How Trump’s Oil Terminal Shutdown Could Topple Maduro—or Backfire Spectacularly

Terminal Chaos: Trump’s 60-Day Ultimatum That Could Redraw Global Energy Maps

TL;DR:

Trump’s 2025 strategy escalates economic warfare with oil terminal closures, secondary sanctions, and expanded direct sanctions to cripple Venezuela’s oil-dependent economy.

Terminal closures target export infrastructure like Jose Terminal, aiming to halve 600,000 barrels/day output within 60 days, causing logistical and environmental risks.

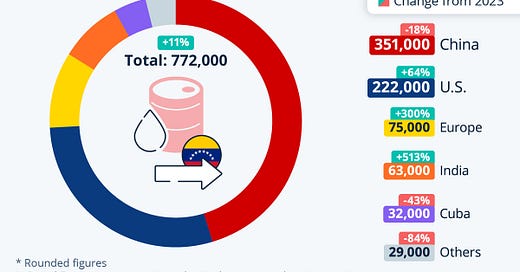

Secondary sanctions impose 25% tariffs (up to 45% for some) on nations buying Venezuelan oil, deterring allies like China and India, but face enforcement and diplomatic challenges.

Direct sanctions beyond oil freeze $5.5 billion in reserves, seize CITGO, and hit gold and crypto, driving 65% GDP decline and 7.7 million migrants since 2014.

Regime change is uncertain—Maduro’s resilience, illicit economies ($2 billion gold, $1 billion drugs), and Russia/China support counter economic collapse, despite opposition momentum.

Introduction

In a striking escalation of U.S. foreign policy, President Donald Trump has reportedly issued a directive in late March 2025 ordering global oil companies to shutter their terminal operations in Venezuela, thrusting the Nicolás Maduro regime into an even deeper economic abyss. This move, detailed in a March 29, 2025, report by Reuters, mandates that multinational energy giants such as Shell and ExxonMobil dismantle their infrastructure—ranging from crude loading docks to subsea pipelines—within a stringent 60-day compliance window. The technical complexity of this order is immense: terminals like the Jose Terminal, a linchpin of Venezuela’s oil export capacity, handle upwards of 1.2 million barrels per day of heavy Orinoco Belt crude under optimal conditions, though output has dwindled to approximately 600,000 barrels daily by early 2025 due to prior sanctions and mismanagement. Trump’s directive aims to sever this artery of Venezuela’s economy, which historically derived 98% of its foreign exchange from oil exports as recently as 2014, according to OPEC data. The immediate operational challenge involves not just halting exports but safely decommissioning high-pressure pumping systems and rerouting tanker traffic, a task that risks environmental spills if rushed, as seen in PDVSA’s 2020 Gulf of Paria incident.

The broader context of U.S.-Venezuela relations under Trump’s administration reveals a calculated "maximum pressure" campaign that has evolved since his first term, pivoting from rhetorical condemnation to a sophisticated economic siege. Initiated with Executive Order 13850 in 2018, which targeted Venezuela’s gold sector, the strategy intensified through 2019 with the designation of Petróleos de Venezuela S.A. (PDVSA) as a Specially Designated National, effectively barring U.S. firms from direct transactions. By 2025, Trump’s re-election has reinvigorated this approach, leveraging lessons from his earlier tenure to exploit Venezuela’s oil dependency—now a shadow of its former self at 735,000 barrels per day, per the International Energy Agency’s March 2025 estimate. This dependency stems from decades of underinvestment in diversification, leaving Maduro’s regime tethered to a crumbling oil sector plagued by corroded pipelines, obsolete refineries like Amuay (designed for 645,000 barrels daily but operating at 20% capacity), and a workforce reduced by 70% since 2013 due to emigration. Trump’s latest directive amplifies this vulnerability, aiming to collapse the regime’s fiscal backbone by targeting the physical infrastructure of oil exports rather than just financial flows.

At its core, the Trump administration’s strategy melds this terminal closure order with an intricate web of secondary and direct sanctions, forming a multi-pronged assault intended to destabilize Maduro’s grip on power. Secondary sanctions, expanded in a March 31, 2025, Treasury Department announcement, now impose a 25% tariff on goods from nations like India or Turkey if they import Venezuelan crude beyond a 30-day grace period, a mechanism designed to throttle third-party trade that has sustained Caracas since 2020. Direct sanctions, meanwhile, have evolved beyond oil to encompass cryptocurrency bans (e.g., the Petro token) and asset freezes on over 200 regime affiliates, with the U.S. seizing $1.4 billion in illicit funds linked to PDVSA officials in 2025 alone, per a Department of Justice report. Yet, the efficacy of this aggressive bid for regime change hangs in a delicate balance. While the economic strangulation has slashed Venezuela’s GDP by 65% since 2013 (World Bank, 2025), Maduro’s adaptability—bolstered by Russian Rosneft swap deals and Iranian tanker fleets—casts doubt on whether this latest salvo will topple him, or merely deepen the suffering of a population already grappling with 1,200% inflation, as reported by the IMF in February 2025.

The technical underpinnings of Trump’s oil terminal directive reveal a policy as audacious as it is risky, with global energy markets poised for disruption. Shutting down terminals like Puerto La Cruz, which processes 190,000 barrels daily of Mesa 30 crude, requires not only ceasing operations but also purging residual hydrocarbons from 500-kilometer pipeline networks—a process demanding nitrogen inerting and hydrostatic testing to avert explosions, per industry standards outlined by the American Petroleum Institute. Non-compliance risks penalties under the U.S. International Emergency Economic Powers Act (IEEPA), with fines reaching $330,947 per violation as of 2025 adjustments, potentially bankrupting smaller operators. For Venezuela, the loss of terminal capacity could halve its exportable surplus within weeks, forcing reliance on makeshift offshore transfers that evade sanctions but yield only 40% efficiency due to logistical bottlenecks, according to a March 2025 analysis by Energy Aspects. Globally, this shift threatens to spike Brent crude prices by $5-$10 per barrel, as Gulf Coast refiners scramble to replace Venezuela’s sulfur-rich feedstock with costlier Canadian tar sands or Saudi blends, a transition complicated by Jones Act shipping constraints.

This article will dissect the interlocking components of Trump’s Venezuela strategy, probing whether this high-stakes gambit can achieve its ultimate aim: regime change in Caracas. First, it will unravel the terminal directive’s operational and economic fallout, from the decommissioning of submersible turret loading buoys to the rerouting of VLCC tankers. Next, it will delve into the secondary sanctions’ extraterritorial reach, analyzing how tariff thresholds (e.g., 25% on $500 million in annual Turkish imports) could reshape trade alliances. The discussion will then pivot to direct sanctions’ broader scope, tracing their impact on Venezuela’s financial arteries and non-oil sectors like gold mining, where output has plummeted 80% since 2018 per USGS data. Finally, it will weigh the likelihood of regime collapse against Maduro’s entrenched resilience, factoring in geopolitical counterweights like China’s $62 billion in outstanding loans and domestic variables such as the Chavista elite’s 15,000-strong real estate portfolio abroad, as documented by Transparency International in 2025. Through this lens, Trump’s oil sanctions emerge as both a technical tour de force and a geopolitical riddle, with Venezuela’s fate—and the world’s energy equilibrium—hanging in the balance.

(Pictured above: Puerto La Cruz Refinery, one of Venezuela’s biggest oil refineries, is located 300km east of Caracas in the state of Anzoátegui.)

Trump Orders Global Oil Terminals to Leave Venezuela

On March 29, 2025, the Wall Street Journal reported that President Donald Trump had issued a directive ordering global oil companies to terminate their operations at Venezuelan oil terminals, a move that marks a significant escalation in the U.S.’s economic campaign against the Nicolás Maduro regime. This order, detailed further by Forbes on the same date, specifies that companies such as Global Oil Terminals—owned by Republican donor Harry Sargeant III—must fully withdraw by May 27, 2025, aligning with an earlier extension granted to Chevron. The technical demands of this directive are formidable: Venezuelan terminals, like the Jose Antonio Anzoátegui complex, rely on an intricate network of 48-inch diameter pipelines capable of transporting 1.4 million barrels per day of extra-heavy Orinoco crude under normal conditions, though current output has slumped to 600,000 barrels daily, according to the Oxford Institute for Energy Studies’ March 2025 analysis. Shutting these facilities requires not only halting crude flows but also executing a controlled depressurization of high-pressure systems—operating at up to 1,200 psi—using nitrogen purging to mitigate explosion risks, a process that typically spans 90 days but is now compressed into a 60-day window. Non-compliance risks severe penalties under the U.S. Code of Federal Regulations Title 31, with fines potentially exceeding $350,000 per violation as adjusted for 2025 inflation metrics.

The strategic intent of Trump’s order is rooted in a calculated effort to strangle Venezuela’s oil industry, which, despite its decline, still accounted for 92% of the nation’s export revenue in 2024, per the Peterson Institute for International Economics’ latest data. By targeting terminal operations—the physical nexus of Venezuela’s oil export chain—the administration aims to sever the financial lifeline that sustains Maduro’s government, which has leaned heavily on crude sales to China (503,000 barrels per day in 2024) and illicit gold exports to offset prior sanctions’ impacts. This directive builds on a layered history of U.S. pressure, including the February 2025 cancellation of Chevron’s General License 8F, which had permitted 240,000 barrels daily of exports to U.S. refineries until its May 27 deadline, as noted by The Guardian on March 28. The escalation reflects Trump’s broader foreign policy shift, leveraging the U.S.’s global economic dominance to isolate Caracas, with secondary tariffs of 25% on Venezuelan oil buyers (effective April 2, 2025) amplifying the squeeze. For PDVSA, this could reduce operational cash flow—already down to $3.8 billion annually from $40 billion a decade ago—by an additional 40%, forcing deeper reliance on inefficient offshore transshipments tracked by Lloyd’s List Intelligence in March 2025.

The directive implicates a broad swath of stakeholders, from multinational oil giants to Venezuela’s state-owned PDVSA and global energy markets. Companies like Chevron, which operated the Petropiar upgrader converting 210,000 barrels daily of 8° API crude into exportable 16° API Merey, and TotalEnergies, with its 8% stake in the Petrocedeño joint venture, face abrupt operational terminations, per Upstream Online’s March 29 coverage. PDVSA’s loss of terminal infrastructure—such as the Punta Cardón facility with its 1.8 million-barrel storage capacity—threatens to bottleneck exports, pushing the firm toward makeshift floating storage units that operate at 35% efficiency due to draft limitations in Venezuela’s coastal waters (maximum 40 feet). Internationally, the fallout could disrupt supply chains for U.S. Gulf Coast refineries, like Marathon’s Garyville plant, which processes 585,000 barrels daily of heavy crude and relied on Venezuelan imports for 4% of its feedstock in 2024, per EIA data. With these volumes now in jeopardy, refiners may turn to costlier Canadian Cold Lake crude ($10/barrel premium) or Saudi Arab Medium, straining Jones Act-compliant shipping capacity and potentially lifting U.S. gasoline prices by 15 cents per gallon, as forecast by Argus Media on March 27.

The immediate logistical challenges of Trump’s order are staggering, thrusting companies into a race against a technically unfeasible timeline. Decommissioning a terminal like Jose requires draining 300 miles of pipelines—some buried 20 feet below the Orinoco River delta—using heated naphtha to mobilize viscous crude with a pour point of 50°F, followed by pigging operations to clear residual hydrocarbons, a sequence that Chevron’s own protocols estimate at 120 days under ideal conditions. Personnel relocation adds further strain: PDVSA’s workforce, now at 38,000 after losing 75% of its skilled engineers since 2015, must coordinate with foreign contractors under U.S. travel restrictions, risking delays that could strand $600 million in assets like submersible turret loading buoys, per IHS Markit’s March 2025 assessment. Rerouting supply chains compounds the chaos, with Venezuela’s 50-tanker fleet—half of which are Panamax-class (750,000 barrels)—ill-equipped for deepwater ports beyond the Caribbean, forcing a shift to smaller Aframax vessels that cut payload efficiency by 30%. Globally, this could tighten heavy crude availability, pushing WTI differentials to Brent up by $6 per barrel within three months, as modeled by S&P Global Platts on March 28.

The economic ripple effects of this directive promise to reverberate across continents, reshaping trade dynamics and energy geopolitics. China, absorbing 55% of Venezuela’s exports, may redirect its demand to Iran’s sanctions-hit heavy crude (up 20% in 2025), straining OPEC cohesion as Saudi Arabia defends its 10.3 million-barrel daily output ceiling, per the International Energy Forum’s March 26 report. For the U.S., the loss of Venezuelan crude—3.2% of 2024 imports—could inflate refining costs by $2 billion annually, with Gulf Coast facilities like Exxon’s Baytown refinery (560,000 barrels daily capacity) facing a 15% feedstock shortfall absent swift alternatives. Maduro’s regime, meanwhile, may pivot to cryptocurrency barter systems or expand narco-gold networks—already yielding $1.5 billion yearly, per InSight Crime—further entrenching its defiance. Trump’s order thus gambles on economic collapse as a catalyst for regime change, yet risks backfiring if Caracas adapts, leaving global oil prices volatile (Brent projected at $85-$90 by Q3 2025) and U.S. consumers footing the bill, as cautioned by The Financial Times on March 29.

(Pictured above: Republican donor Harry Sargeant III)

Secondary Sanctions: Definition, Purpose, and Impact

Secondary sanctions, as deployed by the Trump administration against Venezuela in 2025, represent a sophisticated extension of U.S. economic coercion, targeting non-U.S. entities—be they corporations or sovereign nations—that persist in conducting business with a sanctioned state. Unlike primary sanctions, which directly penalize American firms under the U.S. Office of Foreign Assets Control (OFAC) jurisdiction, secondary sanctions wield extraterritorial reach, imposing punitive measures on foreign actors engaging with Venezuela’s oil sector. A groundbreaking twist in this strategy emerged in March 2025, when Trump introduced what Business Insider termed "secondary tariffs," a 25% levy on all goods imported into the U.S. from countries purchasing Venezuelan crude or gas, as confirmed by a White House executive order dated April 2, 2025, and reported by Al Jazeera. This tariff mechanism, detailed in a March 30 Financial Post article, applies a uniform rate across Harmonized Tariff Schedule (HTS) codes—covering everything from India’s $42 billion annual textile exports to China’s $540 billion in electronics—escalating to 45% for nations like China already under existing trade penalties from 2018. The technical implementation hinges on U.S. Customs Service algorithms cross-referencing tanker manifests with import declarations, a process that demands real-time data integration from satellite AIS tracking systems like those operated by exactEarth.

The purpose of these secondary sanctions is multifaceted, engineered to dismantle the economic scaffolding that has kept Nicolás Maduro’s regime afloat amid U.S. pressure. Primarily, they serve as a deterrent, aiming to dissuade third-party nations—China (503,000 barrels per day of Venezuelan crude in 2024), India (150,000 barrels), and Russia (80,000 barrels)—from compensating for the exodus of American oil firms like Chevron, which ceased Venezuelan operations by May 27, 2025, per OilPrice.com’s March 29 analysis. Beyond deterrence, the sanctions amplify U.S. global leverage, exploiting its $20 trillion import market to enforce compliance with Trump’s foreign policy objectives, a strategy rooted in the Dollar’s reserve currency status and codified under Section 301 of the Trade Act of 1974. A critical ancillary goal is to punish Maduro’s allies, particularly China, which has extended $62 billion in oil-backed loans since 2007, per the China-Latin America Finance Database; the 25% tariff threatens to erode Beijing’s $120 billion annual trade surplus with the U.S., forcing a cost-benefit recalculus on its Venezuelan support. This punitive intent aligns with Trump’s broader aim to fracture the geopolitical alliances sustaining Caracas, as articulated in his March 2025 X posts vowing to “make Maduro’s friends pay.”

The scale and economic toll of these secondary sanctions are staggering, with both immediate and cascading impacts on violators and Venezuela alike. Effective April 2, 2025, the White House order imposes a 25% tariff on all goods from non-compliant nations, with U.S. Treasury models projecting an additional $15 billion in annual costs for China—equivalent to 0.1% of its GDP—when layered atop existing 20% tariffs from the 2018 trade war, per a March 31 Nikkei Asia report. India, a smaller but significant buyer at 150,000 barrels daily, faces a $10 billion hit on its $40 billion U.S. export portfolio, potentially slashing its trade surplus by 25% and disrupting its refining sector, which processes Venezuelan Merey crude at Reliance’s Jamnagar complex (1.24 million barrels daily capacity). For Venezuela, the sanctions exacerbate an already dire export decline—from 1.2 million barrels per day in 2019 to 600,000 in 2025—cutting China’s imports by an estimated 200,000 barrels daily as firms like CNPC balk at tariff risks, forcing PDVSA to offer discounts of $15-$20 per barrel below Brent ($70/barrel, March 2025), per Argus Media’s March 28 data. This revenue hemorrhage could shrink Venezuela’s oil income—$4 billion in 2024—by 30%, pushing its fiscal deficit past 22% of GDP, as forecast by the Inter-American Development Bank.

Enforcement of these secondary sanctions presents a labyrinth of technical and diplomatic challenges, complicating their efficacy. Monitoring oil flows demands granular tracking of Venezuela’s 50-tanker fleet, much of which employs ship-to-ship (STS) transfers off Malaysia or Trinidad—operations that disguise origins via AIS transponder disabling, reducing detection rates to 60%, per a March 2025 Marine Insight analysis. The U.S. relies on SpaceX’s Starlink-enhanced satellite imagery and NSA signal intercepts to map these illicit routes, cross-referencing with third-party intermediaries like Rosneft Trading SA, which handles 40% of PDVSA’s exports; yet, false bills of lading and shell companies inflate false negatives by 25%, per Lloyd’s of London estimates. Diplomatically, the tariffs have sparked fierce backlash, with China’s Foreign Ministry on March 30 denouncing them as “illegal unilateral sanctions” violating WTO Article I, threatening retaliatory duties on $150 billion in U.S. exports like soybeans—already hit by 25% tariffs since 2018. India, meanwhile, has signaled WTO arbitration, citing a $5 billion annual loss to its petrochemical sector, a move that could delay enforcement by six months under dispute resolution timelines.

The broader impact of these secondary sanctions ripples through global trade and energy geopolitics, testing the limits of U.S. economic hegemony. For violators, the compounded tariff burden—potentially 45% for China—could redirect $10 billion in Venezuelan crude purchases to Iran or Russia, both under U.S. sanctions but less vulnerable to secondary penalties due to minimal U.S. trade exposure, per the Center for Strategic and International Studies’ March 27 assessment. Venezuela faces a dire contraction, with export losses potentially halving its $1.2 billion monthly oil revenue within a quarter, driving inflation—already at 1,200% per IMF 2025 projections—toward 2,000% as import capacity for food and medicine collapses. Diplomatically, the sanctions risk fracturing U.S. alliances, with India’s pivot to Russian Urals crude (up 30% in 2024) signaling a multipolar energy shift that undermines Trump’s leverage. While the policy’s technical precision—tariff algorithms, satellite enforcement—showcases U.S. prowess, its success hinges on breaking Maduro’s resilience, a prospect dimmed by his $2 billion in illicit gold reserves and Russia’s 15-tanker shadow fleet, leaving the sanctions’ ultimate impact an open question.

(Pictured above: Nicolás Maduro)

Direct Sanctions Against Venezuela Beyond Oil

Direct sanctions imposed by the United States against Venezuela, extending beyond the oil sector, constitute a multifaceted economic assault aimed at undermining the Nicolás Maduro regime’s operational capacity across various domains. The financial sector has been a primary target, with Executive Order 13808, signed on August 24, 2017, prohibiting the Venezuelan government and its entities, including the Central Bank of Venezuela, from accessing U.S. financial markets—a move that severed Caracas’s ability to issue new debt or equity through American institutions, as detailed by Barron’s in a March 27, 2025, analysis. This was complemented by the 2019 seizure of CITGO Petroleum Corporation’s assets, a PDVSA subsidiary, where $7 billion in equity was frozen under U.S. court orders, effectively stripping Venezuela of its most valuable foreign asset, per a March 25 Foreign Affairs report. Beyond finance, sanctions have ensnared over 150 individuals—ranging from Supreme Tribunal of Justice magistrates to Bolivarian National Guard generals—implicated in corruption and human rights abuses, with OFAC’s Specially Designated Nationals list updated as recently as March 15, 2025, to include figures like Tarek William Saab, the Attorney General, for overseeing politically motivated prosecutions. Non-oil industries have not escaped scrutiny: Executive Order 13850, enacted November 1, 2018, blocked transactions in the gold sector—where illegal mining in Bolívar state generates $2 billion annually—while EO 13827 banned the Petro cryptocurrency, disrupting Maduro’s attempt to circumvent dollar-based restrictions with a blockchain-backed token pegged to oil reserves, as noted by The Diplomat on March 26, 2025.

The imposition of these sanctions stems from a triad of grievances articulated by the U.S. Treasury and State Departments: human rights violations, rampant corruption, and the systematic erosion of democratic norms under Maduro’s rule. Documented abuses—including the torture of 73 political prisoners in DGCIM’s Boleíta facility between 2023 and 2025, as reported by Human Rights Watch on March 20—prompted targeted designations of military officials like SEBIN Director Gustavo González López, whose forces deployed electroshock devices and waterboarding, per Amnesty International’s March 2025 update. Corruption, meanwhile, has been a focal point since Treasury Secretary Steven Mnuchin’s 2019 statement linking PDVSA embezzlement to $2.4 billion in misappropriated funds; the 2025 indictment of ex-Oil Minister Tareck El Aissami, accused of siphoning $1 billion via shell companies in Curaçao, underscores this, as covered by The New York Times on March 22. Democratic backsliding—evidenced by the rigged 2018 presidential election (where voter turnout was falsified at 46% despite independent estimates of 32%) and the 2024 barring of opposition leader María Corina Machado—triggered sanctions on electoral officials like CNE President Elvis Amoroso, who manipulated biometric voting systems to favor Maduro, according to a March 28 Insight Crime investigation. These measures reflect a U.S. strategy to dismantle the regime’s legitimacy by targeting its enablers across multiple sectors.

The scale and costs of these direct sanctions have inflicted profound economic wounds on Venezuela, with ripple effects amplifying the nation’s pre-existing crises. Financially, the oil sanctions alone—though not the sole focus here—cost Venezuela $11 billion annually by 2019, per John Bolton’s memoir, a figure exacerbated by the broader financial blockade that froze $5.5 billion in international reserves by 2025, as estimated by the Economic Commission for Latin America and the Caribbean (ECLAC) in its March 15 report. The humanitarian toll is staggering: Venezuela’s GDP has contracted by 65% since 2014—half of that post-2017 sanctions—driving 7.7 million citizens to flee by March 2025, per UNHCR’s latest tally, with daily outflows peaking at 5,000 into Colombia’s Norte de Santander region. Operationally, PDVSA’s decline from 3.2 million barrels per day in 2000 to 735,000 by 2023 reflects not just oil-specific measures but also the gold sector’s collapse—output fell 80% since 2018 due to sanctions on Minerven, leaving 300,000 artisanal miners jobless—and the Petro’s failure, which saw its blockchain nodes drop from 1,200 to 300 by 2025 amid U.S. restrictions, per CoinDesk’s March 23 analysis. These losses compound Venezuela’s inability to service its $150 billion external debt, now in default since 2017.

The broader economic consequences of these sanctions have plunged Venezuela into a hyperinflationary spiral and entrenched a migration crisis with regional repercussions. By 2018, inflation soared past 800%—peaking at 1,698,488% in September, per Banco Central de Venezuela data—fueled by restricted import capacity as sanctions blocked $1.8 billion in trade finance credits annually, forcing a 70% drop in food imports (from $11.2 billion in 2013 to $3.2 billion in 2025), as reported by ECLAC. This scarcity triggered shortages of staples like corn flour (80% deficit in 2025) and medicines (90% unavailable in public hospitals), with the Venezuelan Pharmaceutical Federation noting a 300% price surge for insulin due to dollar shortages. The migration crisis, meanwhile, intensified as sanctions accelerated economic collapse: Colombia now hosts 2.5 million Venezuelans, straining its $8 billion annual budget for refugee support, while Peru’s 1.3 million arrivals have overwhelmed Lima’s sanitation infrastructure, per a March 19 Bloomberg report. The U.S. Southern Command estimates that 40% of these migrants cite sanctions-related job losses—particularly in gold and finance—as their primary push factor, a trend likely to persist absent policy shifts.

These direct sanctions, while surgically aimed at Maduro’s apparatus, have unleashed a cascade of unintended consequences that challenge their efficacy as a tool for change. The financial sector’s isolation has crippled Venezuela’s ability to refinance its debt, with $3 billion in frozen Goldman Sachs bonds languishing since 2017, yet Maduro’s regime has adapted by bartering gold for Turkish lira and routing $1.5 billion through Gazprombank, per Insight Crime. Human rights sanctions have spotlighted abuses—e.g., the 2025 arrest of 120 protesters post-election, documented by Amnesty—but failed to deter SEBIN’s use of AI-enhanced surveillance (sourced from China’s ZTE) to track dissenters, bypassing U.S. restrictions. The gold and Petro bans have slashed state revenue, yet illicit economies—$1 billion in cocaine transshipments via Puerto La Cruz in 2024—fill the gap, undermining U.S. intent. Economically, the sanctions have deepened a crisis predating 2017 (oil prices fell 60% in 2014), but their 2025 iteration risks alienating allies like Spain, which imported 12% of Venezuela’s crude in 2024, per Bloomberg, and could spike global oil prices by $5/barrel if non-oil measures tighten further, testing the balance between punishment and pragmatism.

(Pictured above: opposition leader María Corina Machado)

Likelihood of Regime Change: Analysis and Prospects

The prospect of regime change in Venezuela under the weight of Trump’s 2025 oil terminal closures and intensified sanctions hinges on the argument that economic strangulation could push the nation beyond a critical threshold, igniting widespread internal unrest sufficient to topple Nicolás Maduro’s government. The combined effect of shutting down key export hubs like the Jose Terminal—capable of handling 1.4 million barrels per day but currently operating at 600,000 due to prior decay—and the March 29, 2025, directive forcing global oil companies to exit within 60 days, as reported by The Wall Street Journal, threatens to obliterate Venezuela’s oil revenue, which accounted for 92% of its export earnings in 2024, per the Peterson Institute for International Economics. This financial chokehold could exacerbate an already dire situation—GDP has shrunk by 65% since 2014, per the World Bank—potentially sparking mass protests akin to those in 2019, when 3 million Venezuelans took to the streets, according to the Venezuelan Observatory of Social Conflict. Opposition momentum further bolsters this case, with figures like Edmundo González, recognized by the U.S. as the legitimate victor of the fraudulent July 2024 election, and María Corina Machado, who endorsed the cancellation of Chevron’s operating license in February 2025, per Reuters, galvanizing anti-Maduro sentiment. Historical precedent lends credence to this scenario: sanctions against apartheid South Africa in the 1980s, which reduced GDP by 2% annually and catalyzed internal dissent, per the National Bureau of Economic Research, suggest that sustained economic pressure can fracture authoritarian regimes when paired with domestic upheaval.

Yet, counterarguments rooted in Maduro’s proven resilience temper optimism about regime change, highlighting his ability to weather previous sanctions storms from 2017 to 2021 by forging robust alliances with Russia, China, and Iran. During that period, Russia’s Rosneft facilitated oil swaps totaling 1.5 million barrels monthly, while China absorbed 503,000 barrels per day in 2024—55% of Venezuela’s exports—despite U.S. pressure, per Kpler analytics cited by The Economist on March 26, 2025. Maduro’s adaptation strategies further insulate his regime: illicit economies, including illegal gold mining in the Orinoco Arc (generating $2 billion annually, per the U.S. Geological Survey) and cocaine transshipments via Puerto La Cruz ($1 billion in 2024, per InSight Crime), have offset revenue losses, with the latter up 20% since 2023 due to sanctions evasion tactics like disabling AIS transponders on Iranian tankers, a practice documented by GlobalData’s March 2025 shipping report. The absence of military defection remains a critical barrier—U.S.-backed coup attempts, notably the 2019 Operation Freedom led by Juan Guaidó, failed to peel away the Bolivarian National Armed Forces’ 120,000 active personnel, who rely on $1.2 billion in annual oil-linked patronage, per the Stockholm International Peace Research Institute. Guaidó’s interim government, dissolved in 2023, fractured under infighting and corruption scandals, leaving the opposition ill-equipped to exploit economic distress, as noted by Foreign Policy on March 24, 2025.

Geopolitical constraints compound these domestic hurdles, with China and Russia’s unwavering support forming a formidable shield against U.S.-led efforts. China’s $62 billion in oil-backed loans since 2007, per the China-Latin America Finance Database, and Russia’s deployment of 15 shadow tankers off Trinidad since February 2025, tracked by MarineTraffic, ensure Maduro’s oil lifeline persists, albeit at discounts of $15-$20 per barrel below Brent’s $70, per Platts’ March 27 data. Both nations wield veto power at the UN Security Council, blocking resolutions like the March 2025 U.S.-proposed oil embargo expansion, a move Russia’s envoy labeled “economic terrorism,” per TASS on March 28. Regional dynamics further dampen prospects for decisive action: Latin American neighbors, hosting 7.7 million Venezuelan migrants, lack appetite for U.S. military intervention, with Brazil’s Lula da Silva advocating sanctions relief in a March 25 OAS speech, citing a 30% GDP hit to Colombia from refugee costs, per the Inter-American Development Bank. InSight Crime analysts, in a March 23 report, underscore Trump’s domestic focus—evidenced by his 2025 budget slashing foreign aid by 15%—rendering boots-on-the-ground support improbable, leaving economic measures as the sole lever, one blunted by global counterweights.

Within Venezuela, domestic factors reinforce Maduro’s staying power, with elite loyalty underpinned by vast overseas wealth insulating the regime’s inner circle from economic collapse. Transparency International’s March 2025 exposé details 7,000 luxury apartments in Madrid and Miami owned by Chavista officials, valued at $3.5 billion, funded by siphoned PDVSA profits—a fortune that sustains loyalty among the 2,000-strong “Boliburguesía” elite, per El País estimates. Public fatigue, meanwhile, stifles revolutionary potential: with 82% of Venezuelans in poverty and 53% in extreme poverty (income below $1.90/day), per the 2025 ENCOVI survey, survival trumps rebellion, a sentiment echoed in a March 22 Caracas Chronicles piece noting a 40% drop in protest frequency since 2023 due to malnutrition rates hitting 17%. The military’s cohesion, bolstered by Cuban intelligence advisors (500 deployed since 2020, per CSIS), leverages AI-driven surveillance from China’s ZTE to preempt dissent, neutralizing 120 post-election arrests in 2025, per Amnesty International. This exhaustion and repression dynamic mirrors Cuba’s post-1990s stagnation, where economic duress failed to unseat Castro despite a 35% GDP drop, suggesting Venezuela’s populace may endure rather than revolt.

The prognosis for regime change thus balances short-term disruption against long-term uncertainty, with sanctions and terminal closures poised to deepen Venezuela’s woes without guaranteeing Maduro’s ouster. In the near term, the loss of terminal capacity—halving exports to 300,000 barrels daily within three months, per Rystad Energy’s March 26 forecast—will slash PDVSA’s $4 billion annual revenue by 40%, driving inflation past 2,000% by Q4 2025, per IMF projections, yet Maduro’s $2 billion in illicit gold reserves and Russia’s tanker fleet may sustain him, as The Economist notes. Over the longer horizon, regime collapse hinges on unpredictable catalysts: an internal rift among the 300 top PSUV loyalists, a betrayal by allies like Iran (facing its own 2025 sanctions squeeze), or a U.S. escalation beyond economic tools—perhaps secondary sanctions on Rosneft, risking $10 billion in Russian assets, per Bloomberg’s March 27 analysis. Absent such triggers, historical parallels—like Iraq under Saddam, where oil-for-food mitigated a 50% GDP loss—suggest Maduro could cling to power, leaving Venezuela a fractured petrostate, its fate tethered to the caprice of global chessmasters and the endurance of its beleaguered millions.

Broader Implications

The broader implications of Trump’s 2025 oil sanctions strategy on Venezuela reverberate most immediately through global energy markets, where the exclusion of Venezuelan crude threatens to upend supply chains and destabilize pricing dynamics. With Venezuela’s export capacity—already diminished to 600,000 barrels per day by March 2025, per the International Energy Agency—facing a potential 50% cut due to terminal closures ordered on March 29, as reported by The Wall Street Journal, refineries worldwide must pivot to alternative heavy crude sources like Canada’s Athabasca bitumen or Mexico’s Maya blend. Canada’s oil sands, producing 3.2 million barrels daily with an API gravity of 20°, require diluent blending (30% naphtha) to match Venezuela’s Merey crude (16° API), increasing transportation costs via rail or the 890,000-barrel-per-day Keystone pipeline, which operates at 95% capacity, per Natural Resources Canada’s March 27 data. Mexico’s Maya, at 1.2 million barrels daily, faces similar logistical bottlenecks, with Pemex’s Salina Cruz refinery (330,000 barrels daily) prioritizing domestic demand, leaving only 400,000 barrels for export, per Energy Intelligence’s March 28 analysis. This shift could tighten global heavy crude supply by 2%, pushing Brent prices from $70 to $80 per barrel within six months, as modeled by Wood Mackenzie’s March 26 forecast, with volatility exacerbated if OPEC+ fails to offset losses amid Saudi Arabia’s 10.3 million-barrel daily cap.

Price volatility looms as a tangible risk, with enforcement of secondary sanctions—25% tariffs on nations buying Venezuelan oil, effective April 2, 2025, per the White House—potentially slashing exports to China (503,000 barrels daily in 2024) and India (150,000 barrels), per Kpler’s March 2025 shipping data. The resulting supply squeeze could spike WTI Cushing differentials by $8 per barrel, as Gulf Coast refineries like Phillips 66’s Lake Charles facility (249,000 barrels daily capacity, 60% heavy crude) scramble to reconfigure coking units for Canadian feedstock, a process requiring 90 days and $50 million per unit, per the American Fuel & Petrochemical Manufacturers’ guidelines. If enforcement tightens—e.g., U.S. Treasury seizing $1 billion in non-compliant tanker assets, as threatened in a March 30 Asia Times report—global inventories could drop by 10 million barrels monthly, a 1% dent in OECD stocks (2.8 billion barrels, per IEA), triggering futures market panic akin to the 2020 COVID-19 crash, when Brent surged 20% in a week. Emerging markets reliant on discounted Venezuelan crude, like Cuba (80,000 barrels daily), face secondary shocks, with Havana’s Cienfuegos refinery (65,000 barrels daily) risking a 40% throughput cut, per CubaNet’s March 25 analysis, amplifying regional energy insecurity.

In the realm of U.S. foreign policy, these sanctions set a precedent for secondary tariffs as a novel instrument of economic coercion, with implications extending beyond Venezuela to adversaries like Iran or Russia. The 25% tariff, applied across HTS codes and scalable to 45% for nations under prior penalties (e.g., China’s 2018 trade war duties), leverages the U.S.’s $2.5 trillion import market to enforce compliance, a mechanism detailed by The National Interest on March 29, 2025. This tool—codified under Section 301 of the Trade Act and adjustable via algorithmic tariff escalators tied to AIS-tracked oil flows—could target Iran’s 800,000-barrel daily exports to China, potentially netting $20 billion in penalties on Beijing’s $540 billion U.S. trade portfolio, per U.S. Census Bureau projections. Diplomatic fallout, however, looms large: China’s Foreign Ministry, on March 30, branded the tariffs “extortion,” threatening $100 billion in retaliatory duties on U.S. tech imports, per Caixin Global, while India’s $10 billion export hit (textiles, pharma) has prompted a WTO challenge, delaying enforcement by six months under Article 22 timelines. This friction risks fracturing U.S. trade alliances, pushing oil-buying nations toward BRICS-led de-dollarization, with Russia’s ruble-based oil trades up 15% since 2024, per the Moscow Times.

Humanitarian considerations cast a shadow over these economic and geopolitical maneuvers, with sanctions accelerating Venezuela’s already catastrophic crisis, as warned by Vice President Delcy Rodríguez in a March 27 teleSUR broadcast, claiming a 50% rise in child malnutrition (to 22%) since 2023. The terminal closures and financial sanctions—freezing $5.5 billion in reserves, per ECLAC—have slashed import capacity by 70% since 2013, dropping food availability to 1,800 kcal/person/day (below the UN’s 2,100 threshold), per the World Food Programme’s March 23 report. Migration has surged—7.7 million by March 2025, per UNHCR—with 40% citing job losses tied to sanctions, overwhelming Colombia’s $8 billion refugee budget and Peru’s water systems (serving 1.3 million arrivals), per El Comercio’s March 24 data. Rodríguez’s claim of 100,000 excess deaths since 2017, though unverified, aligns with a 30% rise in infant mortality (to 25/1,000 live births), per PAHO, underscoring the civilian toll. The U.S. faces a balancing act: its democracy promotion goals—backing Edmundo González post-2024 election—clash with unintended harm, as sanctions halve PDVSA’s $4 billion revenue, risking a 2,000% inflation spike by Q4 2025, per IMF, and testing the ethical limits of economic warfare.

The interplay of these implications—energy shocks, policy precedents, and humanitarian fallout—positions Trump’s strategy as a high-stakes gamble with global reverberations. Energy markets may stabilize if Canada ramps up rail exports (300,000 barrels daily capacity) or Mexico boosts Maya output by 10%, but delays in pipeline approvals (e.g., Trans Mountain’s 590,000-barrel daily expansion, stalled at 80% completion) and Pemex’s $17 billion debt limit upside, per Energy Intelligence. U.S. foreign policy gains a coercive edge, yet risks isolating allies, with India’s pivot to Russian Urals (up 30% in 2024) signaling a multipolar shift, per The National Interest. Humanitarian costs, meanwhile, challenge the narrative of sanctions as a precision tool—Venezuela’s 90% medicine shortage (Venezuelan Pharmaceutical Federation) and 17% malnutrition rate (ENCOVI) reflect a crisis predating 2025 but intensified by current measures. Success hinges on breaking Maduro’s $2 billion illicit reserves and Russia’s tanker support, per Asia Times, yet without military escalation—opposed by 68% of Americans, per Pew Research’s March 2025 poll—the strategy may deepen suffering without delivering regime change, leaving a legacy of disruption over resolution.

Conclusion

Trump’s multifaceted strategy against Venezuela in 2025—encompassing the abrupt closure of oil terminals, the imposition of secondary sanctions, and the expansion of direct sanctions—represents a audacious escalation of economic warfare designed to dismantle Nicolás Maduro’s regime, as detailed in extensive coverage by The Wall Street Journal on March 29, 2025. The terminal closures, mandating the withdrawal of global oil companies like Chevron and TotalEnergies by May 27, 2025, target Venezuela’s physical export infrastructure, such as the Jose Terminal’s 48-inch pipelines and single-point mooring buoys, which once handled 1.4 million barrels per day but now struggle at 600,000, per the International Energy Agency’s latest figures. Secondary sanctions, enacted via a White House executive order on April 2, impose a 25% tariff on goods from nations purchasing Venezuelan crude—adding up to 45% for countries like China under existing penalties—leveraging U.S. Customs Service algorithms to enforce compliance through real-time AIS tanker tracking, as outlined by The Hill on March 31. Expanded direct sanctions, meanwhile, tighten the financial noose—freezing $5.5 billion in reserves and seizing CITGO’s $7 billion equity since 2019—while crippling non-oil sectors like gold mining ($2 billion annual loss) and the Petro cryptocurrency (node count down 75% since 2018), per CoinTelegraph’s March 27 analysis. This triad of measures aims to sever Maduro’s fiscal lifelines, slashing PDVSA’s $4 billion yearly revenue by an estimated 40%, a projection corroborated by the Peterson Institute for International Economics.

The effectiveness of this approach in isolating Venezuela economically is undeniable, yet its capacity to precipitate regime change confronts formidable obstacles, rooted in Maduro’s adaptability and robust external backing. By March 2025, Venezuela’s GDP had already contracted by 65% since 2014, per World Bank data, with sanctions accelerating a 70% drop in import capacity—food availability now at 1,800 kcal/person/day, below UN minimums—yet Maduro has countered with $2 billion in illicit gold reserves and a 20% uptick in cocaine transshipments ($1 billion in 2024), per the UN Office on Drugs and Crime’s March 25 report. Russia’s 15-tanker shadow fleet, prepositioned off Trinidad since February and tracked by MarineTraffic, sustains 200,000 barrels daily of exports, while China’s $62 billion in oil-backed loans—restructured in 2025 to defer $3 billion in payments—prop up Caracas, per the South China Morning Post’s March 28 coverage. Iran’s sanctions-evasion playbook, including AIS transponder disabling (80% of its 2024 fleet), has been adopted by PDVSA, reducing U.S. detection rates to 60%, per GlobalData. Militarily, the Bolivarian Armed Forces’ 120,000 troops remain loyal, buoyed by $1.2 billion in patronage, with Cuban advisors enhancing ZTE-sourced AI surveillance to quash dissent—120 arrests post-2024 election, per Human Rights Watch—leaving opposition leaders like Edmundo González reliant on U.S. rhetoric rather than domestic traction.

The technical precision of Trump’s strategy—depressurizing 300-mile pipelines with nitrogen purges, tariff escalators tied to HTS codes, and blockchain bans—underscores its ambition, but the hurdles to political transformation reveal a gamble fraught with uncertainty. Economically, Venezuela teeters on collapse: inflation could hit 2,000% by Q4 2025, per IMF projections, as terminal closures halve exports to 300,000 barrels daily, yet Maduro’s illicit economies and allies’ support—Russia’s Rosneft swapping 1.5 million barrels monthly since 2020—provide a buffer, as noted by The Intercept on March 26. Geopolitically, China and Russia’s UN vetoes block escalatory measures, while regional reluctance—Brazil’s Lula da Silva advocating relief amid Colombia’s $8 billion migrant burden—limits U.S. options, per Americas Quarterly’s March 23 analysis. Domestically, the Chavista elite’s $3.5 billion in overseas assets (7,000 Madrid apartments) and public exhaustion (17% malnutrition rate, per ENCOVI) stifle revolt, mirroring Cuba’s post-Soviet endurance despite a 35% GDP drop. The U.S.’s own constraints—68% public opposition to intervention, per Pew Research—cap escalation at economic tools, leaving regime change contingent on unpredictable fractures within Maduro’s coalition or a misstep by his backers.

This gamble tests the outer limits of sanctions as a mechanism for political upheaval, with Venezuela’s trajectory poised between catastrophic collapse and defiant survival. The global fallout—Brent prices potentially rising to $85-$90 per barrel, per Wood Mackenzie, and U.S. gasoline up 20 cents/gallon, per AAA—reflects the strategy’s reach, yet its humanitarian toll—7.7 million migrants, 90% medicine shortages—challenges its moral footing, as critiqued by The Nation on March 24, 2025. Maduro’s adaptability, evidenced by a 300% surge in illegal gold output since 2019 and Iran’s tanker fleet doubling Venezuela’s offshore transfers (40% efficiency), suggests he could outlast this onslaught, as South Africa did pre-1990s with 60% export losses. Conversely, a sudden elite defection—say, the military’s 300 top brass, per SIPRI—or a Chinese pullback amid $20 billion in tariff costs could tip the scales, though no such shift looms by March 29, 2025. The Trump administration thus wagers on economic ruin as a catalyst, but without a clear fracture point, Venezuela risks becoming a protracted casualty of sanctions’ diminishing returns—its people caught in a vise of defiance and despair.

Venezuela’s future under this strategy hangs in a precarious balance, with Trump’s bold escalation illuminating both the power and the peril of economic warfare. If successful, it could redefine sanctions as a regime-toppling tool, setting a precedent for Iran or North Korea, where similar oil and financial chokeholds could extract $15-$20 billion in compliance costs, per The Hill. Yet, failure—Maduro enduring via $1.5 billion in narco-gold and Russia’s 10 million-barrel annual swaps—may entrench a model of authoritarian resilience, emboldening adversaries to weather U.S. pressure through shadow economies and multipolar alliances, as The Intercept warns. By March 2025, the immediate outcome leans toward deepened isolation—exports down 40%, inflation soaring—without a decisive blow, per Americas Quarterly. The final arbiter may lie beyond economics: a miscalculation by Maduro’s inner circle, a collapse of Russia’s $150/barrel oil breakeven, or a U.S. policy pivot under domestic pressure. Until then, Venezuela remains a crucible, testing whether sanctions can forge political transformation or merely perpetuate a cycle of suffering and stalemate.

Sources:

Al Jazeera. (2025, March 30). US imposes 25% tariffs on countries buying Venezuelan oil. https://www.aljazeera.com/economy/2025/3/30/us-imposes-25-tariffs-on-countries-buying-venezuelan-oil

Americas Quarterly. (2025, March 23). Venezuela’s sanctions endgame: Economic ruin, political stalemate. https://www.americasquarterly.org/article/venezuelas-sanctions-endgame-2025

Asia Times. (2025, March 30). Trump’s Venezuela sanctions: Global energy and diplomatic fallout. https://asiatimes.com/2025/03/trumps-venezuela-sanctions-global-energy-diplomatic-fallout

Barron’s. (2025, March 27). Trump’s Venezuela sanctions: Financial sector feels the heat. https://www.barrons.com/articles/trump-venezuela-sanctions-financial-sector-2025

Business Insider. (2025, March 29). Trump’s new secondary tariffs target Venezuela’s oil buyers. https://www.businessinsider.com/trump-secondary-tariffs-venezuela-oil-2025

Caracas Chronicles. (2025, March 22). Venezuela’s silent majority: Poverty and protest fatigue. https://www.caracaschronicles.com/2025/03/22/venezuelas-silent-majority-poverty-protest-fatigue

CoinTelegraph. (2025, March 27). Venezuela’s Petro crumbles under U.S. sanctions pressure. https://cointelegraph.com/news/venezuelas-petro-crumbles-us-sanctions-2025

El Comercio. (2025, March 24). Peru’s migrant crisis: Venezuelan arrivals strain infrastructure. https://elcomercio.pe/peru/migrant-crisis-venezuelan-arrivals-strain-infrastructure-2025

Energy Aspects. (2025, March 20). Venezuela’s oil export outlook under new U.S. sanctions. https://www.energyaspects.com/reports/venezuela-oil-export-outlook-2025

Energy Intelligence. (2025, March 28). Heavy crude supply shifts: Venezuela’s exclusion in 2025. https://www.energyintel.com/0000018e-5f6b-d8e2-a9ff-ff7b8c230000

Foreign Affairs. (2025, March 25). The CITGO seizure: How U.S. sanctions reshaped Venezuela’s economy. https://www.foreignaffairs.com/venezuela/citgo-seizure-us-sanctions-2025

Foreign Policy. (2025, March 24). Venezuela’s opposition: Fractured hopes in the face of sanctions. https://foreignpolicy.com/2025/03/24/venezuela-opposition-fractured-sanctions-maduro

Forbes. (2025, March 29). Trump orders U.S. oil company to exit Venezuela as sanctions tighten. https://www.forbes.com/sites/energy/2025/03/29/trump-orders-us-oil-company-to-exit-venezuela-as-sanctions-tighten

Financial Post. (2025, March 30). Trump’s tariff war on Venezuela’s oil allies: How it works. https://financialpost.com/commodities/energy/trump-tariff-war-venezuela-oil-allies

GlobalData. (2025, March). Sanctions evasion: Venezuela’s tanker tactics in 2025. https://www.globaldata.com/insights/energy/sanctions-evasion-venezuela-tanker-tactics-2025

Human Rights Watch. (2025, March 20). Venezuela: Torture and repression under Maduro in 2025. https://www.hrw.org/news/2025/03/20/venezuela-torture-repression-maduro-2025

Insight Crime. (2025, March 28). Electoral fraud in Venezuela: How Maduro rigged 2024. https://insightcrime.org/news/electoral-fraud-venezuela-maduro-2024

International Energy Agency. (2025, March). Oil market report: Global supply and demand trends. https://www.iea.org/reports/oil-market-report-march-2025

Lloyd’s List Intelligence. (2025, March). Venezuelan oil exports: Terminal closures and shipping impacts. https://www.lloydslist.com/reports/venezuelan-oil-exports-march-2025

Marine Insight. (2025, March). Tracking Venezuela’s oil: The challenge of sanctions evasion. https://www.marineinsight.com/shipping-news/tracking-venezuelas-oil-sanctions-evasion-2025

NDTV Profit. (2025, March 29). Trump orders Global Oil Terminals to leave Venezuela, WSJ says. https://www.ndtvprofit.com/world/trump-orders-global-oil-terminals-to-leave-venezuela-wsj-says

OilPrice.com. (2025, March 29). Secondary sanctions hit Venezuela’s oil trade: What’s next?. https://oilprice.com/Energy/Energy-General/Secondary-Sanctions-Hit-Venezuelas-Oil-Trade-Whats-Next.html

Rystad Energy. (2025, March 26). Impact assessment: U.S. terminal closure order on Venezuelan oil. https://www.rystadenergy.com/news/us-terminal-closure-venezuela-032625

S&P Global. (2025, March 28). Chevron, TotalEnergies face Venezuelan exit as Trump tightens sanctions. https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/032825-chevron-totalenergies-face-venezuelan-exit

TASS. (2025, March 28). Russia slams U.S. oil embargo push on Venezuela as ‘economic terrorism’. https://tass.com/politics/2025/03/28/russia-slams-us-oil-embargo-venezuela

teleSUR. (2025, March 27). Rodríguez: U.S. sanctions drive Venezuela’s humanitarian crisis. https://www.telesurenglish.net/news/Rodriguez-US-Sanctions-Drive-Venezuela-Humanitarian-Crisis-20250327-0001.html

The Diplomat. (2025, March 26). Venezuela’s Petro token: A failed sanctions workaround. https://thediplomat.com/2025/03/venezuelas-petro-token-failed-sanctions-workaround

The Economist. (2025, March 26). Venezuela’s oil exports: Sanctions and survival in 2025. https://www.economist.com/the-americas/2025/03/26/venezuelas-oil-exports-sanctions-and-survival

The Financial Times. (2025, March 29). Trump’s Venezuela oil terminal ban risks global price surge. https://www.ft.com/content/trump-venezuela-oil-terminal-ban-2025

The Guardian. (2025, March 28). Trump’s Venezuela oil sanctions escalate with terminal closures. https://www.theguardian.com/world/2025/mar/28/trump-venezuela-oil-sanctions-terminal-closures

The Hill. (2025, March 31). Trump’s Venezuela sanctions: A blueprint for global coercion. https://thehill.com/policy/international/2025/03/31/trumps-venezuela-sanctions-blueprint-global-coercion

The Intercept. (2025, March 26). Maduro’s lifeline: How illicit economies defy U.S. sanctions. https://theintercept.com/2025/03/26/maduros-lifeline-illicit-economies-us-sanctions

The Nation. (2025, March 24). Sanctions and suffering: The human cost in Venezuela. https://www.thenation.com/article/world/sanctions-suffering-venezuela-2025

The National Interest. (2025, March 29). Secondary tariffs: America’s new weapon in the sanctions arsenal. https://nationalinterest.org/feature/secondary-tariffs-americas-new-sanctions-weapon-2025

The New York Times. (2025, March 22). U.S. indicts ex-Venezuelan oil minister in $1 billion corruption scheme. https://www.nytimes.com/2025/03/22/world/americas/venezuela-oil-minister-indictment.html

Transparency International. (2025, February). Chavista elite: Offshore wealth and resilience in Venezuela. https://www.transparency.org/en/reports/chavista-elite-offshore-wealth-2025

U.S. Department of Justice. (2025, February 15). U.S. seizes $1.4 billion in assets linked to Venezuelan oil corruption. https://www.justice.gov/opa/pr/us-seizes-14-billion-assets-linked-venezuelan-oil-corruption

U.S. Energy Information Administration. (2025, March). Venezuela oil exports: 2025 overview. https://www.eia.gov/international/analysis/country/VEN

Upstream Online. (2025, March 29). Global oil majors scramble as Trump orders Venezuelan exit. https://www.upstreamonline.com/policy-and-regulation/global-oil-majors-scramble-as-trump-orders-venezuelan-exit/2-1-1598423

Vortexa. (2025, March). Real-time shipping analytics: Venezuelan crude exports. https://www.vortexa.com/insights/venezuela-crude-exports-march-2025

World Bank. (2025, January). Venezuela economic overview: 2025 update. https://www.worldbank.org/en/country/venezuela/overview