Trump and Panama: What’s it all about…

Arm Twisting in Panama: What’s Really Driving U.S. Interest?

TL;DR

Canal Ownership Not the Goal: The idea of U.S. direct ownership of the Panama Canal under Trump is unlikely due to operational challenges, high maintenance costs, and limited profitability. Droughts, environmental concerns, and competition from alternative shipping routes further diminish its appeal.

China’s Presence at Key Ports: The real concern lies in Chinese influence through CK Hutchison Holdings, which operates critical ports at both ends of the canal. This Hong Kong-based company has upgraded Balboa and Cristobal into regional logistics hubs, raising U.S. national security concerns about China’s foothold near strategic U.S. trade routes.

Peru’s Port Chancay as a Threat: China’s construction of Port Chancay in Peru could bypass the Panama Canal entirely, challenging its dominance in global trade routes. This development aligns with China’s broader Belt and Road Initiative, amplifying its control over Latin American infrastructure.

Strategic U.S. Focus: The U.S. likely seeks to counter China’s influence through geopolitical maneuvering rather than direct ownership. This involves pressuring Panama to reduce Chinese involvement at the canal and securing alliances to protect U.S. interests in Latin America.

Broader Implications: The Panama Canal represents more than a trade route; it is a geopolitical flashpoint in the U.S.-China competition for influence. The U.S. aims to ensure that this vital infrastructure aligns with its strategic goals amid escalating global power struggles.

Now for the Deep Dive….

Introduction

The interplay between global trade, geopolitics, and strategic infrastructure often leads to complex and nuanced scenarios that challenge conventional thinking. One such case is the intersection of the Panama Canal and incoming President Donald Trump’s potential interests in its operation. Despite the intrigue surrounding this subject, I have resisted writing about it—until now.

This exploration is not about asserting that Trump seeks direct ownership or physical control of the Panama Canal. Instead, I propose a more subtle objective that warrants consideration. By analyzing key data points and setting aside certain practicalities—such as the feasibility of acquisition, associated costs, and operational challenges—I aim to provide a clearer view of why direct ownership may not be the endgame. This discussion ultimately leads to a broader geopolitical context involving China’s influence in Latin America and the ripple effects it has on U.S. strategic interests.

With that framework in mind, let’s dive into the factors at play, the challenges inherent in operating the canal, and the role of Chinese entities in this critical global trade hub. The evidence points to a strategy less about acquisition and more about influence—and potentially curbing China’s foothold in a region vital to global trade.

Discussion

I am guessing (and that’s all it is) that Trump’s desired end state is not to physically occupy or own the Panama Canal. It may be more subtle and less direct.

Here are some data points as to why ownership/possession/operation of the Panama Canal is not the desired end state.

For the sake of this thought experiment, let’s just set aside the majorly important question of “how” the US takes possession: by force or by buying it. Setting aside issues of loss of life and costs of a military operation or the possibility of a protracted insurgency and the loss of life or costs of continued military operations seems silly but let’s do that. Forgetting about the billions of dollars in acquisition cost for buying the Canal also seems silly but let’s do that too.

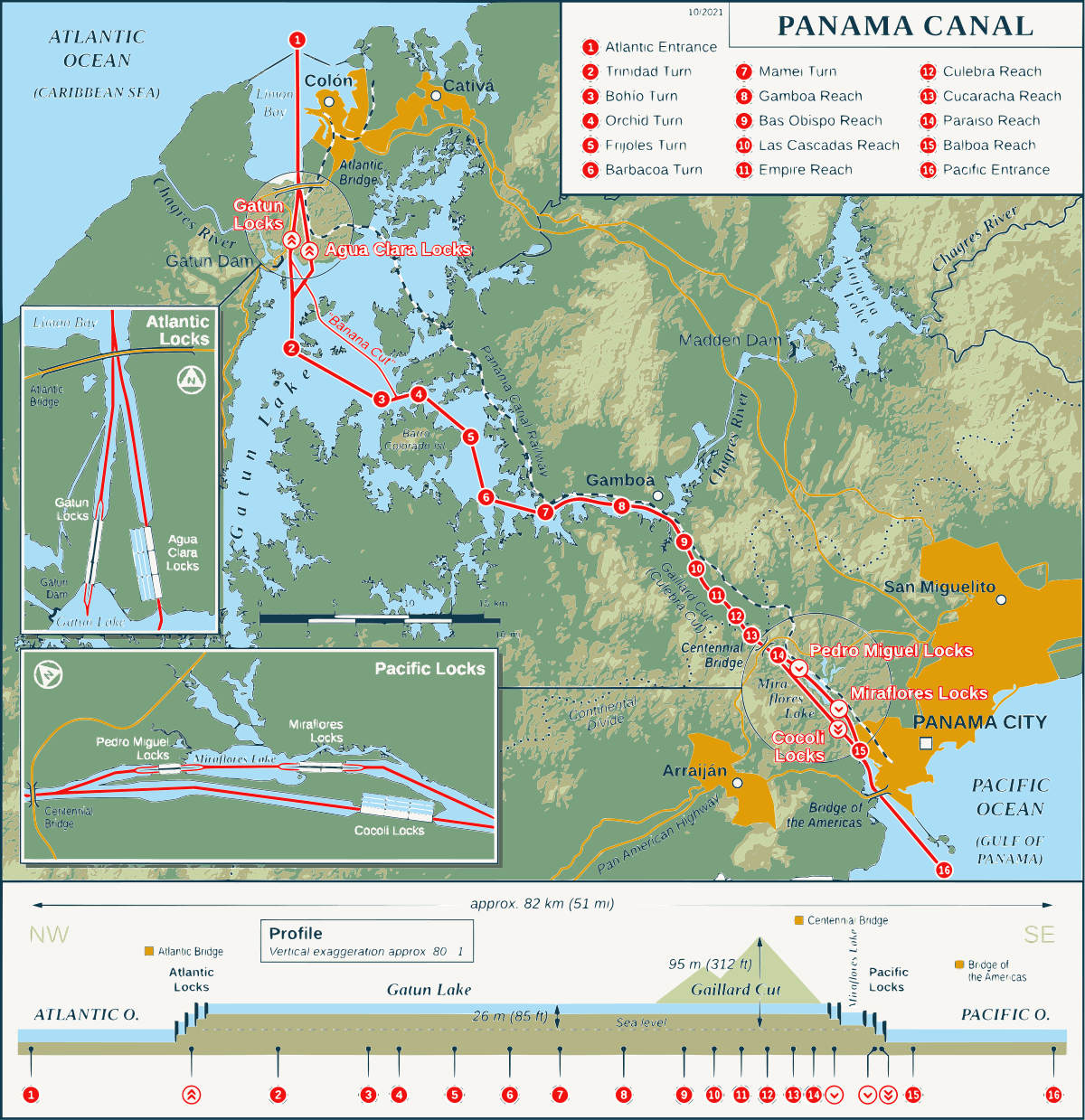

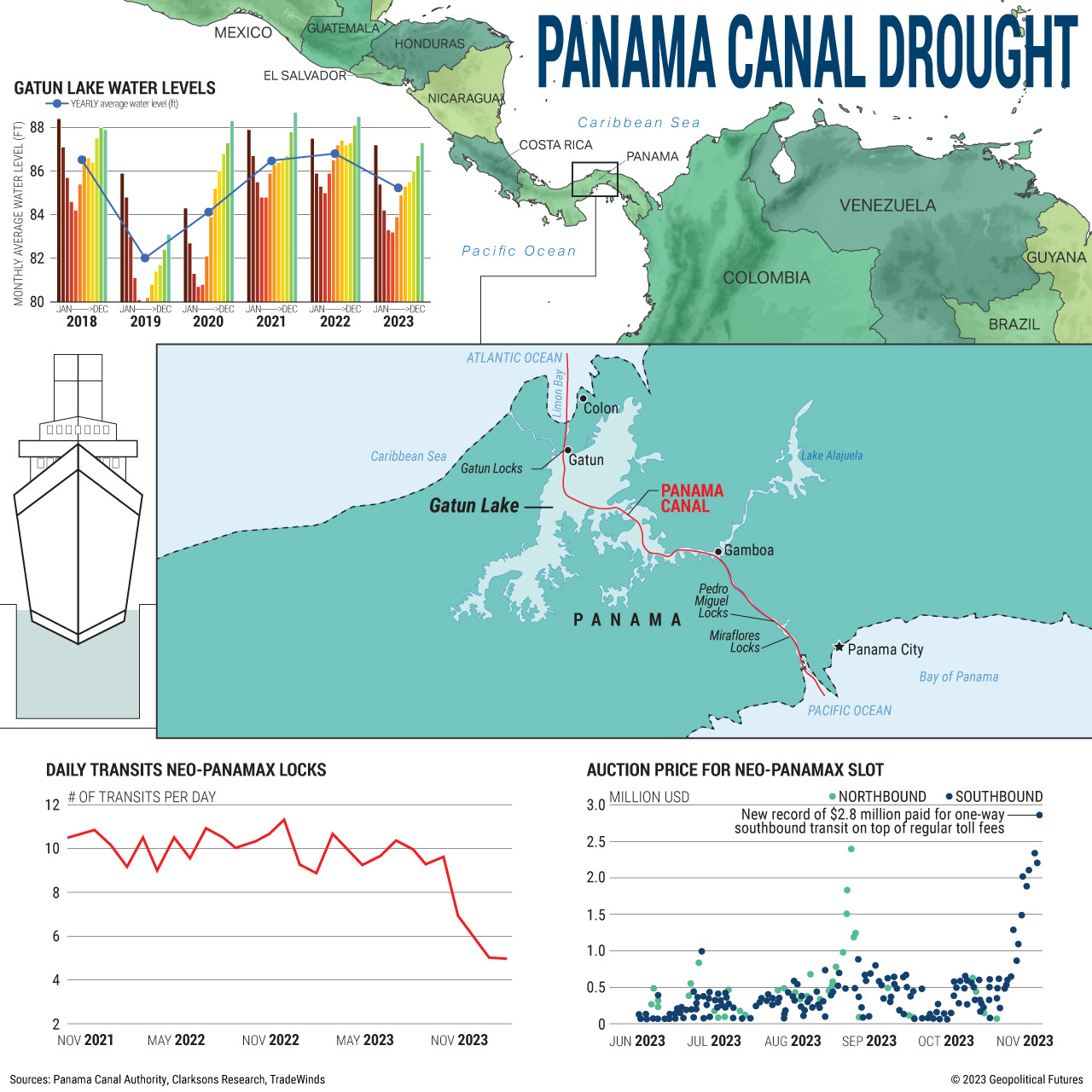

First, there are drought issues that are at times an operational nightmare. There is a certain factor of if the US takes it, then it will have fix this problem by building a new reservoir on the Indio River. That is estimated to cost around $1.6 billion. That’s just an estimate and like all government projects, there will be overruns and project delays. Plus, there is likely to me strong pushback from environmental groups especially if the US is involved. So hard money and uncertainty of when or truly if there will be a deliverable end product which is this fix. That is strike one.

Second, the Panama Canal, while undoubtedly an engineering marvel and a crucial link for global shipping currently, does not necessarily translate its strategic importance into exceptional profitability as one might expect. One of the primary reasons for this is the significant operational costs involved in maintaining and operating the canal. The infrastructure demands constant maintenance due to the harsh maritime environment, including the regular dredging of the canal, upkeep of the locks, and managing the water levels which are critical for the canal's operation. These costs are substantial and can eat into the revenue generated from tolls.

Moreover, the canal faces competition from alternative shipping routes. The expansion of the canal completed in 2016 allowed for larger ships, but it also meant more competition from other routes like the Suez Canal, which has been improving its capacity and service. Additionally, advances in shipbuilding technology have led to the construction of mega-ships that can take longer but potentially cheaper routes around continents, reducing the dependency on the Panama Canal for some shipping companies.

Toll revenue, which is the primary source of income for the Panama Canal Authority, is also subject to fluctuations based on global economic conditions. During economic downturns, maritime trade volumes decrease, directly impacting the canal's income. The canal's pricing strategy for tolls must balance between being competitive to attract traffic and generating enough revenue to cover operational costs, which does not always result in high profit margins. Furthermore, geopolitical tensions or regional instability can lead to rerouting of ships, bypassing the canal altogether.

Environmental considerations also play a role in limiting profitability. The canal's water management is increasingly challenged by climate change, with more frequent droughts affecting water availability for lock operations. This not only increases operational costs but also limits the number of ships that can transit daily, thus capping potential revenue. The Panama Canal Authority must invest in sustainable water management practices, which are expensive and do not immediately translate into financial returns.

Its net income was around $3.45 billion in the fiscal year ending in September 2024. The Canal Authority reported a 9.5% profit increase despite the droughts. But frankly operating it is a pain in the ass administratively. That is strike two.

This move really cannot be to lower transit costs for US flagged ships because less than 200 US flagged ships transit the Panama Canal per year. There are over 14,000 ships a year that transit the Canal. US ships are less than 1.5% of the traffic.

This move is not about a trade imbalance with Panama and correcting it as the U.S. has had a trade surplus with Panama every year since 2016. In 2022, the US had $11.4 billion goods trade surplus and a $208 million services trade surplus.

So what is strike three? One word:

China.

A Hong Kong-based corporation, CK Hutchison Holdings has operated two of the canal’s ports, located on the Caribbean and Pacific entrances, since 1997.

CK Hutchison Holdings

CK Hutchison Holdings operates through its subsidiary, Hutchison Ports PPC, which manages two key ports strategically located at either end of the Panama Canal: Cristobal on the Atlantic side and Balboa on the Pacific side. These ports serve as critical nodes in global maritime trade, facilitating the movement of goods between major trade routes connecting the Atlantic and Pacific Oceans. Since taking control in 1997 under a concession agreement granted by the Panamanian government, Hutchison Ports PPC has expanded and modernized these facilities to handle an increasing volume of cargo.

The operations at Balboa Port are characterized by its role as Latin America's premier transshipment terminal, with an annual capacity to handle five million TEUs (Twenty-foot Equivalent Units). Balboa is equipped with comprehensive facilities for handling containers, general cargo, and passenger vessels. The port includes significant infrastructure like 25 quay cranes, with several capable of servicing Post-Panamax and Super Post-Panamax vessels, ensuring that it can manage the largest ships that transit the canal post-expansion. Balboa's strategic location makes it an essential gateway for trade moving between Asia, North America, and South America.

On the Atlantic side, Cristobal Port complements Balboa by managing a wide variety of freight, including general cargo, reefer containers, and non-containerized cargo. With an annual capacity of two million TEUs, Cristobal has 13 quay cranes and multiple berth positions, designed to connect with the most significant shipping routes in the Caribbean and the Atlantic Ocean. The port's unique layout allows for handling diverse services, from bulk cargo to Ro-Ro (Roll-on/Roll-off) operations, enhancing its utility as a multi-purpose terminal.

Both ports are integral to the logistics network of the region, offering not only transshipment but also warehousing, intermodal services (including rail connections between the ports), and various value-added services like cargo consolidation, maintenance of refrigerated containers, and inspection facilities. Hutchison Ports PPC has invested heavily in upgrading these ports, with projects aimed at increasing capacity, improving efficiency, and integrating advanced technology for better cargo management, like blockchain systems for tracking.

The operations are not without their controversies, particularly regarding national security concerns due to the involvement of a Hong Kong-based company in managing ports adjacent to an asset of such strategic importance as the Panama Canal. Nonetheless, the economic impact of these ports is substantial, contributing significantly to Panama's GDP through direct and indirect job creation, port fees, and investments in local infrastructure. The concession agreement includes revenue sharing with the Panamanian government, ensuring that the operations of these ports also benefit national coffers, although the specifics of these arrangements, including dividends and tariffs, have been subject to public and political scrutiny over the years.

CK Hutchison Holdings, through its subsidiary Hutchison Ports, operates a vast network of ports around the globe. The company has stakes in over 50 ports spanning 25 countries across Asia, the Middle East, Africa, Europe, the Americas, and Australasia. Some notable operations include the ports in Hong Kong like Hongkong International Terminals Limited (HIT), one of the busiest container ports in the world, and the Yantian International Container Terminals in China. Beyond Asia, Hutchison Ports manages significant operations in Europe, including the Port of Felixstowe in the United Kingdom, which is the UK's largest container port, and the Port of Rotterdam in the Netherlands. In the Americas, aside from the previously mentioned Panama Canal ports, Hutchison Ports has operations in countries like Argentina with the Buenos Aires Container Terminal and in Mexico with the Ensenada International Terminal.

Regarding links to the Chinese government, CK Hutchison Holdings does not have direct ownership by the Chinese government. However, its operations and strategic decisions can be influenced by its business environment in China and Hong Kong. The company was founded by Li Ka-shing, who, despite being one of Hong Kong's most influential business tycoons, has operated within a political landscape where the government's influence is significant, especially post the 1997 handover of Hong Kong to China. CK Hutchison Holdings benefits from the economic policies and infrastructure development in China, where state influence plays a crucial role.

The company's operations in China, particularly through its port investments, are subject to regulations and policies set by the Chinese government. The government's Belt and Road Initiative, which aims to enhance global trade routes, has indirectly benefited companies like CK Hutchison by increasing the demand for port services where Hutchison Ports has investments. Furthermore, the company's dealings with state-owned enterprises or government projects in China can imply indirect links or dependencies on government policies.

In terms of specific connections, in 2023, there were discussions about PSA International, a Singaporean company with significant interest in CK Hutchison's port assets, potentially selling its stake to Chinese state-owned giants like China Merchants Group and China Cosco Shipping Corp., indicating the intricate web of state and private enterprise interactions in the sector. This scenario shows how CK Hutchison's operations can intersect with Chinese state interests, although the company itself operates as a private entity.

In summary, CK Hutchison Holdings, through Hutchison Ports PPC, plays a pivotal role in managing and operating the ports at the Panama Canal's entrances, influencing not just the flow of global trade but also the economic landscape of Panama itself.

More about China’s Latin American port play

When you couple who operates the strategic ports at the entry of the Panama Canal with new Port Chancy in Peru, the answer of what this is truly all about reveals itself.

I have written on Port Chancy before here:

The Chancy port is a radical potential game changer for the Panama Canal. If Chinese ambitions in Peru come true, then Port Chancy will supplant a lot of the Panama Canal’s business. That would be another reason against ownership of the Panama Canal.

In short, this might be an attempt at arm twisting to kick the Chinese out of the two Panama Canal ports.

Conclusion

The idea of the United States directly owning or controlling the Panama Canal is not only impractical but also strategically misaligned with current geopolitical realities. While the canal remains a marvel of engineering and a vital artery for global commerce, its operational challenges, limited profitability, and vulnerability to competition make it a dubious investment for direct control.

Instead, the true focus of this thought experiment seems to be the geopolitical implications of Chinese influence at both ends of the canal through CK Hutchison Holdings and the broader context of China’s port strategy in Latin America, particularly with the development of Port Chancay in Peru. These moves represent a long-term challenge to the strategic and economic dominance of the Panama Canal and, by extension, U.S. interests in the region.

If there is a U.S. strategy behind the rhetoric, it may well involve leveraging influence to counter China’s growing foothold rather than physically taking control of the canal. By addressing China’s presence and securing partnerships that reinforce U.S. strategic interests, the U.S. can maintain its influence over key trade routes without the heavy costs and risks associated with direct ownership.

Ultimately, the Panama Canal is not just about trade—it is about the power dynamics shaping the 21st century. Whether through diplomacy, economic influence, or geopolitical maneuvering, the U.S.’s goal is likely to ensure that this critical infrastructure remains aligned with its strategic interests, even in the face of mounting competition from China.

Sources:

Management of Panama Canal ports by Hong Kong firm poses risks, US House panel hears. (2023, May 10). *South China Morning Post*. https://www.scmp.com/news/china/article/3262984/management-panama-canal-ports-hong-kong-firm-poses-risks-us-house-panel-hears

CK Hutchison Holdings Limited. (2017, March 23). *CK Hutchison Holdings announces 2016 annual results*. https://www.ckh.com.hk/en/media/press_each.php?id=352

Hutchison completes Panama Canal deal. (2006, October 9). *South China Morning Post*. https://www.scmp.com/article/186992/hutchison-completes-panama-canal-deal

Key decision point coming for the Panama Canal. (2020, November 10). *Center for Strategic and International Studies*. https://www.csis.org/analysis/key-decision-point-coming-panama-canal

Panama ports company looking at the future. (2018, March 2). *Seatrade Maritime News*. https://www.seatrade-maritime.com/ports-logistics/panama-ports-company-looking-at-the-future

Panama renews 25-year concession to Hutchison's Panama Ports. (2019, September 24). *Seatrade Maritime News*. https://www.seatrade-maritime.com/ports-logistics/panama-renews-25-year-concession-to-hutchison-s-panama-ports

Panama Ports Company. (n.d.). *Learn about PPC*. https://www.ppc.com.pa/en/learn-about-ppc/

CK Hutchison Holdings Limited. (2023, August 1). *CK Hutchison Holdings announces 2022 annual results*. https://www.ckh.com.hk/en/media/press_each.php?id=551

Hutchison Ports PPC: Facilitating the future of freight. (2022, April 1). *North America Outlook Magazine*. https://www.northamericaoutlookmag.com/supply-chain/hutchison-ports-ppc-facilitating-the-future-of-freight

Panama Ports Company (PPC). (n.d.). *BNamericas*. https://www.bnamericas.com/en/company-profile/panama-ports-company-ppc

U.S. interests in Panama. (1999, December 8). *The Washington Post*. https://www.washingtonpost.com/wp-srv/WPcap/1999-12/08/008r-120899-idx.html

Hutchison Whampoa completes acquisition of Panama Ports Company. (2006, October 9). *Hutchison Whampoa Limited*. http://www.hutchison-whampoa.com/en/media/press_each.php?id=353

Hutchison Whampoa takes control of Panama port. (2006, October 9). *MarineLink*. https://www.marinelink.com/news/hutchison-whampoa-control305044

Panama Ports Company. (n.d.). *North America Outlook Magazine*. https://www.northamericaoutlookmag.com/company-profiles/56-panama-ports-company

Runde, D. (2021, May 21). Key decision point coming for the Panama Canal. *Daniel Runde*. https://danielrunde.com/2021/05/21/key-decision-point-coming-for-the-panama-canal/

Protect U.S. interests in Panama. (1999, October 9). *The Ledger*. https://www.theledger.com/story/news/1999/10/09/protect-us-interests-in-panama/26719511007/

Congressmen want probe of Hutchison deal. (2006, December 12). *South China Morning Post*. https://www.scmp.com/article/196396/congressmen-want-probe-hutchison-deal

Panama - Foreign relations - People's Republic of China. (n.d.). *GlobalSecurity.org*. https://www.globalsecurity.org/military/world/centam/pa-forrel-prc.htm

Panama Ports Causeway. (n.d.). *Great Lakes Consortium*. https://glcm.cee.illinois.edu/panama-ports-cause-way/

Trump threatens to retake control of Panama Canal unless deal reached. (2024, December 22). *The Irish Times*. https://www.irishtimes.com/world/us/2024/12/22/trump-threatens-to-retake-control-of-panama-canal-unless-deal-reached/

Hutchinson operates 168 gantry cranes in ports of Panama. (2023, October 3). *Opportimes*. https://www.opportimes.com/hutchinson-operates-168-gantry-cranes-in-ports-of-panama/