. YPF, once owned by Repsol of Spain and then nationalized in 2012, was instrumental in the initial development, leveraging its knowledge of local geology to start tapping into the shale's potential. However, the scale of investment and technological expertise required for unconventional drilling pushed the government to seek international partnerships.

The economic landscape of Argentina, marked by cycles of booms and busts, directly influenced how Vaca Muerta was approached. During times of economic crisis, such as the early 2000s, foreign investment in Argentina's energy sector was cautious, with high inflation and currency controls deterring commitments. However, as the global shale revolution took hold, particularly with the success of hydraulic fracturing in the United States, Argentina's policy shifted towards encouraging international investment. This was marked by regulatory reforms aimed at stabilizing the investment climate, including incentives for oil and gas companies and adjustments in fiscal policies to make the exploitation of Vaca Muerta more attractive.

The interplay between state control and international investment has been a pivotal aspect of Vaca Muerta's development. The Argentine government has had to balance the nationalistic desire to control its natural resources with the practical need for capital and technology from abroad. This dynamic has led to a hybrid model where YPF often leads major projects in partnership with international giants like Chevron, Total, and Shell. These collaborations have brought not only financial investment but also advanced fracking technologies, drilling techniques, and management practices that have accelerated the development of the shale play.

Economic policies have also had a direct impact on the speed and scale of Vaca Muerta's development. For instance, during times of economic stability or when export tariffs were favorable, there was a surge in drilling activities. Conversely, during economic downturns or when government policies fluctuated, such as with sudden changes in taxation or export policies, investment often slowed down. The economic framework, including currency devaluation, has also influenced how much of Vaca Muerta's production is aimed at the domestic market versus export, affecting the overall strategy for development.

Despite these challenges, Vaca Muerta has gradually become a beacon of potential economic revival for Argentina. The project's scale promises not just energy independence but also significant revenue that could help mitigate the country's chronic fiscal deficits. The economic impact extends beyond direct revenues. It includes job creation, the growth of related industries, and the potential for infrastructure development around the Neuquén region, which could transform local economies previously dependent on agriculture.

However, the economic benefits are contingent on a stable political and regulatory environment. Investors have been wary of Argentina's history of policy reversals, which can affect long-term investment plans. The government's approach to managing this resource, including how it balances environmental concerns with economic benefits, will be crucial. The development of Vaca Muerta has also sparked debates over resource nationalism versus global integration, with arguments for and against the privatization of benefits from such a national treasure.

The historical context of Vaca Muerta's discovery and development is deeply interwoven with Argentina's economic policies. From initial explorations to current-day operations, the narrative of Vaca Muerta reflects the challenges and opportunities of harnessing one of the world's largest unconventional hydrocarbon reserves. The balance between national interests and the need for international expertise and capital continues to shape the trajectory of this shale formation, potentially setting the stage for Argentina's economic transformation or highlighting the complexities of managing such vast natural resources in a volatile economic environment.

Economic Implications

The development of Vaca Muerta presents Argentina with a golden opportunity to achieve energy independence, a goal that has long been elusive given the country's heavy reliance on energy imports. Historically, Argentina has faced energy deficits, leading to a significant drain on its national budget due to the costs associated with importing oil and gas, particularly during times of high global energy prices. With Vaca Muerta, Argentina could potentially reverse this scenario, producing enough oil and gas not only to meet domestic demand but also to store reserves for times of need. This shift towards self-sufficiency would stabilize the energy supply, reduce import bills, and free up resources for other critical sectors of the economy, potentially decreasing the fiscal deficit that has plagued Argentina for decades.

Moreover, as Vaca Muerta ramps up production, Argentina is poised to make a significant impact on the global energy market. The potential to export both liquefied natural gas (LNG) and shale oil from Vaca Muerta could transform Argentina into a notable energy exporter. This would not only diversify global energy supply chains but also provide Argentina with a new revenue stream from international markets. The global demand for LNG, in particular, has been on the rise as countries look for cleaner fossil fuel alternatives to coal. Argentina's entry into this market could be timely, offering an alternative supply source at a time when traditional exporters like Russia face geopolitical and logistical constraints.

The economic implications of Vaca Muerta extend far beyond energy independence and market positioning; they include substantial potential for GDP growth. The direct economic benefits from the extraction, processing, and export of hydrocarbons could significantly contribute to Argentina's national income. Economic forecasts suggest that if Vaca Muerta reaches full potential, it could increase Argentina's GDP by several percentage points annually over the next decade. This growth would be driven by both the direct revenues from oil and gas sales and the indirect economic activity generated by the sector's expansion.

Job creation is another critical aspect of Vaca Muerta's economic influence. The development of shale resources requires a broad spectrum of labor, from highly skilled engineers and geologists to workers in logistics, construction, and maintenance. This could lead to a reduction in unemployment rates, particularly in the Patagonian region where the shale basin is located. The influx of jobs would stimulate local economies, increasing disposable income and consumer spending, which in turn would further drive economic growth. Moreover, the training and education required for these positions could elevate the skill level of the workforce, providing long-term benefits to the national labor market.

Infrastructure development is an inevitable byproduct of such extensive resource exploitation. The need for pipelines, processing facilities, and export terminals would necessitate significant investment in both public and private infrastructure. This could lead to improvements in transportation networks, port facilities, and energy distribution systems, which would benefit the economy beyond just the oil and gas sector. Enhanced infrastructure would make Argentina more attractive for other types of investments, fostering a broader economic development strategy.

However, the economic growth promised by Vaca Muerta is not without its challenges and risks. The volatility of global oil prices could affect the profitability of investments in the shale play, potentially leading to boom-and-bust cycles. Additionally, the economic benefits depend heavily on the political stability and regulatory environment in Argentina, areas that have historically been unpredictable. Investors need assurance that the legal and fiscal frameworks will remain consistent to justify long-term commitments to such capital-intensive projects.

Moreover, while Vaca Muerta could be a catalyst for economic growth, the distribution of these benefits across society needs careful management to ensure they do not lead to increased inequality. The government's role in regulating the sector, ensuring fair labor practices, and directing some of the wealth back into public services and infrastructure is crucial for sustainable development. This includes considerations for environmental regulations to mitigate the impacts of fracking on local ecosystems and communities.

The economic implications of Vaca Muerta's development are vast and multifaceted, offering pathways to energy independence, a stronger position in global markets, significant GDP growth, job creation, and infrastructure development. However, realizing these benefits while managing the associated risks requires strategic economic planning, stable governance, and a commitment to equitable distribution of the wealth generated. If navigated wisely, Vaca Muerta could indeed be the economic engine Argentina needs to propel itself into a new era of prosperity.

Geopolitical Dynamics

The Vaca Muerta shale formation is reshaping Argentina's geopolitical dynamics, particularly in its interactions with neighboring countries. As Argentina moves from an energy importer to potentially a significant exporter, the dynamics of energy security and trade within South America are undergoing a transformation. Countries like Brazil, which have historically relied on Bolivian gas, might now look towards Argentina for supply, especially with the development of infrastructure like the Néstor Kirchner pipeline. This shift could recalibrate trade relations, offering Argentina leverage in regional negotiations, especially if it can assure stable and competitively priced gas exports. This could strengthen Argentina's position in regional energy politics, fostering new alliances or even reviving dormant ones, provided the supply is reliable and the terms of trade are favorable.

On the international stage, Vaca Muerta has become a focal point for major global powers keen on diversifying their energy portfolios. The United States, having pioneered shale technology, has shown interest in Vaca Muerta not only as a market for its technology and services but also as a strategic partner to counterbalance other global energy players. American companies like Chevron and ExxonMobil have invested heavily, which could lead to closer diplomatic ties, perhaps even influencing Argentina's international policy alignments. Similarly, China, with its voracious appetite for energy resources, might seek to invest in or secure long-term supply contracts from Vaca Muerta, enhancing its strategic presence in Latin America and potentially affecting Argentina's foreign policy decisions, especially concerning trade and investment treaties.

However, the geopolitical landscape is not solely defined by economic interests. Environmental concerns related to fracking in Vaca Muerta have sparked international debates and could strain relations with environmentally conscious nations. Countries pushing for global commitments to reduce carbon emissions might view Argentina's expansion of fossil fuel production with skepticism or outright criticism, especially in forums like the United Nations climate change conferences. This could lead to diplomatic friction, particularly if Argentina does not adequately address these environmental issues or if global policies move more aggressively towards renewable energies.

Social and environmental considerations also play into domestic geopolitics, particularly in terms of indigenous rights and the Not In My Backyard (NIMBY) syndrome. Indigenous communities in Neuquén and surrounding areas have resisted fracking due to concerns over land rights, water contamination, and cultural preservation. This resistance can lead to local and international advocacy movements that challenge the government's policies, potentially affecting Argentina's international image. The country might face accusations of human rights abuses if it does not engage in transparent and fair negotiations with these communities, leading to geopolitical tensions as international NGOs and foreign governments weigh in on these issues.

Resource nationalism is another geopolitical consideration. As Argentina seeks to maximize the benefits from Vaca Muerta, there is a tension between opening up to foreign investment and retaining control over what is seen as a national treasure. This has historical precedence in Argentina with events like the nationalization of YPF in 2012, which sent mixed signals to international markets. The balance Argentina strikes between inviting foreign capital and maintaining national sovereignty over its resources will influence its relations with countries and corporations worldwide, potentially affecting investment flows and diplomatic relations.

Furthermore, the development of Vaca Muerta could lead to geopolitical maneuvering among energy companies and countries to secure stakes or influence in this potentially lucrative area. This could manifest in various forms, including energy diplomacy where countries offer trade deals, technology transfers, or even military cooperation in exchange for access to Vaca Muerta's resources. Such dynamics might also see Argentina playing a role in broader geopolitical strategies, like those aimed at countering the influence of other global powers in Latin America.

The environmental and social fallout from Vaca Muerta could also ripple through international organizations and treaties. Argentina's adherence to or deviation from international environmental agreements could impact its standing in global forums. If Argentina opts for rapid development at the cost of environmental degradation or social unrest, it might face sanctions, trade barriers, or exclusion from green financing initiatives, all of which have geopolitical implications.

Vaca Muerta's geopolitical dynamics are complex, involving regional power plays, international diplomacy, and the intricate balance of environmental and social responsibilities. Argentina's handling of these aspects will not only shape its domestic policy but also its international relations, positioning it as either a cooperative partner in global energy markets or a contentious player if it fails to navigate these multifaceted challenges effectively. The way Argentina manages these dynamics will be crucial in defining its future geopolitical role in a world increasingly focused on energy security, environmental sustainability, and equitable development.

Technological and Infrastructure Challenges

The technological and infrastructure challenges facing the development of Vaca Muerta are significant, starting with the primary extraction method: hydraulic fracturing or fracking. Fracking has been employed in Argentina since the 1960s but has seen a surge with the focus on shale resources. The process requires substantial volumes of water, sand, and chemicals, which must be managed efficiently to minimize environmental impact. Innovations in fracking technology, like the use of waterless or minimal-water techniques, are being explored to address water scarcity issues in the arid regions of Patagonia. However, these methods still need to prove their efficacy and scalability in Vaca Muerta's unique geological setting.

Sustainability in fracking operations is crucial, not just for environmental reasons but also for the long-term economic viability of the wells. Techniques to recycle water, reduce seismic activity, and manage waste are areas where Argentina has started to invest, but these innovations often require foreign expertise, particularly from the U.S., where shale technology is more advanced. The sustainability of fracking also involves optimizing the recovery rate from wells, which means improving techniques like multi-stage fracturing, horizontal drilling, and the use of proppants. Here, local capacity for innovation and adaptation is growing but still lags behind international standards, necessitating a partnership with global tech leaders.

Regarding the availability of skilled technical workers, Argentina faces a significant challenge. The oil and gas sector requires a workforce adept in geophysics, petroleum engineering, and environmental science, among others. While Argentina has a tradition of producing competent engineers, the rapid expansion of Vaca Muerta has outpaced the supply of specialized labor. Posts on social media highlight the shortage of technical personnel, estimating a need for around 50,000 workers by 2030 against only about 15,000 graduates from technical schools annually. This gap suggests that without significant educational initiatives and immigration of skilled workers, Argentina will continue to rely on foreign expertise, particularly from the U.S., for complex tasks like mud log reading, which is critical for understanding the geological formations and optimizing drilling operations.

The demographic profile and the Not in Employment, Education, or Training (NEET) rate in Argentina add another layer of complexity to the labor equation. With a high NEET rate, particularly among the youth, there is a pool of untapped labor that could potentially be trained for roles in the oil and gas industry. However, the transition from being NEET to becoming a specialized worker in this sector involves overcoming educational and skill deficits. This situation underscores the need for targeted educational reforms and vocational training programs tailored to the oil and gas sector's demands.

Universities in Argentina have responded to this need by introducing or expanding petroleum studies. Institutions like the National University of La Plata, the University of Buenos Aires, and the National Technological University have programs in petroleum engineering, geology, and related fields. These initiatives aim to cultivate a new generation of professionals equipped to handle the technical aspects of oil and gas extraction, including fracking. However, the capacity of these programs to scale up quickly enough to meet industry needs is questionable, given the rapid pace of Vaca Muerta's development.

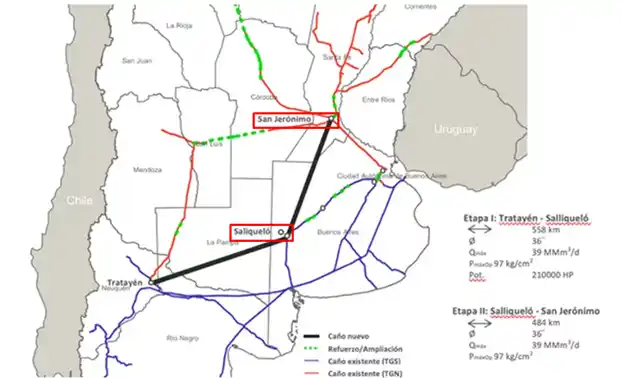

Infrastructure challenges further compound the technological issues. The expansion of Vaca Muerta requires not just drilling rigs and fracking equipment but also extensive pipeline networks to transport oil and gas to domestic markets or export terminals. The construction of the Néstor Kirchner pipeline is a step in the right direction, but more infrastructure is needed to avoid bottlenecks that could hinder production and export capabilities. This includes not only physical infrastructure but also the digital infrastructure for managing complex, large-scale operations, where data analytics and IoT solutions could play a pivotal role in optimizing production.

The reliance on international technology and expertise for both the technical and infrastructure aspects of Vaca Muerta's development has economic implications. While it can accelerate the project's timeline, it also means a significant outflow of capital for services and technology, which might not be sustainable in the long run without building a strong domestic capability. Therefore, there's a push for technology transfer agreements and joint ventures that can help in skill development and local manufacturing of equipment.

The technological and infrastructure challenges at Vaca Muerta are multifaceted, involving not just the physical act of extracting oil and gas but also the sustainability of these operations, the development of a skilled workforce, and the construction of supporting infrastructure. While Argentina has made strides in all these areas, the pace and scale of Vaca Muerta's development demand accelerated efforts in education, technology transfer, and infrastructure investment. The nation's success in overcoming these challenges will largely determine whether it can maintain control over its energy destiny or remain dependent on external support.

Infrastructure Needs:

The infrastructure landscape for Vaca Muerta is pivotal to its exploitation as one of the largest shale oil and gas reserves in the world. Currently, the most significant development is the Néstor Kirchner gas pipeline, which was inaugurated to transport natural gas from the Vaca Muerta formation to urban centers and potential export points. This pipeline has been a game-changer by increasing the capacity to move gas from the shale-rich areas of Neuquén to demand centers in Buenos Aires and beyond, with an initial capacity of 24 million cubic meters per day. However, even with this addition, the infrastructure network is still in its infancy relative to the potential output of Vaca Muerta.

The current state of pipelines is somewhat limited for the scale of production Vaca Muerta could achieve. Besides the Néstor Kirchner pipeline, there are existing pipelines like the Oldelval for oil, which has been expanded but still faces capacity constraints. The Vaca Muerta Sur oil pipeline project, announced to be constructed by companies including YPF, Pampa Energía, Vista Oil & Gas, and Pan American Energy, aims to extend from Añelo to Punta Colorada, offering an additional route for oil export. However, these projects are just the beginning; the region requires a more extensive network of pipelines to handle both oil and gas to avoid bottlenecks that could stifle production growth.

Refineries in Argentina have traditionally been designed to process conventional crude, which differs from the lighter, shale-derived oils that Vaca Muerta produces. The current refining capacity in Argentina is not optimized for the type of crude coming out of Vaca Muerta, leading to inefficiencies. There is a pressing need for upgrades or even new refinery projects that can handle the specific characteristics of shale oil, which includes lower viscosity and different chemical compositions. Investment in new or expanded refineries is crucial to convert the raw output into valuable products for both domestic use and export, enhancing economic returns from Vaca Muerta.

Export facilities are another bottleneck in the current infrastructure setup. Argentina has ambitions to become a significant exporter of both oil and LNG, but the existing infrastructure, including ports and liquefaction plants, is inadequate for the scale envisioned. The port of Punta Colorada is planned to be developed into an export hub for oil, but further investment in LNG terminals is necessary to tap into global markets. The construction of LNG plants, like the one proposed by YPF and Malaysia's Petronas, is vital to convert natural gas into a form suitable for export, which could significantly alter Argentina's position in the global energy trade.

Further developments needed to fully exploit Vaca Muerta include not only physical infrastructure but also policy frameworks that encourage such investments. The construction of additional pipelines, both for domestic distribution and export, is essential. This includes not just one or two major pipelines but potentially a network that can handle the projected increase in production. Plans for gas pipelines to Brazil and Chile are under consideration but require significant capital and cross-border agreements.

The development of midstream infrastructure, like gas gathering systems and processing plants, is equally important. These facilities must be expanded to manage the initial stages of gas and oil collection from multiple wells, ensuring that production from Vaca Muerta can be efficiently aggregated and transported. The current gathering pipelines and conditioning plants, such as those operated by TGS, are steps in the right direction but need to be scaled up significantly.

Moreover, the environmental and logistical aspects of expanding this infrastructure cannot be ignored. The construction of pipelines, refineries, and export facilities must comply with environmental regulations and consider the ecological impact, especially in a region like Patagonia, known for its delicate ecosystems. Public opposition and regulatory hurdles due to environmental concerns have already delayed projects, indicating that future infrastructure must be developed with sustainable practices in mind.

While the Néstor Kirchner pipeline marks a significant step forward, Vaca Muerta's full exploitation requires a comprehensive overhaul of Argentina's energy infrastructure. This includes building new pipelines, upgrading or constructing refineries suited for shale oil, and developing export facilities for both oil and LNG. The challenge lies not just in the physical construction but in creating an environment where these projects can be realized swiftly and sustainably, ensuring that Vaca Muerta's potential translates into tangible economic benefits for Argentina.

Investment Climate:

The investment climate for oil and gas in Argentina, particularly around Vaca Muerta, is shaped by a complex interplay of regulatory environments, incentives, and barriers. The government has made concerted efforts to make the sector more attractive to investors. One of the most significant legislative moves was the introduction of the RIGI (Regime of Incentives for Large Investments), which provides tax stability for 30 years to large-scale projects, ensuring predictability in returns for investors. This framework was designed to counteract the historical volatility in Argentina's economic policies that often deterred long-term investment.

However, despite these incentives, the regulatory environment remains challenging. Argentina's history of sudden policy shifts, including changes in export taxes, royalties, and currency controls, has made investors cautious. For example, the government has at times imposed export taxes on hydrocarbons, which can significantly impact profitability, especially when global prices are low. These taxes are seen as a barrier, as they reduce the net return on investment, making projects less attractive when compared to opportunities in other countries with more consistent fiscal policies.

On the positive side, tax incentives specifically tailored for the oil and gas sector in Vaca Muerta include exemptions from certain municipal and provincial taxes, which can lower the operational costs for companies. There's also a program called "Plan Gas.Ar" aimed at encouraging natural gas production through price incentives, ensuring that producers receive a floor price for gas sold domestically, which helps in mitigating market price volatility.

Foreign investment in Vaca Muerta is also influenced by Argentina's capital controls. These controls limit the ability of foreign companies to repatriate profits or dividends, which can act as a significant deterrent. The inability to freely convert local currency into US dollars for repatriation or to pay for imports necessary for operations adds layers of financial risk and operational complexity, often requiring companies to negotiate special terms or wait for government approvals, which can delay projects.

The regulatory environment is further complicated by the federal structure of Argentina, where provinces have significant autonomy over natural resources. This leads to a patchwork of regulations where each province, like Neuquén where Vaca Muerta is located, might have its own set of rules for exploration, production, and environmental compliance. This decentralization can be both an incentive, as provinces can offer competitive terms, and a barrier, due to the complexity of navigating multiple regulatory frameworks.

Environmental regulations and community relations also play critical roles in the investment climate. The government has increasingly had to address environmental concerns related to fracking, which has led to stricter environmental compliance requirements. These regulations aim to protect local water sources and manage waste but can increase the cost and timeline of projects. Moreover, social licenses to operate, involving negotiations with local and indigenous communities, have become a significant aspect of investment considerations, potentially leading to delays or additional costs if not managed well.

Incentives for domestic investment include the opportunity for local companies to partner with international giants, gaining access to technology, expertise, and capital. The government has also encouraged local content policies to some extent, promoting the use of Argentine goods and services in oil and gas projects, which can stimulate the domestic economy and reduce dependency on imports. However, these policies must be balanced to not deter foreign investors who might prefer to bring in their trusted suppliers.

While the investment climate for oil and gas in Argentina has seen improvements with frameworks like RIGI and specific incentive programs, challenges remain. The regulatory environment is still perceived as unstable due to past policy flip-flops, and the barriers posed by capital controls, varying provincial regulations, and stringent environmental and social requirements continue to shape investor sentiment. For Vaca Muerta to reach its full potential, Argentina needs to maintain a consistent, transparent, and investor-friendly regulatory environment that balances economic incentives with environmental and social responsibilities.

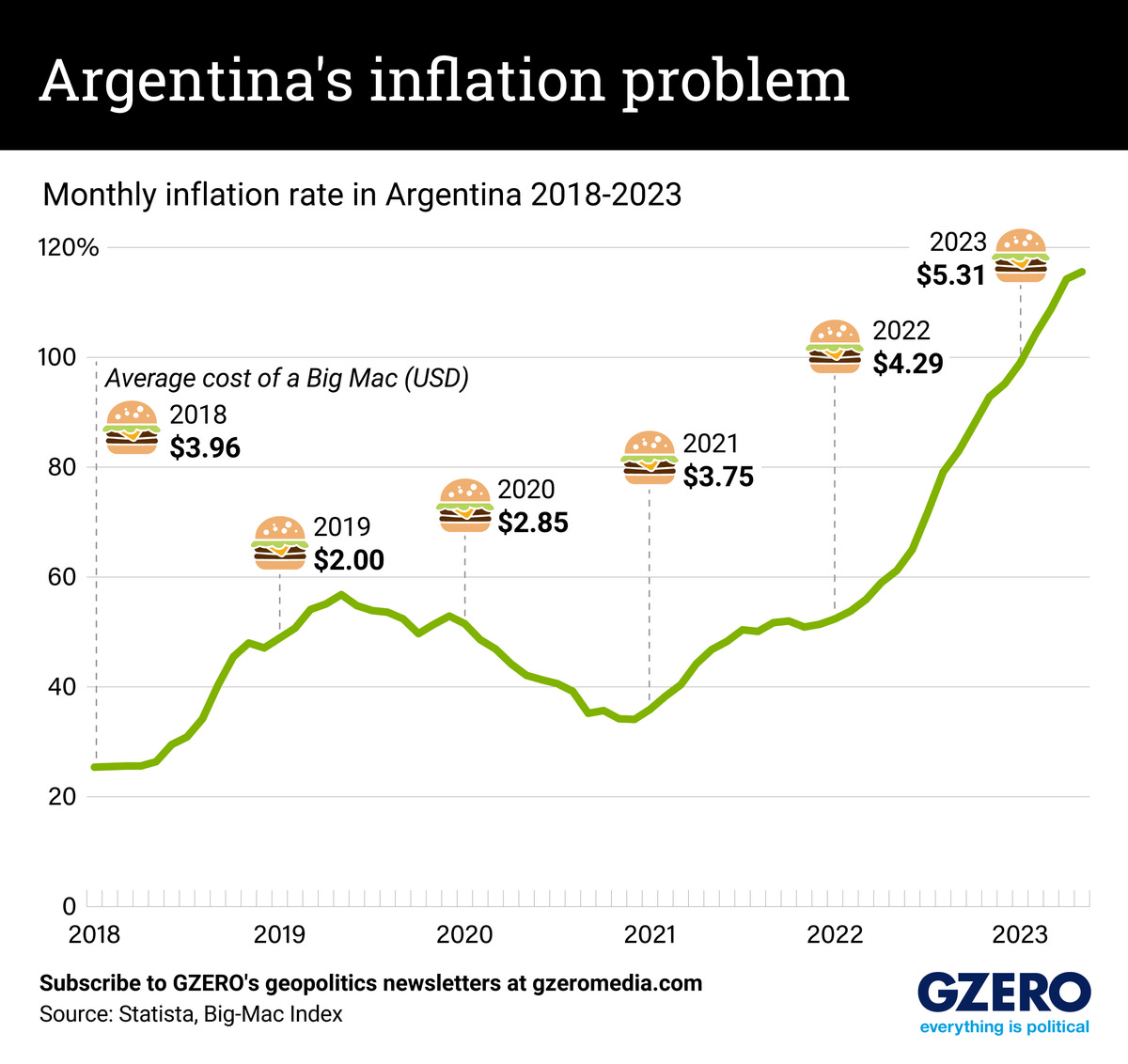

Argentina's current entanglement with the International Monetary Fund (IMF) is a continuation of a long and tumultuous relationship. As of early 2025, Argentina is dealing with significant debt issues, particularly with the IMF, following a series of economic crises. In 2018, Argentina received a $57 billion bailout from the IMF, which was the largest in the fund's history, aimed at stabilizing the country's faltering economy. However, this program did not achieve its goals, leading to a partial disbursement of $44 billion before the program was effectively halted. The current administration has been in discussions for a new loan agreement, but the previous loan's conditions and Argentina's failure to meet several performance targets have created a cautious atmosphere around any new financial arrangements. Argentina's poverty rate has soared, with inflation still at alarming levels, reflecting the ongoing economic strain despite these IMF interventions.

The history of hyperinflation in Argentina adds another layer of complexity to its current debt situation. The country has experienced several bouts of hyperinflation, most notably in the late 1980s, where inflation rates exceeded 5,000% annually. These episodes were typically triggered by a combination of high government spending, monetary expansion to finance budget deficits, and a lack of confidence in the domestic currency. For instance, between 1975 and 1990, Argentina saw average annual inflation rates around 300%, significantly eroding the purchasing power of the middle class. Attempts to control inflation, like the Austral Plan in 1985 which introduced a new currency, were short-lived. High inflation persisted, leading to drastic policy changes including the pegging of the peso to the US dollar in the early 1990s under the Convertibility Plan. However, this too eventually collapsed in 2001, leading to yet another default and severe economic crisis.

The interplay between Argentina's debt issues with the IMF and its history of hyperinflation illustrates a cycle of economic instability. The 2001 default, one of the largest sovereign debt defaults globally, was followed by a long period of economic recovery under different administrations, but the underlying structural problems, like fiscal irresponsibility and political instability, have not been fully resolved. Each time Argentina has approached the IMF for assistance, it has been under the shadow of this history, with both parties wary of the outcomes. The current discussions with the IMF are thus not just about managing debt but also about implementing reforms that could prevent a return to hyperinflation, which would require addressing deep-seated issues in fiscal policy, governance, and economic management. The challenge for Argentina is to break this cycle of borrowing, default, and inflation, which has characterized much of its recent economic history.

Future Prospects

The future economic prospects for Argentina hinge significantly on the development of Vaca Muerta. In an optimistic scenario where Vaca Muerta reaches its full potential, Argentina could see a substantial uplift in its economic performance. With projections indicating that the shale formation could produce up to one million barrels of oil per day by 2030, alongside significant gas output, Argentina might transition from an energy importer to a net exporter. This would not only boost the nation's foreign reserves but also reduce the fiscal deficit, historically bloated by energy import costs. Economic forecasts from various sources suggest that if Vaca Muerta scales up as planned, GDP growth could average between 3-5% annually in the coming decade, driven by increased export revenues, investment in the energy sector, and related job creation.

In this scenario, the ripple effects would be widespread. The agricultural sector, traditionally Argentina's economic backbone, could benefit from cheaper and more reliable energy inputs, potentially increasing productivity and export volumes. The industrial sector would also gain from lower energy costs, enhancing competitiveness in global markets. Infrastructure development around Vaca Muerta, including pipelines, refineries, and export facilities, would stimulate construction and manufacturing sectors, leading to a broader economic revival. Moreover, the influx of foreign investment and technology could catalyze innovation in other areas of the economy, potentially leading to a more diversified growth model.

However, without the full realization of Vaca Muerta's potential, the economic outlook for Argentina could be markedly different. If development stalls due to regulatory hurdles, insufficient investment, or environmental and social backlash, Argentina might continue to grapple with its chronic issues of high inflation, fiscal deficits, and economic instability. The absence of significant revenue from oil and gas exports would mean continued reliance on agricultural and service sectors, which are vulnerable to global price fluctuations and climate change. In this scenario, economic forecasts might project a modest growth rate, possibly below 2% annually, with persistent high inflation, as the country would still need to import energy, straining its balance of payments.

Furthermore, the lack of Vaca Muerta's development would likely mean missed opportunities for job creation and infrastructure investment. Unemployment could remain high, particularly in the Patagonian regions where Vaca Muerta is located, as local economies would not benefit from the ancillary industries that oil and gas development could spawn. The government would face challenges in funding public services and infrastructure without the additional tax revenues from the energy sector, potentially leading to increased public debt or austerity measures that could further dampen economic activity.

The geopolitical implications of these two scenarios are also significant. With Vaca Muerta fully developed, Argentina could leverage its position as an energy supplier to negotiate better trade deals, secure foreign investments, and strengthen diplomatic relations with energy-hungry nations. This could lead to a more assertive role for Argentina in regional and global politics. Conversely, without Vaca Muerta's energy wealth, Argentina might continue in a more subdued diplomatic stance, with limited influence in international energy markets and possibly more dependent on foreign aid or loans, like those from the IMF, to stabilize its economy.

Environmental and social considerations could also shape these economic futures. Full exploitation of Vaca Muerta might lead to environmental degradation if not managed with sustainable practices, potentially facing international criticism or trade sanctions, which could offset some economic gains. On the other hand, a cautious approach to Vaca Muerta's development, focusing on sustainability and community consent, could enhance Argentina's international environmental standing, possibly attracting green investments but at a slower economic pace.

The role of government policy in these scenarios is pivotal. With the right mix of economic reforms, investment incentives, and stable regulatory frameworks, Vaca Muerta could indeed be the catalyst for economic transformation. However, political instability, policy reversals, or populist measures could undo any positive trends, leading to a scenario where Vaca Muerta becomes more of a missed opportunity than an economic boon.

The future economic forecasts for Argentina with Vaca Muerta at full throttle paint a picture of growth, increased international stature, and possibly, a break from the cycle of economic crises. Without it, Argentina might continue to face its historical economic challenges, with less room for maneuver in terms of policy and international relations. The nation's trajectory will largely depend on how it navigates the complex interplay of resource management, political will, environmental stewardship, and economic policy.

Political Risks:

The Vaca Muerta project's trajectory is highly susceptible to political risks, primarily due to Argentina's history of political volatility and frequent shifts in government policy. Changes in administration can lead to drastic alterations in energy policy, from nationalization to privatization or from encouraging foreign investment to imposing stringent controls. For instance, the nationalization of YPF in 2012 under the administration of Cristina Fernández de Kirchner sent shockwaves through the investment community, making foreign companies wary of committing long-term capital to projects like Vaca Muerta. If future governments adopt similar policies, the project could face significant setbacks due to decreased investor confidence and potential expropriation threats.

The history of YPF (Yacimientos Petrolíferos Fiscales) nationalization is a significant chapter in Argentina's economic and political narrative, illustrating the country's complex relationship with its natural resources, foreign investment, and state control over key industries. YPF was established in 1922 under President Hipólito Yrigoyen's administration as the first oil company in the world set up as a state enterprise outside the Soviet Union. Its initial director, Enrique Mosconi, was a proponent of economic independence through the control of natural resources. Despite early efforts towards nationalizing oil, political upheavals, including a military coup in 1930 against Yrigoyen, halted these ambitions. The journey towards YPF's nationalization began with its privatization in 1993 under President Carlos Menem. This move was part of broader economic reforms aimed at liberalizing Argentina's economy, following the State Reform Law of 1989. YPF was sold to investors worldwide, with Spain's Repsol acquiring a controlling interest in 1999, renaming the company Repsol YPF. This privatization was seen as a means to attract foreign capital, technology, and management to improve efficiency and productivity.

By the early 2010s, dissatisfaction with Repsol's management of YPF had grown. Critics argued that Repsol had underinvested in Argentina, focusing instead on repatriating profits, which led to decreased oil production and an energy deficit for the country. This was particularly acute given Argentina's increasing energy demands, leading to the first energy trade deficit since 1987 by 2011. The discovery of the Vaca Muerta shale formation by Repsol YPF in 2011 further highlighted the stakes involved. In April 2012, under President Cristina Fernández de Kirchner, Argentina's government announced the partial renationalization of YPF. A bill was introduced to seize 51% of YPF's shares, with the state acquiring 51% of that package, and the remaining shares distributed among ten provincial governments. This move was overwhelmingly supported by both houses of Congress, and the law was signed on May 5, 2012. The government justified this action by declaring it in the "public interest" to ensure energy security and to spur development of the Vaca Muerta field.

Argentina agreed to pay Repsol $5 billion in compensation for the nationalized shares, which was settled in 2014. However, this nationalization led to several legal disputes. Minority shareholders, including Petersen Energía Inversora and Eton Park, sued Argentina in U.S. courts, leading to rulings that Argentina owed these shareholders significant sums for failing to extend a tender offer to them during the nationalization, culminating in a $16 billion judgment in 2023.

After nationalization, YPF's management was overhauled with the appointment of Miguel Galuccio, a former Schlumberger executive, indicating a commitment to professional management. Under state control, YPF's focus shifted towards increasing production, particularly from Vaca Muerta, leading to partnerships with international companies like Chevron and Petronas to develop this resource. The company's stock value saw a significant recovery, and production levels increased, reversing the decline seen under Repsol's management.

The nationalization of YPF has had a lasting impact on Argentina's energy policy, its relations with international investors, and its domestic political discourse. While it was celebrated by many as a reclaiming of national resources, it also led to a cautious approach from foreign investors wary of Argentina's policy volatility. Debates continue regarding whether the nationalization was beneficial in the long term, especially considering the legal and financial repercussions, but it undeniably shifted the control of Argentina's energy sector back to the state, aiming for greater energy self-sufficiency and development.

This history reflects a broader theme in Argentine politics of oscillating between state control and market liberalization, with significant implications for economic policy, foreign investment, and national development strategies.

Political instability in Argentina often manifests through economic policy swings, which directly impact the oil and gas sector. Policies like sudden increases in export taxes, changes in currency controls, or renegotiation of contracts can alter the profitability landscape overnight. An example is the 2019 primary election results, which led to a sharp devaluation of the peso and an immediate imposition of capital controls, affecting the financial planning of energy companies operating in Vaca Muerta. Such instability can deter new investments as companies fear the unpredictability of their returns or the stability of their operational environment.

The regulatory environment is another area where political changes can have a profound effect. Each administration might bring its own set of regulations, environmental laws, or tax regimes. The introduction of new laws or the revocation of existing incentives, like those provided by the RIGI regime for large investments, could disrupt ongoing projects. For instance, if a government decides to tighten environmental regulations without providing a clear path for compliance, it could lead to delays, increased costs, or even project cancellations, especially if the regulatory changes are perceived as politically motivated rather than environmentally necessary.

Moreover, political instability can influence the negotiation and enforcement of contracts with both domestic and international firms. The success of Vaca Muerta depends heavily on long-term commitments from investors, which require a stable legal and fiscal framework. Any perception of political risk, such as the lack of contract sanctity or the potential for retroactive policy changes, can lead companies to opt out of or scale back their involvement. This was evident when previous administrations imposed new taxes or altered royalty agreements mid-stream, leading to legal disputes or renegotiations that delayed development.

Provincial politics also play a critical role, given Argentina's federal structure where provinces control natural resources. Neuquén, where Vaca Muerta is located, has its own political dynamics that could affect project outcomes. Changes in local governance might lead to new local laws or demands, such as higher royalties or community benefits, which could alter the economic model for Vaca Muerta's development. The 2023 gubernatorial elections in Neuquén, for example, could have introduced new local policies affecting how Vaca Muerta is managed if a change in the ruling party occurred.

The political risk landscape is also influenced by public opinion and protests. Environmental and social activism against fracking has been significant in Argentina, with concerns over water use, land rights, and indigenous rights. A government more responsive to these protests might impose stricter regulations or delays on projects to appease public sentiment, which could slow down or alter the development path of Vaca Muerta. This not only affects project timelines but also the perception of Argentina as a stable place for investment in the oil and gas sector.

International relations are another aspect where political risks can impact the project. Argentina's relationship with major global powers and organizations like the IMF can influence its energy policy. For example, under pressure from international environmental agreements or from countries advocating for climate action, a government might shift policy towards reducing fossil fuel dependence, which could mean less emphasis on Vaca Muerta or imposing new conditions that make development less attractive.

The political risks surrounding Vaca Muerta are multifaceted, stemming from national policy shifts, local governance changes, public activism, and international pressures. How these risks are managed will significantly determine whether Vaca Muerta can achieve its potential or if it will be another example of Argentina's struggle with economic development due to political instability. The project's success will largely depend on the ability of successive governments to provide a stable, predictable, and investor-friendly environment while balancing national interests, environmental concerns, and public welfare.

Global Energy Trends:

Global energy trends, particularly the transition to renewable energy sources and the fluctuating demand for oil, are set to significantly influence the future role of Vaca Muerta in Argentina's energy landscape and its position on the global stage. With the world increasingly focusing on reducing carbon emissions, the demand for fossil fuels like those from Vaca Muerta might see a decline in the long term. However, in the near to medium term, oil and gas are expected to remain crucial, especially in regions still industrializing or those transitioning more slowly to renewables. This gives Vaca Muerta a window to capitalize on existing demand, particularly if it can offer competitively priced gas and oil during periods of market volatility or geopolitical disruptions in traditional supply chains.

The transition to renewables globally does not mean an immediate cessation of hydrocarbon use but rather a gradual shift. Argentina's strategy with Vaca Muerta could involve leveraging its oil and gas as a transitional fuel, especially natural gas, which is considered less polluting than coal or oil. Natural gas from Vaca Muerta could serve as a bridge fuel, powering both domestic consumption and potentially exporting to countries still heavily reliant on coal. However, for Vaca Muerta to remain relevant, investments in carbon capture and storage or other green technologies might need to be considered to align with global environmental goals.

Changes in oil demand are also influenced by economic recovery post-global crises, geopolitical tensions, and technological shifts, like the rise of electric vehicles reducing the need for gasoline. Vaca Muerta's heavy oil production might face challenges if global oil demand decreases due to these factors. However, the region's gas reserves could still be in demand, particularly for electricity generation in countries moving away from coal but not yet fully transitioning to renewables. This scenario makes the development of infrastructure for gas, like LNG terminals, critical for Argentina to tap into international markets.

Argentina's refining capacity is another pivotal aspect that could determine Vaca Muerta's economic impact. Currently, Argentina's refineries are not fully optimized for the lighter crude Vaca Muerta produces, which differs from the heavier crude historically processed. This mismatch means that without upgrading or building new refineries, much of the oil might need to be exported in its raw form, potentially missing out on higher value-added products. However, if Argentina invests in refineries tailored to Vaca Muerta's output, it could transform crude oil into a broader range of products like gasoline, diesel, jet fuel, and petrochemicals, including fertilizers, which are critical for the agricultural sector.

The production of fertilizers from Vaca Muerta's gas could be particularly transformative for Argentina's economy, given its status as an agricultural powerhouse. Natural gas is a key input for nitrogen-based fertilizers like urea and ammonia. With Vaca Muerta's gas, Argentina could reduce its import dependency on fertilizers, thereby enhancing food security and agricultural competitiveness. If the country develops facilities to produce these derivatives domestically, it would not only stabilize local supply but could also export these products, adding another layer of economic value to the resources extracted from Vaca Muerta.

This move towards self-sufficiency in fertilizer production could be a game-changer, not just economically but geopolitically. Countries with the capability to produce their own fertilizers have a strategic advantage, especially in times of global supply chain disruptions. Posts on social media have highlighted potential investments in fertilizer production, with companies like Profertil and Pampa Energía considering projects that could leverage Vaca Muerta's gas. Such developments would diversify Argentina's energy strategy, moving beyond mere extraction to industrial applications.

However, the success of this strategy will depend on several factors, including the global price of natural gas, the cost-effectiveness of producing fertilizers domestically versus importing, and the environmental policies governing emissions from such industrial processes. If sustainable practices are adopted, like using captured CO2 in fertilizer production, it could also align with global trends towards cleaner industrial processes.

While global energy trends lean towards renewables, Vaca Muerta's future is not entirely dimmed but rather reshaped. Its role could evolve from a primary source of crude oil and gas to a supplier of cleaner energy products and industrial inputs like fertilizers. This transformation requires investment in refining capabilities and a strategic alignment with global markets' evolving needs, potentially making Argentina not just an energy exporter but a significant player in industrial commodities as well. The adaptability of Vaca Muerta's development to these trends will be crucial in determining whether it remains a cornerstone of Argentina's economic strategy in a changing world.

Conclusion

The Vaca Muerta shale formation is not merely an untapped reservoir of hydrocarbons but a pivotal asset in reshaping Argentina's economic, geopolitical, and energy landscapes. Its immense potential to produce oil and natural gas at globally competitive levels has positioned it as a cornerstone of Argentina’s ambitions for energy independence, export-driven growth, and regional leadership in South America. The transformation from a nation reliant on energy imports to a significant player in the global energy market hinges on the strategic and sustainable development of this resource.

However, the path to realizing Vaca Muerta's promise is fraught with challenges. Political instability, regulatory uncertainty, and infrastructure limitations remain significant obstacles that must be addressed to attract the investment and expertise needed to unlock its full potential. Equally critical are the environmental and social concerns that demand careful management to ensure that development does not come at an unsustainable cost to local communities and ecosystems.

The future of Vaca Muerta will also be shaped by global energy trends, including the transition to renewable energy sources and the evolving dynamics of oil and gas markets. To remain competitive, Argentina must embrace innovation, invest in complementary infrastructure such as LNG terminals and refineries, and align its strategies with international environmental standards. Additionally, leveraging the natural gas from Vaca Muerta for industrial applications, such as fertilizer production, offers an opportunity to diversify economic benefits while reducing reliance on raw exports.

In many ways, Vaca Muerta represents a test of Argentina’s capacity for long-term governance, strategic planning, and international cooperation. If managed prudently, it has the potential to drive sustained economic growth, bolster Argentina’s position in global energy markets, and provide a foundation for broader industrial development. Conversely, mismanagement or neglect could see it join the ranks of missed opportunities in Argentina’s economic history.

Ultimately, the future of Vaca Muerta will not just define the trajectory of Argentina’s energy sector but also serve as a litmus test for its ability to navigate the complexities of resource management in an interconnected and increasingly sustainability-conscious world. With vision, investment, and commitment, the 'Dead Cow' could truly come to life, fueling a new era of prosperity for Argentina.

Sources:

Reuters. (2023, May 31). Argentina's Vaca Muerta could pump 1 mln bpd of crude by 2030, Rystad says. Reuters. https://www.reuters.com/markets/commodities/argentinas-vaca-muerta-could-pump-1-mln-bpd-crude-by-2030-rystad-says-2023-05-31/

Fontevecchia, A. (n.d.). Does Vaca Muerta hold the key to Argentina's economic revival? Yahoo Finance. https://finance.yahoo.com/news/does-vaca-muerta-hold-key-143700995.html

Reuters. (2022, April 11). Chevron granted shale exploration concession in Argentina's Vaca Muerta. Reuters. https://www.reuters.com/business/energy/chevron-granted-shale-exploration-concession-argentinas-vaca-muerta-2022-04-11/

Hartzell, C., & Hartley, P. R. (n.d.). Political risk and foreign investment in Argentina's Vaca Muerta. Rice University’s Baker Institute for Public Policy. https://www.bakerinstitute.org/research/political-risk-and-foreign-investment-argentinas-vaca-muerta

Enverus. (n.d.). Vaca Muerta oil production data analysis & forecast. Enverus. https://www.enverus.com/vaca-muerta-oil-production-data-analysis-forecast/

World Oil. (2023, February 27). Argentina awakens Vaca Muerta shale to increase oil and natural gas production. World Oil. https://www.worldoil.com/news/2023/2/27/argentina-awakens-vaca-muerta-shale-to-increase-oil-and-natural-gas-production/

Reuters. (2022, December 27). Argentina's Vaca Muerta shale boom is running out of road. Reuters. https://www.reuters.com/business/energy/argentinas-vaca-muerta-shale-boom-is-running-out-road-2022-12-27/

López, M. (n.d.). Argentina: Vaca Muerta and fracking resistance. NACLA. https://nacla.org/argentina-vaca-muerta-fracking-resistance

Dialogue Earth. (n.d.). Vaca Muerta gas field residents lack heat and power. Dialogue Earth. https://dialogue.earth/en/energy/370438-vaca-muerta-gas-field-residents-lack-heat-and-power/

Reuters. (2024, October 23). Argentina's Vaca Muerta shale lands its 'drill, baby, drill'. Reuters. https://www.reuters.com/business/energy/argentinas-vaca-muerta-shale-lands-its-drill-baby-drill-2024-10-23/

Toledano, P., & Maemling, N. (2024). The environmental implications of shale gas development in the Vaca Muerta formation, Argentina. Applied Sciences, 14(4), 1366. https://www.mdpi.com/2076-3417/14/4/1366

Reuters. (2022, December 27). Argentina's Vaca Muerta shale boom is running out of road. Reuters. https://www.reuters.com/business/energy/argentinas-vaca-muerta-shale-boom-is-running-out-road-2022-12-27/

BBVA. (n.d.). Vaca Muerta, the world's second largest shale gas deposit. BBVA. https://www.bbva.com/en/vaca-muerta-worlds-second-largest-shale-gas-deposit/

Watts, J. (2023, October 18). Vaca Muerta oil shale: Argentina goes all in on fracking. The Guardian. https://www.theguardian.com/global-development/2023/oct/18/vaca-muerta-oil-shale-argentina-goes-all-in-on-fracking

López, M. (n.d.). Argentina: Vaca Muerta and fracking resistance. NACLA. https://nacla.org/argentina-vaca-muerta-fracking-resistance

U.S. Energy Information Administration. (2020, June 8). Growth in Argentina's Vaca Muerta shale and tight gas production leads to LNG exports. EIA. https://www.eia.gov/todayinenergy/detail.php?id=40093

Reuters. (2023, May 31). Argentina's Vaca Muerta could pump 1 mln bpd of crude by 2030, Rystad says. Reuters. https://www.reuters.com/markets/commodities/argentinas-vaca-muerta-could-pump-1-mln-bpd-crude-by-2030-rystad-says-2023-05-31/

Pipeline & Gas Journal. (2024, March). Argentina's Vaca Muerta shale formation drives record oil production in February. Pipeline & Gas Journal. https://pgjonline.com/news/2024/march/argentinas-vaca-muerta-shale-formation-drives-record-oil-production-in-february

Lacy, C. (2022, July 18). Achieving energy self-sufficiency: Argentina's game-changing Vaca Muerta. Hart Energy. https://www.hartenergy.com/exclusives/achieving-energy-self-sufficiency-argentinas-game-changing-vaca-muerta-207442

World Oil. (2023, February 27). Argentina awakens Vaca Muerta shale to increase oil and natural gas production. World Oil. https://www.worldoil.com/news/2023/2/27/argentina-awakens-vaca-muerta-shale-to-increase-oil-and-natural-gas-production/

Reuters. (2017, October 11). Troubled labor pact raises obstacle to Argentina shale development. Reuters. https://www.reuters.com/article/us-argentina-shale/troubled-labor-pact-raises-obstacle-to-argentina-shale-development-idUSKBN1H22N1/

Reuters. (2022, April 11). Chevron granted shale exploration concession in Argentina's Vaca Muerta. Reuters. https://www.reuters.com/business/energy/chevron-granted-shale-exploration-concession-argentinas-vaca-muerta-2022-04-11/

Reuters. (2019, September 16). Argentina's government reinforces security in Vaca Muerta shale oil zone. Reuters. https://www.reuters.com/article/us-argentina-vacamuerta/argentinas-government-reinforces-security-in-vaca-muerta-shale-oil-zone-idUSKBN1W2016/

Fontevecchia, A. (2022, May 31). Vaca Muerta, the world's second largest shale deposit, a failed opportunity that will cost Argentina $5 billion this year alone. Forbes. https://www.forbes.com/sites/afontevecchia/2022/05/31/vaca-muerta-the-worlds-second-largest-shale-deposit-a-failed-opportunity-that-will-cost-argentina-5-billion-this-year-alone/

Enverus. (n.d.). Vaca Muerta oil production data analysis & forecast. Enverus. https://www.enverus.com/vaca-muerta-oil-production-data-analysis-forecast/

Deheza. (n.d.). Argentina's Vaca Muerta shale revolution. Deheza. https://www.deheza.co.uk/argentinas-vaca-muerta-shale-revolution/

Fontevecchia, A. (n.d.). Does Vaca Muerta hold the key to Argentina's economic revival? Yahoo Finance. https://finance.yahoo.com/news/does-vaca-muerta-hold-key-143700995.html

Bloomberg. (2024, July 24). Argentina's shale ambitions may finally come to fruition. Bloomberg. https://www.bloomberg.com/news/newsletters/2024-07-24/argentina-s-shale-ambitions-may-finally-come-to-fruition

Hartzell, C., & Hartley, P. R. (n.d.). Political risk and foreign investment in Argentina's Vaca Muerta. Rice University’s Baker Institute for Public Policy. https://www.bakerinstitute.org/research/political-risk-and-foreign-investment-argentinas-vaca-muerta

Dialogue Earth. (n.d.). Vaca Muerta gas field residents lack heat and power. Dialogue Earth. https://dialogue.earth/en/energy/370438-vaca-muerta-gas-field-residents-lack-heat-and-power/

Fontevecchia, A. (2019, December 9). Argentina's Vaca Muerta could lead to a shale boom to rival the United States. Forbes. https://www.forbes.com/sites/afontevecchia/2019/12/09/argentinas-vaca-muerta-could-lead-to-a-shale-boom-to-rival-the-united-states/

OilPrice.com. (n.d.). Is this Argentinian shale play the next Permian? OilPrice.com. https://oilprice.com/Energy/Crude-Oil/Is-This-Argentinian-Shale-Play-The-Next-Permian.html

Offshore Technology. (n.d.). Vaca Muerta shale oil and gas field. Offshore Technology. https://www.offshore-technology.com/projects/vaca-muerta-shale-oil-and-gas-field/

Ratliff, W. (2023, July 14). Argentina and Bolivia's tussle over natural gas. Foreign Policy. https://foreignpolicy.com/2023/07/14/argentina-bolivia-natural-gas-vaca-muerta-massa-election/

McKinsey & Company. (n.d.). Vaca Muerta: An opportunity to respond to the global energy crisis. McKinsey & Company. https://www.mckinsey.com/industries/oil-and-gas/our-insights/vaca-muerta-an-opportunity-to-respond-to-the-global-energy-crisis

Atlas Report. (n.d.). How oil exploration in the Vaca Muerta region is Argentina's hope to escape the economic crisis. Atlas Report. https://atlas-report.com/how-oil-exploration-in-the-vaca-muerta-region-is-argentinas-hope-to-escape-the-economic-crisis/

Reuters. (2019, October 1). Political turmoil, price freeze cast shadow on Argentina's Vaca Muerta. Reuters. https://www.reuters.com/article/us-argentina-economy-energy/political-turmoil-price-freeze-cast-shadow-on-argentinas-vaca-muerta-idUSKBN1W111P/

Hartley, P. R. (n.d.). The winds of political change blowing through Argentina's Vaca Muerta. Rice University’s Baker Institute for Public Policy. https://www.bakerinstitute.org/research/wind-political-change-blowing-argentinas-vaca-muerta

Dialogue Earth. (n.d.). Vaca Muerta: Argentina's climate, cash, jobs, and justice. Dialogue Earth. https://dialogue.earth/en/energy/361054-vaca-muerta-argentina-climate-cash-jobs-justice/

Reuters. (2024, November 21). Argentina's Vaca Muerta gas export plan is a pipe dream. Reuters. https://www.reuters.com/business/energy/argentinas-vaca-muerta-gas-export-plan-is-pipe-dream-2024-11-21/

The Buenos Aires Times. (n.d.). Vaca Muerta: A failed opportunity that will cost Argentina US$5 billion this year alone. The Buenos Aires Times. https://www.batimes.com.ar/news/opinion-and-analysis/vaca-muerta-a-failed-opportunity-that-will-cost-argentina-us5-billion-this-year-alone.phtml

Lacy, C. (2022, July 18). The Permian 2.0 case for Argentina's Vaca Muerta. Hart Energy. https://www.hartenergy.com/exclusives/permian-20-case-argentinas-vaca-muerta-207492

BBVA. (n.d.). Vaca Muerta, the world's second largest shale gas deposit. BBVA. https://www.bbva.com/en/vaca-muerta-worlds-second-largest-shale-gas-deposit/

Reuters. (2023, May 31). Argentina's Vaca Muerta could pump 1 mln bpd of crude by 2030, Rystad says. Reuters. https://www.reuters.com/markets/commodities/argentinas-vaca-muerta-could-pump-1-mln-bpd-crude-by-2030-rystad-says-2023-05-31/

Watts, J. (2023, October 18). Vaca Muerta oil shale: Argentina goes all in on fracking. The Guardian. https://www.theguardian.com/global-development/2023/oct/18/vaca-muerta-oil-shale-argentina-goes-all-in-on-fracking

Fontevecchia, A. (n.d.). Does Vaca Muerta hold the key to Argentina's economic revival? Yahoo Finance. https://finance.yahoo.com/news/does-vaca-muerta-hold-key-143700995.html

Uno Magazine. (n.d.). Expectations and natural resources: Vaca Muerta and other Argentinian challenges. Uno Magazine. https://www.uno-magazine.com/number-16/expectations-and-natural-resources-vaca-muerta-and-other-argentinian-challenges/

Gas Outlook. (n.d.). Argentina woos gas buyers amid geopolitical flux. Gas Outlook. https://gasoutlook.com/analysis/argentina-woos-gas-buyers-amid-geopolitical-flux/

López, M. (n.d.). Argentina: Vaca Muerta and fracking resistance. NACLA. https://nacla.org/argentina-vaca-muerta-fracking-resistance

Carrillo, A. (2023). Economic and environmental implications of shale oil and gas production in Vaca Muerta, Argentina. Journal of Latin American Geography, 17(3), Article 6. https://repository.lsu.edu/jlag/vol17/iss3/6/

Reuters. (2017, October 11). Troubled labor pact raises obstacle to Argentina shale development. Reuters. https://www.reuters.com/article/us-argentina-shale/troubled-labor-pact-raises-obstacle-to-argentina-shale-development-idUSKBN1H22N1/

U.S. Energy Information Administration. (2019, July 12). Growth in Argentina's Vaca Muerta shale and tight gas production leads to LNG exports. EIA. https://www.worldoil.com/news/2019/7/12/eia-growth-in-argentina-s-vaca-muerta-shale-tight-gas-production-leads-to-lng-exports

Stockholm Environment Institute. (n.d.). Watershed implications of shale oil and gas production in Vaca Muerta, Argentina. SEI. https://www.sei.org/publications/watershed-implications-of-shale-oil-and-gas-production-in-vaca-muerta-argentina/

Romero, S. (2013, October 21). Argentina's oil ambitions create unlikely alliance with Chevron. The New York Times. https://www.nytimes.com/2013/10/22/business/energy-environment/argentinas-oil-ambitions-create-unlikely-alliance-with-chevron.html