Trump’s Commands to US Shale Oil and Gas Producers: Will It and Can It Be Followed?

The Decentralized Nature of U.S. Shale Oil and Gas Upstream Production

TL;DR

Industry Structure: The U.S. shale oil and gas sector is a fragmented landscape of independent producers and a few large companies. This decentralized structure drives innovation, particularly in fracking and horizontal drilling, but creates financial and operational vulnerabilities due to market volatility and high costs.

Production Dynamics: Shale wells are characterized by high initial output followed by sharp declines, requiring continuous drilling to sustain production. This short-cycle responsiveness allows U.S. shale to adapt quickly to price signals, influencing global energy markets but also amplifying volatility.

Global Impact: U.S. shale has transformed the global energy landscape, making the U.S. a top oil and gas producer and exporter. Its agility contrasts with OPEC's coordinated production strategy, introducing competition and reducing global reliance on traditional oil-exporting nations.

Regulatory Challenges: Strict U.S. antitrust laws prevent coordination among producers, leading to boom-and-bust cycles. Regulatory compliance, varying by state, adds complexity for small producers already grappling with financial constraints.

Major Players' Role: International oil majors like ExxonMobil and Chevron maintain a cautious presence in shale, favoring long-term global projects over the high-risk, high-reward U.S. shale model. Independent producers dominate, but their reliance on high oil prices conflicts with policies promoting low energy costs.

Economic and Environmental Tensions: Independent producers face financial strain from fluctuating prices and regulatory costs. Trump's push for "energy dominance" highlights the tension between increasing production to lower prices and the independents' need for profitability which demands higher prices. If profits decline due to overproduction driving down prices, new drilling will cease. This is because shale production typically experiences high initial output followed by sharp declines, leading to reduced supply and ultimately causing prices to rise. High profits and high production cannot coexist in this scenario; it is a trade-off. Moreover, the fragmented nature of the shale industry, dominated by many independent producers, significantly limits Trump's ability to exert meaningful influence over production levels if they are against the profit motivation of ownership.

Future Outlook: The U.S. shale industry’s decentralized, innovative nature ensures its continued global significance. However, achieving political goals like "energy dominance" requires balancing market realities, regulatory frameworks, and industry sustainability amidst environmental and economic pressures.

And now for the Deep Dive….

(Pictured above: One of the author’s wells with its characteristic Christmas Tree that controls the flow of oil and gas, injects chemicals, and releases pressure. This well is in free flow with no artificial lift.)

Introduction

The U.S. shale oil and gas industry has transformed the global energy landscape, largely due to its decentralized and dynamic structure. Shale oil and gas refer to hydrocarbons trapped within shale rock formations, which are extracted through advanced techniques such as horizontal drilling and hydraulic fracturing, or "fracking." This development has been pivotal in reshaping energy markets by providing an abundant source of domestic energy, thereby reducing the U.S. reliance on foreign oil imports and turning the country into one of the largest oil and natural gas producers worldwide. It has also become the largest refined goods exporter in the world. The upstream segment of the oil and gas industry—focused on exploration, drilling, and extraction—plays a critical role in this transformation. This segment's activities directly influence the supply side of the energy market, affecting global oil and gas prices and security of supply.

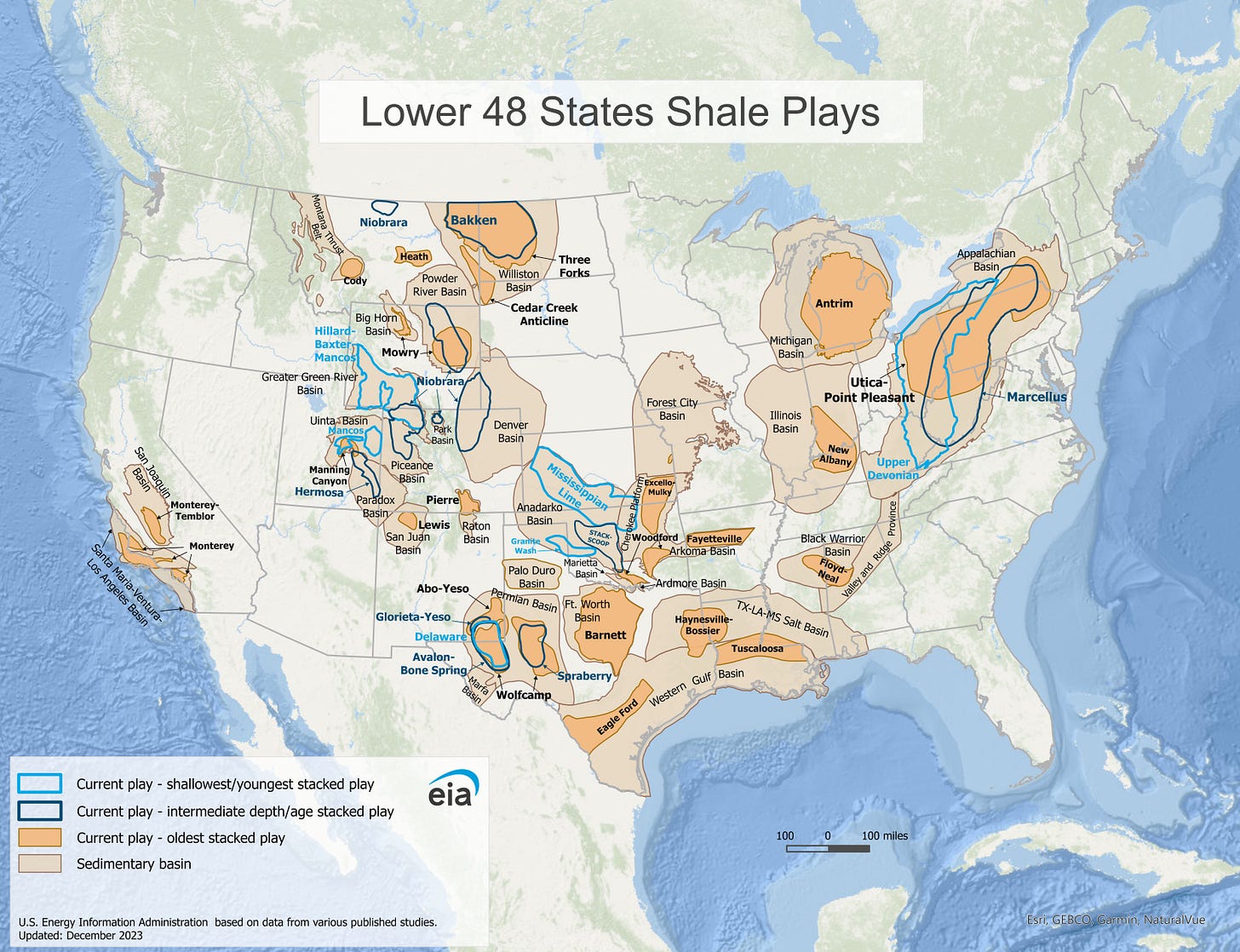

The U.S. shale industry's structure is notably fragmented, characterized by a multitude of small to medium-sized independent producers alongside a minority of major integrated oil companies. This decentralization stems from the vast and dispersed nature of shale formations across states like Texas, Oklahoma, Kansas, Pennsylvania, and North Dakota. Unlike traditional oil and gas fields managed by a few large corporations, shale plays are often developed by numerous smaller companies that own or lease smaller parcels of land. These independent producers have been instrumental in driving innovation, particularly in fracking technology, due to their agility and focus on specific regions. In contrast, major integrated oil companies, with their extensive resources and global presence, have also entered the shale market but often approach it with more strategic considerations, balancing their diverse portfolios.

The purpose of this article is to delve into the implications of this decentralized nature of the U.S. shale oil and gas upstream production. By exploring how the industry operates with many small players, we can better understand the unique dynamics of competition and innovation within this sector. The fragmented structure inherently limits the possibility of coordinated market actions among producers, which is further reinforced by stringent antitrust laws in the U.S. that prevent collusion and foster competition. This legal framework ensures that the market remains competitive, although it can lead to boom-and-bust cycles in production, investment, and employment. The decentralized model also impacts market dynamics by introducing a high level of supply responsiveness to price changes, where numerous small producers can quickly ramp up or scale back operations based on market signals, contributing to both market volatility and resilience. This analysis not only highlights the operational and economic implications but also underscores the strategic significance of U.S. shale in the global energy context.

(Pictured above: The view from the top of a oil storage tank at a US Shale oil and gas well at one of the author’s oil/gas wells)

The Patchwork of Independents

The U.S. shale oil and gas industry is notably characterized by what is often referred to as 'The Patchwork of Independents,' where numerous smaller, localized operators play a significant role, particularly in prolific shale basins like the Permian, Bakken, and Mississippian. These independent producers are typically smaller entities compared to the multinational oil giants, focusing their operations within specific geographic areas where they have deep local knowledge. They dominate these regions not just in numbers but also in terms of innovation, often pioneering new drilling techniques and fracking methods that have unlocked vast hydrocarbon reserves previously considered uneconomical. This risk-taking ethos has been central to the shale boom, with independents willing to experiment and adapt quickly to geological challenges and market conditions, driving technological advancements that benefit the entire sector.

However, this innovation and agility come with their own set of challenges. Independent producers often face significant financial hurdles, including access to capital for drilling and development. Their smaller scale can mean they operate with less financial cushioning against downturns in oil and gas prices, leading to higher exposure to market volatility. Operational challenges also abound. Managing logistics, contracts, and the intricacies of local regulations can be particularly taxing for these smaller entities. Moreover, securing leases, dealing with environmental compliance, and managing the lifecycle of wells from drilling to eventual decommissioning require both capital and expertise, often straining these companies' resources.

The geographical and operational diversity among these independents further shapes the industry's landscape. Different shale basins require varied production practices due to geological variances, regulatory environments, and even cultural aspects of land ownership and use. For instance, operators in the Permian Basin might employ strategies different from those in the Bakken, not only in terms of drilling techniques but also in how they approach water management, infrastructure development, or even community relations. This diversity leads to a rich tapestry of practices that can enhance overall market adaptability, allowing the industry to respond swiftly to changes in market demand or technological breakthroughs. This patchwork of approaches contributes significantly to the resilience and dynamism of the U.S. shale sector, influencing market dynamics by introducing a wide spectrum of supply responses to price signals. It's this very diversity that can stabilize or disrupt markets, as the collective actions of these independents can either cushion or exacerbate price swings, depending on their collective response to economic incentives.

(Pictured above: The author with one of his wells)

What Makes US Shale Drilling Different

The U.S. shale upstream sector, focused on exploration and extraction, fundamentally differs from offshore drilling or conventional drilling, such as that practiced in the Middle East, in several key aspects. At the core of these differences are the geological formations, technological approaches, regulatory frameworks, and the structure of the industry itself.

First, consider the geological context. Shale oil and gas are extracted from shale rock formations, which are fine-grained, organic-rich sedimentary rocks known for their low permeability. This contrasts sharply with the more porous and permeable sandstone or carbonate reservoirs common in conventional drilling, particularly in the Middle East, where oil can often be extracted with less intervention. Shale requires the use of hydraulic fracturing (fracking) to break apart the rock and release the hydrocarbons trapped within, a process not typically necessary in conventional fields where oil might flow naturally or with minimal stimulation.

The technology involved in shale extraction is another major differentiator. Shale development heavily relies on advancements in horizontal drilling and fracking, which allow producers to access oil and gas over a large area from a single wellpad. This technique is less common in conventional oil fields where vertical drilling can be sufficient. Offshore drilling, while also technologically intensive, focuses on different challenges like deep water drilling, subsea well control, and managing operations from platforms or ships, requiring specialized equipment for harsh marine environments. The cost structure in shale is also unique. The initial investment in drilling and fracking can be high, but the decline rates are steep, necessitating continuous drilling to maintain production levels, unlike the more stable production profiles of many Middle Eastern fields.

Regulatory environments and land ownership also play significant roles. In the U.S., shale operations are subject to a complex web of federal, state, and sometimes local regulations, which can vary widely from one jurisdiction to another. This includes strict environmental regulations concerning water use, waste disposal, and emissions. Moreover, in the U.S., land ownership often allows for mineral rights to be owned by private individuals or entities, leading to a fragmented ownership landscape where companies must negotiate leases with numerous parties. This is in stark contrast to many Middle Eastern countries where oil resources are predominantly state-controlled, with national oil companies managing both the exploration and production under a centralized regulatory system, which can streamline operations but also potentially limit innovation and efficiency gains seen in the decentralized U.S. model.

The structure of the industry itself further highlights these differences. U.S. shale is characterized by numerous small to medium-sized independent operators alongside larger companies, fostering a highly competitive environment that drives innovation but also leads to boom-and-bust cycles. This contrasts with the Middle Eastern oil industry, where large national oil companies or consortiums with significant government involvement dominate, often with long-term, stable production strategies aimed at managing global supply. Offshore drilling in various parts of the world, including the U.S., involves high capital expenditure, long lead times for project development, and significant environmental and safety considerations, which can lead to different operational philosophies and risk management strategies compared to the agile, quick-to-market approach of shale.

Finally, the economic implications are distinct. Shale has enabled a rapid increase in U.S. oil and gas production, contributing to energy independence and altering global energy market dynamics. This flexibility and responsiveness to price signals differ from the more strategic, production quota-based approach seen in OPEC countries, where output decisions are often influenced by geopolitical considerations rather than immediate market conditions. Shale's short cycle time from investment to production allows for quicker adaptation to market changes, whereas conventional fields, especially offshore, involve longer development periods and thus less agility in response to market fluctuations.

In summary, the U.S. shale upstream sector's approach to exploration and extraction is marked by unique geological challenges, technological innovations, a diverse regulatory landscape, and an industry structure that supports rapid, if sometimes volatile, growth. These aspects collectively distinguish it from the more traditional and often state-controlled or consortium-driven models of offshore and Middle Eastern oil production.

Steps in US Shale Oil Production

This is over simplified. The process of fracking in U.S. shale formations, from spudding to flow, involves several intricate steps, each critical to the successful extraction of hydrocarbons. It begins with spudding, the act of starting to drill a well. Initially, a vertical well is drilled down to the depth where the shale layer begins. This initial drilling phase can take several days to weeks, depending on the depth and geological complexity.

A mud log is a detailed record of the geological formations, hydrocarbon presence, and drilling conditions encountered during the drilling of an oil or gas well. It is created by analyzing the drilling mud (which carries cuttings from the bottom of the well to the surface) for signs of oil, gas, and rock types, thereby providing insights into the subsurface geology. This log includes data on lithology (rock types), porosity, permeability, hydrocarbon shows, and various drilling parameters like rate of penetration and mud properties, helping geologists, drillers, and engineers make informed decisions about well direction, casing points, and potential reservoir zones. It is this specialized technical analysis that the US excels at. Picking the wrong spot to go horizontal (the kick off point) can lead to a “dry hole” meaning you have drilled into nothing. Mud log analysis is crucial.

Once the vertical well reaches the target shale formation, the process transitions to horizontal drilling. This involves turning the drill bit to drill horizontally through the shale layer, which can extend for thousands of feet, significantly increasing the area from which hydrocarbons can be extracted. Horizontal drilling allows access to a larger volume of the reservoir, enhancing the well's productivity. This step requires precision to ensure the drill stays within the narrow shale band, using advanced directional drilling techniques and real-time data from downhole tools.

After the well is drilled, the next phase is casing and cementing. Steel casings are inserted into the wellbore to prevent the well from collapsing and to isolate different geological layers to avoid contamination. Cement is then pumped between the casing and the wellbore wall to seal the space, ensuring that the fracking fluids and hydrocarbons stay within the intended zone. This step is crucial for environmental protection and well integrity.

With the well cased and cemented, the actual hydraulic fracturing, or fracking, begins. Frac crews move in with large volumes of water, sand (proppant), and various chemicals mixed into what is known as frac fluid. This fluid is pumped at high pressure into the well, creating fractures in the shale. The pressure is significant, often thousands of pounds per square inch, designed to crack the rock and allow the hydrocarbons to flow. The sand keeps these fractures open once the pressure is released, while chemicals can serve various functions like reducing friction, preventing bacterial growth, or altering the fluid's properties to enhance fracturing efficiency.

Following the injection of frac fluid, there's a period called the soaking or "shut-in" time where the well is left to sit. This allows the fluid to interact with the rock, maximizing the effectiveness of the fractures. The duration of this period can vary but is crucial for optimizing recovery.

After soaking, the well is ready for flowback. The pressure is reduced, allowing the frac fluid, now mixed with hydrocarbons, to flow back to the surface. This initial flowback contains much of the injected water and chemicals, which are captured for treatment, recycling, or disposal, depending on regulations and available technology. The hydrocarbons start to flow alongside this fluid, marking the beginning of production.

The final step is production, where the well enters its operational phase. Initially, the well might produce a mix of hydrocarbons, water, and remaining frac fluids, which require separation. Over time, the composition shifts towards predominantly hydrocarbons as the water is depleted. Production rates can be high initially but decline over time, necessitating periodic interventions like refracturing or additional drilling to sustain output. Throughout this phase, wells are monitored for pressure, flow rates, and other parameters to manage the reservoir effectively.

This entire process from spudding to flow is highly regulated, with environmental considerations at each step, from managing water usage and disposal to ensuring the integrity of the well to prevent leaks or contamination. Each well's journey through these stages can vary based on the specifics of the shale formation, local regulations, and the technological approaches of the operating company.

Every Oil Well is a Gas Well in the US

In the context of U.S. oil and gas production, the statement "every oil well is a gas well" reflects a fundamental reality of hydrocarbon extraction, particularly from shale formations. When oil is extracted from the subsurface, it is not just oil that comes to the surface. Natural gas is an inseparable companion. This phenomenon is due to the nature of how hydrocarbons are stored and produced in geological formations.

Oil reservoirs, especially in shale plays, contain not only liquid hydrocarbons but also significant amounts of natural gas, which can be in the form of associated gas (dissolved in the oil) or free gas within the reservoir. When an oil well is drilled and oil starts flowing, the pressure reduction causes the release of this gas. In many shale oil wells, particularly those in formations like the Eagle Ford or Bakken, the gas-to-oil ratio (GOR) can be quite high, meaning that for every barrel of oil produced, a substantial volume of gas is also extracted. For example, some wells in the Eagle Ford might produce gas at ratios exceeding 1,000 cubic feet of gas per barrel of oil, though this can vary widely across different plays and even within the same play.

This co-production of gas with oil presents both opportunities and challenges. On the opportunity side, it allows for the monetization of natural gas alongside oil, contributing to the economic viability of the well. The gas can be sold, used for on-site power generation, or reinjected into the reservoir for pressure maintenance or enhanced oil recovery (EOR). However, the challenges are significant as well. Infrastructure for gas handling, such as pipelines or processing facilities, must be in place or developed to manage the gas. In areas where gas infrastructure lags behind oil development, operators might face issues like flaring or venting, which are not only environmentally harmful but also potentially wasteful and subject to regulatory penalties.

Furthermore, the composition of the gas can vary, sometimes including valuable natural gas liquids (NGLs) like ethane, propane, butane, and pentane, which can be separated out and sold at a premium. This adds another layer of complexity and value to the operation of what might be primarily considered an oil well. The need to manage this gas component also influences well design, completion strategies, and production management practices. Operators must decide whether to choke back production to manage gas rates, invest in gas capture technology, or even adjust drilling and fracking methods to optimize the balance between oil and gas production.

The Flow of US Shale Based Oil and Gas

The rate of flow for shale based oil and gas using horizontal drilling and fracking is very unique. The initial heavy hydrocarbon flow is universally followed by a sharp decrease over time, culminating in a lower but steady plateau. It is a known and well studied hallmark characteristic of U.S. shale oil and gas wells, which is significantly different from conventional wells. When a shale well is first brought into production, it often experiences an initial production (IP) rate that can be extraordinarily high due to the release of pressure and the newly opened fractures from hydraulic fracturing. For instance, in the Bakken Shale, new wells during their first month might produce at rates averaging around 1,000 to 2,000 barrels of oil per day (bopd), with some wells achieving even higher initial flows. Similarly, in the Eagle Ford, initial production can exceed 1,500 bopd in the first few months, according to data from the U.S. Energy Information Administration (EIA).

However, this high initial production rate is not sustainable. The decline curve for shale wells is steep due to the rapid depletion of accessible hydrocarbons from the newly created fractures. A study by Enverus on wells in the Permian Basin showed an average decline rate of about 70% in the first year, meaning that if a well starts at 1,000 bopd, it might drop to 300 bopd within 12 months. In the Marcellus Shale, gas wells might see an initial production of over 5 million cubic feet per day (MMcf/d), but this can plummet by up to 80% within the first year, as noted by the EIA's analysis of decline curves.

Following this sharp decline, production typically stabilizes at a much lower rate but can continue for many years, forming a plateau. For example, after the initial steep decline, a Bakken well might stabilize at around 50-150 bopd for several years, while an Eagle Ford well might level off at similar rates. This plateau phase is where the well continues to produce but at a much less dramatic rate, often determined by the reservoir's natural pressure and the effectiveness of the fracturing job. The EIA's Drilling Productivity Report has shown that over time, the total production from a shale play might only decline by about 20-30% per year after the first year's drastic reduction, thanks to this stabilization.

Most important to note is that this pattern of production—high initial flow, rapid decline, and then a sustained lower output—underscores the need for continuous drilling to maintain or increase production levels from shale plays. The economic implications are significant. Operators must manage the lifecycle of wells from this initial burst of production to the long-term, lower-yield phase, often requiring reinvestment in new wells to offset declining production from older ones. This cycle has been a key driver behind the U.S.'s ability to increase its oil and gas output dramatically in recent years, contributing to the country's status as a leading producer but also highlighting the intensive nature of shale development over time.

The Big Fields in the US

The Marcellus Shale is a significant geological formation located primarily in the northeastern United States, spanning across states like Pennsylvania, New York, Ohio, West Virginia, Maryland, and parts of Virginia. This shale formation, from the Middle Devonian period, is known for its high natural gas content, making it one of the largest natural gas fields in the U.S. Its unique characteristics include its thickness, which can range from less than 50 feet in some areas to over 250 feet in others, and its depth, varying from roughly 4,000 to 8,000 feet below the surface. The Marcellus Shale has a relatively high organic content, which, when combined with modern drilling techniques like horizontal drilling and hydraulic fracturing, has unlocked vast amounts of previously inaccessible natural gas.

The Permian Basin, situated in West Texas and southeastern New Mexico, is another critical hydrocarbon-producing area but is distinguished by its vastness and diversity in oil and gas resources. Covering about 75,000 square miles, it is one of the most prolific oil and gas basins in the world. The Permian is unique due to its multiple stacked layers of hydrocarbon-bearing formations, including limestone, sandstone, and shale, which allow for the extraction of both oil and natural gas at various depths. The basin includes sub-basins like the Midland and Delaware, each with its geological nuances. The thickness of the hydrocarbon-producing zone here can be significantly greater than in other shale plays, sometimes exceeding 1,000 feet, offering a robust and long-term production potential. Its history of oil production dates back to the 1920s, but modern techniques have revived and expanded its output, making it central to U.S. oil production.

The Mississippian Lime is found primarily in Oklahoma and Kansas, with some extension into Texas and Colorado. This formation, from the Mississippian Period, is known for both oil and gas production but is particularly noted for its oil content. Unlike the Marcellus or Permian, the Mississippian Basin consists of a mix of limestone, dolomite, and shale, presenting a complex reservoir system. Its unique characteristic is the presence of both conventional and unconventional resources, where traditional vertical wells have been supplemented by horizontal drilling in recent years to access the shale layers. The Mississippian Lime is often described as having moderate porosity and permeability, which impacts recovery rates but has been enhanced by fracking technologies.

The Bakken Shale is located in the Williston Basin, stretching across western North Dakota, eastern Montana, and parts of Saskatchewan and Manitoba in Canada. This geological formation, from the Late Devonian to Early Mississippian age, is renowned for its oil production rather than natural gas, making it one of the largest continuous oil accumulations in the United States. The Bakken Formation is unique because it consists of three distinct layers: an upper shale, a middle dolomite or limestone layer (the primary oil-bearing zone), and a lower shale. These layers have different properties. The shales act as source rocks and seals, while the middle member serves as the reservoir.

The Bakken's geology is characterized by its low permeability, meaning the oil does not flow easily through the rock, necessitating advanced recovery techniques like horizontal drilling and hydraulic fracturing to extract the hydrocarbons economically. The formation is relatively thin, with a maximum thickness of about 150 feet, but it covers a vast area, which contributes to its significant resource potential. The Bakken is also known for its high pressure, which has helped in maintaining high initial production rates when wells are fracked.

One distinctive feature of the Bakken is the quality of its oil, which is light sweet crude, highly valued in refining due to its lower sulfur content and ease of processing. The oil boom in the Bakken has transformed North Dakota into one of the top oil-producing states in the U.S., significantly impacting local economies, infrastructure, and demographics. Another unique aspect of the Bakken is the phenomenon of "super wells" or high-performing wells, where technological advancements in drilling and completion have led to some wells producing well above average rates, sometimes exceeding 5,000 barrels of oil per day initially. The Bakken's development has been marked by cycles of boom and bust, influenced by oil prices, technological innovation, and regulatory changes, showcasing the volatile yet dynamic nature of shale oil production.

International Major Oil Companies and U.S. Shale

The relationship between International Major Oil Companies (IOCs) and the U.S. shale sector illustrates significant strategic and operational divergences. Major oil companies, often referred to as supermajors, are characterized by their extensive, diversified operations across the globe, focusing on large-scale, long-term conventional oil and gas projects. These projects typically involve substantial capital investments with long lead times, such as deepwater offshore drilling or mega-project developments in countries with significant reserves. This preference for stability and predictability contrasts sharply with the dynamic, risk-prone environment of U.S. shale, where production can be ramped up or down quickly in response to market conditions.

One of the key reasons for the reluctance of major oil companies to heavily invest in U.S. shale is the structural difference between them and the independent shale producers. Shale operations are dominated by smaller, agile companies that are adept at navigating the fragmented land ownership, local regulations, and rapid technological innovations inherent to shale plays. These independents have driven the shale revolution through their willingness to take on high initial risks for potentially high rewards, something less aligned with the risk management strategies of the majors, who are more accustomed to leveraging their size and resources in more predictable investment environments.

ExxonMobil and Chevron, for instance, have historically focused on diversifying their global portfolios rather than concentrating on U.S. shale. While both have some presence in U.S. shale plays like the Permian Basin, their investments are often more measured compared to their commitment to conventional oil projects worldwide. ExxonMobil, for example, has emphasized investments in areas like Guyana for offshore oil or in LNG projects globally, where the scale of investment and potential returns align more with their business model. Chevron has similarly balanced its U.S. shale investments with significant international endeavors, often viewing U.S. shale as one component of a broader strategy rather than its core focus.

European majors like Shell and BP have also shown caution in their approach to U.S. shale. Shell, while it has engaged in shale, particularly in the Permian, has historically preferred to invest in projects where it can leverage its expertise in integrated gas and chemicals, or in large-scale projects like LNG, which offer more predictable cash flows over time. BP, after experiencing significant write-downs on its U.S. shale investments in the past, has been more selective, focusing on shale as part of a broader portfolio rather than a primary growth area. This cautiousness stems from the cyclical nature of shale, where boom periods can quickly turn into busts, leading to volatile returns, which contrasts with the steady, long-term income streams from conventional projects.

In summary, the reluctance of major international oil companies to fully embrace U.S. shale stems from a strategic mismatch between their business models, which favor large, stable investments, and the high-risk, high-reward, and highly competitive nature of U.S. shale operations. The examples of ExxonMobil, Chevron, Shell, and BP illustrate how these companies, while not entirely absent from shale, approach it with a different lens, one that prioritizes their global operations and long-term asset value over the immediate, albeit sometimes lucrative, opportunities in U.S. shale.

The landscape of U.S. shale has been marked by numerous ventures, some of which have not lived up to expectations, particularly when large, international companies tried to adapt their business models to the fast-paced, high-risk environment of shale development. A notable example is Shell, which decided to exit most of its U.S. shale assets in 2021. This decision was driven by the low returns these assets were yielding compared to the high capital expenditures required to maintain and expand operations in shale plays like the Permian Basin. Shell's experience highlighted the pressure from shareholders for better financial performance and a shift towards more sustainable and profitable investments, leading to a strategic retreat from a sector where the financial returns did not match the investment scale.

BHP Billiton, an Australian mining giant, also ventured into U.S. shale with high expectations but faced substantial challenges, leading to a significant divestiture in 2018. BHP invested heavily in the Eagle Ford shale but encountered operational inefficiencies and geological uncertainties that resulted in losses rather than the anticipated gains. The company's attempt to apply its mining expertise to oil and gas was not as successful in the shale context, where agility and quick adaptation to market changes are key. Eventually, BHP sold these assets to BP, acknowledging that the shale sector demanded a different operational philosophy than what it was accustomed to in its traditional mining operations.

Similarly, Equinor (formerly Statoil), Norway's state-owned oil company, ventured into U.S. shale, particularly in the Bakken shale, with high hopes but ended up divesting in 2021 after incurring significant financial losses. The company struggled with the volatile nature of shale economics, where wells deplete quickly, requiring continuous drilling to maintain production volumes. Equinor's large-scale, centralized approach didn't align well with the need for rapid, decentralized decision-making in shale operations, leading to inefficiencies and ultimately, financial underperformance.

These examples underscore a common theme among international majors in U.S. shale: their size and traditional business models are often not well-suited to the nimble, lean operations that characterize successful shale companies. Large companies tend to be more bureaucratic, with higher overheads and a focus on long-term, large-scale projects rather than the quick, adaptable drilling programs that thrive in shale environments. Small independents, on the other hand, can execute more cost-effectively, with less capital waste, focusing on localized knowledge and immediate market conditions. They are better positioned to innovate in drilling and fracking techniques, adapt to the geological complexities of shale, and manage the inherent risks without the same level of financial pressure from investors expecting consistent returns from vast, diversified portfolios. This contrast in operational efficiency, cost management, and strategic agility often leads to the conclusion that "big" doesn't always mean "better" in the context of U.S. shale production.

The reasons behind the exits of various companies from U.S. shale ventures are multifaceted, reflecting the complex nature of this sector. One primary reason is the inherent volatility of shale markets characterized by boom-and-bust cycles. These cycles are predominantly driven by the fluctuating prices of oil and gas, which can dramatically affect profitability. For instance, during a boom, the initial production from a new shale well can be exceptionally high. In the Bakken Shale, wells might start with an average of around 1,000 to 2,000 barrels of oil per day (bopd). However, this production rate can decline steeply, often by about 70% in the first year, as observed in the Permian Basin, leading to a sharp drop-off unless measures like artificial lift are employed to maintain output. Over time, wells might stabilize at a much lower, but sustainable, plateau, with production rates possibly as low as 50-150 bopd after several years, necessitating continuous drilling to keep overall production levels up. This volatility can lead to significant financial losses when oil prices drop, pushing companies to exit investments that no longer align with their financial strategies.

High operating costs associated with shale development also play a crucial role in companies' decisions to divest. The cost of hydraulic fracturing, or fracking, which is essential for unlocking hydrocarbons from shale, involves not only the direct expenses of drilling and fracking operations but also the management of water resources, waste disposal, and infrastructure. For example, the cost to drill and frack a single well can easily exceed $5 million in some of the major shale plays like the Eagle Ford or Marcellus. Additionally, to maintain production rates, companies often need to employ techniques like refracturing or enhanced oil recovery, adding to the operational expenses. This high cost structure becomes particularly burdensome during periods of low commodity prices, making shale less economically viable for companies accustomed to lower-cost conventional operations.

Another factor is the incompatibility of shale operations with the traditional business models of major oil companies. These companies often prioritize large, predictable projects with long-term, stable returns, like offshore or mega-project developments in stable regions. Shale, however, requires a different approach, with rapid decision-making, smaller capital commitments per asset, and the ability to scale operations up or down quickly in response to market conditions. This mismatch can lead to inefficiencies when majors try to apply their conventional operational strategies to shale, resulting in higher costs and lower returns, ultimately prompting exits from these ventures.

Legal Restrictions on Market Coordination

In the United States, the legal framework surrounding market coordination, particularly in the oil and gas sector, is heavily influenced by U.S. antitrust and anti-competition laws, which aim to preserve market competition and prevent monopolistic practices. At the heart of this framework is the Sherman Antitrust Act of 1890, which is one of the oldest and most significant pieces of antitrust legislation in the U.S. The Sherman Act outlaws agreements that unreasonably restrain trade or commerce, with Section 1 focusing explicitly on prohibiting contracts, combinations, or conspiracies in restraint of trade, and Section 2 targeting monopolization or attempts to monopolize any part of trade or commerce. This legislation has been instrumental in shaping the competitive landscape of industries, ensuring that businesses compete on merit rather than through collusion or other anti-competitive means.

Complementing the Sherman Act is the Federal Trade Commission (FTC) Act, enacted in 1914, which further strengthens the government's ability to combat unfair methods of competition and deceptive practices in commerce. The FTC Act established the Federal Trade Commission, which has broad authority to enforce antitrust laws, investigate practices that might lead to reduced competition, and act against those that harm consumers or stifle innovation. Together, these laws create a robust environment where activities like price-fixing, market allocation, or any form of collusion are strictly prohibited. Violations can lead to severe penalties, including hefty fines, imprisonment for individuals involved, and civil lawsuits seeking damages from affected parties.

These legal provisions directly impact the oil and gas industry, especially in the context of U.S. shale production, where numerous independent companies operate. The inability to legally coordinate production or pricing strategies means that each company must respond to market forces independently, which can lead to significant volatility in supply and pricing. This is in stark contrast to the operations of the Organization of the Petroleum Exporting Countries (OPEC), which functions as a cartel where member countries coordinate their oil production levels to influence global oil prices. OPEC's structure allows for collective decision-making where members agree on quotas to manage supply, aiming to stabilize or elevate oil prices for mutual benefit.

However, U.S. shale companies, due to antitrust laws, cannot engage in similar practices. Even the mere appearance of coordination could lead to investigations by regulatory bodies like the Department of Justice or the FTC. The legal barriers are clear: any attempt by U.S. companies to mimic OPEC's approach by collectively deciding on production levels or prices would be considered a violation of antitrust laws. This not only includes explicit agreements but also any form of tacit coordination that might suggest collusion. The consequences for such illegal market coordination are significant, ranging from fines that could run into billions of dollars to criminal charges against corporate officers, which could include jail time.

The impact of these legal restrictions on market coordination contributes to the unique volatility of the U.S. oil market. Without the ability to act as a unified group, each shale producer must make decisions based on their individual assessments of market conditions, leading to a supply response that is often more reactive and less predictable than that of coordinated entities like OPEC. This can result in sharp swings in production and prices, especially during periods of rapid change in oil demand or geopolitical events affecting global supply. For instance, when oil prices rise, U.S. shale producers might ramp up drilling, increasing supply which can eventually lead to price drops. Conversely, during downturns, the lack of coordinated reduction in output can exacerbate price falls as each company tries to maintain cash flow by selling at lower prices.

The free-market forces at play in the U.S. shale sector mean that prices and production levels are largely determined by the balance of supply and demand in a competitive environment. This system, while fostering innovation and efficiency, also leads to cycles of overproduction followed by necessary cutbacks, often without the cushion of collective action to smooth out these cycles. The absence of coordination can lead to periods of significant market correction, where prices might fall to levels that make many operations unprofitable, leading to bankruptcies, mergers, or asset sales among smaller producers.

The contrast between the U.S. and OPEC's approach to market management illustrates a fundamental difference in economic philosophy. While OPEC seeks to control market conditions through coordinated action, the U.S. relies on the competitive dynamics of the market to regulate itself. This has historically led to the U.S. oil industry being at the forefront of technological innovation, as companies compete not just on price but on efficiency and technology. Yet, this environment also means that U.S. producers must constantly adapt to market signals without the safety net of a coordinated supply strategy, making the industry particularly sensitive to global economic shifts, policy changes, and technological advances.

In summary, the legal restrictions imposed by U.S. antitrust laws fundamentally shape how the shale oil and gas industry operates, preventing any form of market coordination that could be seen as anti-competitive. This leads to a market characterized by its responsiveness to immediate economic signals but also one prone to volatility, where the absence of coordinated supply management can result in significant price and production fluctuations. Understanding these dynamics is crucial for stakeholders in the energy sector, as they navigate the complexities of a market driven by competition rather than by coordination.

U.S. Prosecution of Anti-Competitive Practices

The U.S. has a stringent legal framework aimed at deterring and punishing anti-competitive practices, with numerous historical and recent cases highlighting the government's commitment to maintaining fair market competition. One notable example involves market manipulation by executives. In 2016, four former oil and gas executives were charged with manipulating the U.S. physical crude oil market by coordinating their trades to artificially inflate prices. This case underscored the DOJ's vigilance in prosecuting not just companies but also individuals for market manipulation, with the defendants facing potential prison sentences and fines if convicted.

Another area of focus has been collusion among competitors in bidding processes, particularly for drilling rights or services. A significant case was brought against executives from companies bidding for oil and gas leases in the Gulf of Mexico. In 2014, the DOJ charged several executives with conspiring to suppress competition by agreeing not to bid against each other for certain leases, which is a clear violation of antitrust laws. This conspiracy resulted in one of the defendants, David H. Disiere, being sentenced to two years in prison and ordered to pay a $75,000 fine, illustrating the severe penalties for such anti-competitive behavior.

In terms of price collusion, the case of Scott Sheffield, former CEO of Pioneer Natural Resources, is particularly illustrative. In 2021, Sheffield faced allegations by the FTC of colluding with OPEC to stabilize oil prices through public statements that could be interpreted as signals to coordinate production levels. Although Sheffield denied these allegations, this case highlighted the thin line between public commentary and actionable collusion, showcasing how closely the U.S. monitors even indirect forms of market coordination.

The City of Baltimore, in a different context, took legal action against oil companies for allegedly concealing their knowledge of climate change impacts, which could be seen as a form of market manipulation by not allowing consumers to make informed decisions based on full disclosure. This class action, while not directly about price-fixing, illustrates how anti-competitive practices can extend beyond traditional price or bid collusion to include environmental impact and public health.

Enforcement of these laws is primarily the responsibility of two federal agencies: the Department of Justice (DOJ) and the Federal Trade Commission (FTC). The DOJ, through its Antitrust Division, prosecutes criminal violations of antitrust laws, focusing on cases involving price-fixing, bid rigging, and other forms of market manipulation. The FTC, meanwhile, has both investigative and adjudicative powers, overseeing civil anti-competitive practices, including mergers and acquisitions that might substantially lessen competition. Both agencies work in tandem, sometimes sharing jurisdiction based on the specifics of a case. Additionally, they often cooperate with state attorneys general, who can also bring actions under state antitrust laws, which can be broader or more stringent than federal statutes, ensuring a comprehensive enforcement strategy across the U.S.

The implications of these enforcement actions for industry practices are profound. Companies are now more cautious, implementing robust compliance programs to avoid running afoul of antitrust laws. This involves training employees on antitrust principles, establishing strict internal policies against collusion, and often hiring compliance officers or external legal advisors to monitor activities that could be perceived as anti-competitive. The fear of severe penalties, including criminal charges for individuals, has led to a cultural shift in how business is conducted, with an emphasis on transparency and competition rather than coordination.

Moreover, the enforcement actions serve as a deterrent, reshaping corporate behavior by making it clear that any form of market coordination, whether explicit or implied, will be met with significant legal consequences. Companies are also more likely to engage in self-reporting or seek leniency if they discover internal wrongdoing, leveraging DOJ's and FTC's leniency programs to mitigate potential penalties. This proactive approach to compliance has not only aimed at preventing violations but also at fostering a business environment where competition flourishes, ultimately benefiting consumers with better pricing and innovation.

In conclusion, U.S. prosecution of anti-competitive practices has a rich history of setting precedents that guide current enforcement actions. Through high-profile cases and substantial penalties, the DOJ and FTC, along with state agencies, continue to enforce antitrust laws, ensuring that competition remains the cornerstone of market dynamics. This enforcement has led to significant changes in how companies operate, emphasizing compliance, transparency, and competitive market practices. People go to jail. Companies are heavily fined.

Implications and Related Matters

Independent producers in the U.S. shale oil and gas sector face numerous challenges that stem from their structural and operational characteristics. One of the primary hurdles is the difficulty in achieving economies of scale. Unlike major integrated oil companies, which can leverage large-scale operations to reduce per-unit costs, independents often operate with smaller, dispersed assets. This fragmentation means they struggle to influence market prices or secure the same level of bargaining power with suppliers or in sales markets. Their production capabilities might be substantial in aggregate, but individually, these companies lack the clout to affect market conditions significantly. This situation is compounded by high initial capital expenditures for drilling and fracking, where the benefits of scale are crucial for cost efficiency.

Financial vulnerabilities are another significant challenge for these producers due to the inherent volatility of the energy markets. Without the ability to coordinate supply or prices, independents must navigate through boom-and-bust cycles driven by global oil price fluctuations. During downturns, smaller producers with less financial resilience can quickly find themselves in precarious positions, facing reduced cash flows that might not cover operational costs or debt obligations. This lack of coordination also means they cannot collectively adjust production to stabilize markets, leading to scenarios where overproduction can depress prices, further straining their finances. The need for continuous drilling to replace declining wells adds another layer of financial pressure, requiring constant access to capital markets, which can be capricious in their support.

When considering the global competitiveness of U.S. shale, it's essential to contrast it with the operations of national oil companies (NOCs) and international majors. NOCs, especially those from OPEC countries, have the advantage of government backing, which can include direct financial support, control over production quotas, and sometimes, the ability to influence global oil prices through coordinated action. International majors have diversified portfolios that can absorb shocks in one region with gains in another, and their large-scale, integrated operations from exploration to refining allow for more predictable revenue streams. U.S. shale, with its decentralized and competitive structure, offers agility and innovation but struggles with the stability and market influence that these larger entities enjoy. This fragmented approach means that while U.S. shale can rapidly increase production in response to high prices, it also bears the brunt of price falls without the buffer of coordinated supply management.

The structure of U.S. shale impacts its ability to respond to global market shifts. When global oil demand drops or geopolitical issues disrupt supply elsewhere, U.S. shale can quickly adjust production, but this reaction can sometimes flood the market, leading to price corrections. This responsiveness contrasts with the slower, more strategic adjustments by OPEC or the majors, which can use their collective power to manage supply for price stability. However, this agility has also allowed U.S. shale to become a significant player in the global energy market, providing a counterbalance to OPEC's influence by introducing more supply when needed, although not always in a coordinated or predictable manner.

Regulations have a profound impact on decentralized production, where compliance can be more challenging due to the scale and number of operators. Environmental regulations, especially concerning water use, emissions, and land reclamation, can increase operational costs and require significant adaptation, which smaller companies might find burdensome. State-level variations in regulations further complicate operations, as what might be permissible in one state could be strictly controlled or prohibited in another, leading to a patchwork of compliance requirements that can stifle efficiency and innovation.

The potential for legislative and policy changes is often discussed in the context of improving industry stability without infringing on antitrust laws. One idea is to create mechanisms for sharing best practices or data that could help manage production more sustainably without direct coordination on prices or output. This could involve government or industry-led programs that provide technical assistance or funding for research into more efficient or environmentally friendly production methods. Another approach might involve adjusting tax policies or offering incentives for practices that align with national energy or environmental goals, thereby indirectly influencing market behavior without explicit coordination.

In conclusion, the implications for independent producers in the U.S. shale industry are vast, touching on economic, environmental, and regulatory fronts. The challenges of achieving economies of scale, navigating financial volatility, maintaining global competitiveness, and adapting to stringent but variable environmental regulations are significant. However, these challenges also spur innovation and resilience within the sector. Potential legislative and policy changes could offer pathways to mitigate some of these challenges, promoting stability and sustainability in the industry while adhering to the principles of free market competition and environmental stewardship.

Trump’s Commands to US Shale Oil and Gas: Will It and Can It Be Followed?

The Trump administration's vision for a second term, often referred to as "Trump administration 2.0," included a strong emphasis on achieving "energy dominance" rather than merely energy independence. Energy dominance, as envisioned by Trump, goes beyond ensuring the U.S. produces enough energy for its own needs. It aims to make the U.S. an even larger exporter of energy, thereby influencing global energy markets and enhancing national security and economic prosperity. Trump articulated this vision during his campaign, stating on September 16, 2024, at a rally in Texas, "We will become, and stay, totally independent of any need to import energy from the OPEC cartel or any nations hostile to our interests. We will achieve energy dominance, not just independence, making America the energy powerhouse of the world." This statement encapsulates his belief that energy dominance would give the U.S. strategic leverage in international relations and economic policy.

To Trump, achieving energy dominance means not only increasing domestic production but also aggressively exporting oil, gas, and other energy products, thereby lowering global energy prices and reducing the geopolitical influence of oil-rich nations like those in OPEC. The strategy involves deregulating the energy sector, promoting fossil fuel production, and removing barriers to drilling and infrastructure development. The idea is that by flooding the global market with U.S. energy, prices would naturally decline due to increased supply, which in turn would benefit American consumers and industries with lower energy costs.

However, this approach runs counter to the financial interests of independent shale producers. These companies thrive on higher oil prices because their business model is predicated on drilling new wells to replace the rapid decline in production from existing wells. When prices fall due to oversupply, the financial viability of drilling new wells diminishes. Trump's vision of driving down energy costs through increased production directly threatens the profitability of these independents. As oil prices drop, the return on investment for new drilling operations becomes less attractive, potentially leading to reduced activity.

The mechanics here are straightforward: lower oil prices mean that the revenue from selling oil does not cover the high costs of drilling, fracking, and maintaining production rates, especially given the steep decline rates associated with shale wells. For independents who often operate on thin margins and rely on high oil prices to justify new capital expenditures, this scenario could lead to a contraction in drilling activities. Fewer new wells would mean a decrease in overall production growth, which could ironically counteract Trump's goal of achieving energy dominance if the industry cannot sustain the necessary investment in new production.

Moreover, the independent nature of the U.S. shale market complicates any attempt to dictate production levels. Unlike countries with national oil corporations where government can directly influence production, the U.S. shale industry is a decentralized network of small to medium-sized companies. There is no single entity akin to Saudi Aramco or Russia's Rosneft that the government can leverage to control supply. Each company makes its drilling decisions based on market signals, financial capacity, and individual assessments of risk and reward, making coordinated action under governmental direction nearly impossible due to legal constraints around antitrust and free-market principles.

This fragmentation means that while Trump could push policies to encourage more drilling, such as easing regulations or offering tax incentives, he cannot mandate production levels. The market is driven by price signals; when prices are low, drilling slows down, and when prices are high, drilling ramps up. This dynamic is at odds with Trump's stated goal because if his policies lead to lower prices without a corresponding increase in demand, the result would be less drilling, not more, from the independents who are key players in U.S. shale production.

The absence of a national oil company in the U.S. further underscores the challenge of achieving a coordinated response to policy directives. Without a centralized control mechanism, the administration's ability to influence the market in a predictable manner is limited. This situation leads to a paradoxical outcome where the very policies intended to increase production might instead lead to industry contraction if they result in sustained low prices, which are detrimental to the financial health of independent producers.

In essence, Trump's push for energy dominance through increased production and lower prices directly conflicts with the economic realities faced by independent shale companies. These firms need higher oil prices to fund new drilling, manage debt, and ensure profitability. The market's response to low prices, driven by the independents' need to survive, would likely be to reduce drilling, which could undermine the goal of energy dominance.

Therefore, while Trump's rhetoric might have galvanized support among those who favor deregulation and traditional energy dominance, the practical implications of such policies within the context of U.S. shale's decentralized structure reveal significant challenges. The independents, vital to the shale boom, are inherently resistant to top-down directives due to their need to respond to market conditions rather than policy dictates, highlighting the complexities of aligning political visions with industry realities.

Conclusion:

The U.S. shale oil and gas industry, emblematic of innovation, decentralization, and resilience, represents both the strengths and limitations of a fragmented energy market. While it has enabled the U.S. to ascend to a dominant position in global energy production, the sector's decentralized structure and reliance on high oil prices for sustainability pose inherent challenges to aligning industry dynamics with political objectives like "energy dominance."

President Trump's vision for U.S. energy dominance underscores the tension between political ambition and economic reality. The push for increased production and lower global energy prices contradicts the operational and financial needs of independent shale producers, who rely on higher oil prices to offset the costs of continuous drilling and production. This paradox highlights the complexities of managing a decentralized industry, where individual companies respond to market signals rather than government directives, making coordinated efforts nearly impossible within the bounds of U.S. antitrust laws.

Despite these challenges, the U.S. shale industry remains a critical player in global energy markets, characterized by its responsiveness, innovation, and ability to disrupt traditional energy paradigms. However, achieving a balance between political goals, economic sustainability, and the realities of decentralized production requires nuanced strategies. These may include fostering innovation, incentivizing sustainable practices, and implementing policies that support rather than destabilize the industry.

Ultimately, the U.S. shale sector's continued success will depend on its ability to adapt to shifting market conditions, technological advancements, and regulatory environments, while navigating the inherent volatility of global energy markets. The quest for energy dominance must, therefore, reconcile the diverse interests of independent producers, policymakers, and global stakeholders, ensuring that the sector remains a cornerstone of U.S. economic and geopolitical strength without undermining its foundational principles of competition and innovation.

Sources:

Library of Congress. (n.d.). Upstream oil and gas industry. Retrieved from https://guides.loc.gov/oil-and-gas-industry/upstream

Strauss Center. (n.d.). The U.S. shale revolution. Retrieved from https://www.strausscenter.org/energy-and-security-project/the-u-s-shale-revolution/

Deloitte. (n.d.). U.S. shale gas ecosystem. Retrieved from https://www2.deloitte.com/uk/en/insights/industry/oil-and-gas/us-shale-gas-ecosystem.html

ExxonMobil. (n.d.). Unconventional. Retrieved from https://corporate.exxonmobil.com/who-we-are/our-global-organization/business-divisions/upstream/unconventional

U.S. Energy Information Administration. (n.d.). Where our natural gas comes from. Retrieved from https://www.eia.gov/energyexplained/natural-gas/where-our-natural-gas-comes-from.php

Banker, S. (2014, August 8). The upstream unconventional oil and gas supply chain. Forbes. Retrieved from https://www.forbes.com/sites/stevebanker/2014/08/08/the-upstream-unconventional-oil-gas-supply-chain/

Investopedia. (n.d.). What is the difference between upstream and downstream oil and gas operations?. Retrieved from https://www.investopedia.com/ask/answers/060215/what-difference-between-upstream-and-downstream-oil-and-gas-operations.asp

U.S. Environmental Protection Agency. (n.d.). Unconventional oil and gas. Retrieved from https://www.epa.gov/uog

Kimray. (n.d.). Upstream vs. downstream oil and gas operations. Retrieved from https://kimray.com/training/upstream-vs-downstream-oil-and-gas-operations

Nature. (2020). Shale revolution's global implications. Nature Communications. Retrieved from https://www.nature.com/articles/s41467-020-18226-w

U.S. Energy Information Administration. (2013). Today in energy: U.S. natural gas production. Retrieved from https://www.eia.gov/todayinenergy/detail.php?id=11611

DW Energy Group. (n.d.). Upstream, midstream, and downstream in oil and gas operations. Retrieved from https://www.dwenergygroup.com/upstream-midstream-and-downstream-in-oil-and-gas-operations/

U.S. Environmental Protection Agency. (2021). Unconventional oil and gas snapshot. Retrieved from https://19january2021snapshot.epa.gov/uog_.html

Clemente, J. (2019, January 13). U.S. shale oil and natural gas underestimated its whole life. Forbes. Retrieved from https://www.forbes.com/sites/judeclemente/2019/01/13/u-s-shale-oil-and-natural-gas-underestimated-its-whole-life/

Nature. (2021). Challenges in U.S. shale production. Nature Communications. Retrieved from https://www.nature.com/articles/s41467-021-25017-4

Nature. (2013). The shale revolution’s impact on global markets. Nature. Retrieved from https://www.nature.com/articles/494307a

OilPrice. (n.d.). U.S. natural gas production soars. Retrieved from https://oilprice.com/Energy/Energy-General/US-Natural-Gas-Production-Soars.html

Investopedia. (n.d.). What percentage of the global economy is comprised of the oil and gas drilling sector?. Retrieved from https://www.investopedia.com/ask/answers/030915/what-percentage-global-economy-comprised-oil-gas-drilling-sector.asp

Investopedia. (n.d.). Oil and gas industry overview. Retrieved from https://www.investopedia.com/investing/oil-gas-industry-overview/

Mansfield Energy. (2023, July 5). What is the upstream petroleum industry?. Retrieved from https://mansfield.energy/2023/07/05/what-is-it-upstream-petroleum-industry/

Investopedia. (n.d.). Shale oil. Retrieved from https://www.investopedia.com/terms/s/shaleoil.asp

U.S. Energy Information Administration. (n.d.). Petroleum wells. Retrieved from https://www.eia.gov/petroleum/wells/

U.S. Energy Information Administration. (n.d.). Drilling productivity curve analysis. Retrieved from https://www.eia.gov/analysis/drilling/curve_analysis/

Statista. (n.d.). Shale gas production in the United States since 1999. Retrieved from https://www.statista.com/statistics/183740/shale-gas-production-in-the-united-states-since-1999/

Hart Energy. (n.d.). Why U.S. shale production declines are higher than you might think. Retrieved from https://www.hartenergy.com/exclusives/why-us-shale-production-declines-are-higher-you-might-think-188251

Strauss Center. (n.d.). The U.S. shale revolution. Retrieved from https://www.strausscenter.org/energy-and-security-project/the-u-s-shale-revolution/

U.S. Energy Information Administration. (n.d.). Shale gas production statistics. Retrieved from https://www.eia.gov/dnav/ng/ng_prod_shalegas_s1_a.htm

JPT SPE. (n.d.). Shale wells producing more early on, then declining faster than ever. Retrieved from https://jpt.spe.org/shale-wells-producing-more-early-on-then-declining-faster-than-ever

Rock River Minerals. (n.d.). Oil and gas decline curves. Retrieved from http://www.rockriverminerals.com/knowledge-center/oil-and-gas-decline-curves

SpringerLink. (2016). Shale decline curve analysis. Natural Resources Research. Retrieved from https://link.springer.com/article/10.1007/s11053-016-9323-2

Geology.com. (n.d.). Production decline curves. Retrieved from https://geology.com/royalty/production-decline.shtml

Frontiers. (2022). Decline curve analysis in U.S. shale plays. Frontiers in Energy Research. Retrieved from https://www.frontiersin.org/articles/10.3389/fenrg.2022.845651/full

University of Michigan Center for Sustainable Systems. (n.d.). Unconventional fossil fuels factsheet. Retrieved from https://css.umich.edu/publications/factsheets/energy/unconventional-fossil-fuels-factsheet

World Economic Forum. (2019). American shale boom and energy trends. Retrieved from https://www.weforum.org/stories/2019/04/american-shale-boom-energy-trends-charts/

Investopedia. (n.d.). Initial production. Retrieved from https://www.investopedia.com/terms/i/initial-production.asp

Council on Foreign Relations. (n.d.). Shale gas and tight oil boom. Retrieved from https://www.cfr.org/report/shale-gas-and-tight-oil-boom

OilPrice. (n.d.). U.S. shale nears limits of productivity gains. Retrieved from https://oilprice.com/Energy/Crude-Oil/US-Shale-Nears-Limits-of-Productivity-Gains.html

S&P Global. (2020, January 10). U.S. shale oil productivity growth expected to slow in some basins. Retrieved from https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/011020-feature-us-shale-oil-productivity-growth-expected-to-slow-in-some-basins

U.S. Energy Information Administration. (n.d.). Annual energy outlook: Resource trends. Retrieved from https://www.eia.gov/outlooks/aeo/grt.php

U.S. Energy Information Administration. (2023). Today in energy: Bakken productivity trends. Retrieved from https://www.eia.gov/todayinenergy/detail.php?id=63506

Geology.com. (n.d.). Bakken formation overview. Retrieved from https://geology.com/articles/bakken-formation.shtml

U.S. Department of Energy. (n.d.). Bakken formation resource estimates. Retrieved from https://netl.doe.gov/node/2637

University of North Dakota. (n.d.). Bakken oil and gas research. Retrieved from https://bakken.undeerc.org/

Shale Experts. (n.d.). Bakken shale overview. Retrieved from https://www.shaleexperts.com/plays/bakken-shale/Overview/

Bakken Shale. (n.d.). Bakken geology and resources. Retrieved from https://www.bakkenshale.com/geology

Geology.com. (n.d.). Marcellus Shale. Retrieved from https://geology.com/articles/marcellus-shale.shtml

American Petroleum Institute. (n.d.). Marcellus Shale. Retrieved from https://www.api.org/oil-and-natural-gas/energy-primers/hydraulic-fracturing/marcellus-shale

Penn State. (n.d.). Explore Shale. Retrieved from https://exploreshale.psu.edu/

U.S. Geological Survey. (2022). USGS estimates 214 trillion cubic feet of natural gas in Appalachian Basin. Retrieved from https://www.usgs.gov/news/national-news-release/usgs-estimates-214-trillion-cubic-feet-natural-gas-appalachian-basin

Palmer, I. (2022, March 30). The king of shale oil: The Permian Basin is still riding the wave. Forbes. Retrieved from https://www.forbes.com/sites/ianpalmer/2022/03/30/the-king-of-shale-oil-the-permian-basin-is-still-riding-the-wave/

Natural Gas Intelligence. (n.d.). What is the Permian Shale Basin?. Retrieved from https://naturalgasintel.com/glossary/what-is-the-permian-shale-basin/

Statista. (n.d.). Largest shale oil producers in the U.S.. Retrieved from https://www.statista.com/statistics/1181897/oil-largest-shale-oil-producers/

Reuters. (2020, March 9). Few U.S. shale firms can withstand prolonged oil price war. Retrieved from https://www.reuters.com/article/us-global-oil-shale-costs-analysis/few-u-s-shale-firms-can-withstand-prolonged-oil-price-war-idUSKBN2130HL/

NS Energy. (n.d.). U.S. shale industry. Retrieved from https://www.nsenergybusiness.com/news/us-shale-industry/

Reuters. (2019, March 27). Oil majors rush to dominate U.S. shale as independents scale back. Retrieved from https://www.reuters.com/article/us-usa-shale-majors-insight/oil-majors-rush-to-dominate-u-s-shale-as-independents-scale-back-idUSKCN1R10C3/

The Motley Fool. (2016, July 16). Which companies are the biggest shale players in the U.S.?. Retrieved from https://www.fool.com/investing/2016/07/16/which-companies-are-the-biggest-shale-players-in-t.aspx

Baker Institute. (2020, March 19). U.S. shale goes viral. Forbes. Retrieved from https://www.forbes.com/sites/thebakersinstitute/2020/03/19/us-shale-goes-viral/

Reuters. (2021, September 14). Oil well backlog shrinks; U.S. shale may upset investors, drill more. Retrieved from https://www.reuters.com/business/energy/oil-well-backlog-shrinks-us-shale-may-upset-investors-drill-more-2021-09-14/

AOGR. (n.d.). U.S. holds most recoverable oil reserves. Retrieved from https://www.aogr.com/web-exclusives/exclusive-story/u.s.-holds-most-recoverable-oil-reserves

DW Energy Group. (n.d.). Global giants: A guide to the world’s leading shale oil and gas reserves. Retrieved from https://www.dwenergygroup.com/global-giants-a-guide-to-the-worlds-leading-shale-oil-and-gas-reserves/

GIS Reports Online. (n.d.). Shale oil overview. Retrieved from https://www.gisreportsonline.com/r/shale-oil/

Amadeo, K. (n.d.). The U.S. shale oil boom and bust. The Balance Money. Retrieved from https://www.thebalancemoney.com/us-shale-oil-boom-and-bust-3305553

Helman, C. (2016, May 9). The 15 biggest oil bankruptcies so far. Forbes. Retrieved from https://www.forbes.com/sites/christopherhelman/2016/05/09/the-15-biggest-oil-bankruptcies-so-far/

Reuters. (2020, August 31). Second U.S. shale boom’s legacy: Overpriced deals, unwanted assets. Retrieved from https://www.reuters.com/article/us-global-oil-shale-investments/second-u-s-shale-booms-legacy-overpriced-deals-unwanted-assets-idUSKBN25R1GG/

Reuters. (2017, April 19). Analysis: Undaunted by oil bust, financiers pour billions into U.S. shale. Retrieved from https://www.reuters.com/article/usa-shale-funders/analysis-undaunted-by-oil-bust-financiers-pour-billions-into-u-s-shale-idUSL1N1HP1D9/

Reuters. (2019, July 23). Texas shale pioneers struggle to appease investors, compete with majors. Retrieved from https://www.reuters.com/article/us-usa-shale-independents-insight/texas-shale-pioneers-struggle-to-appease-investors-compete-with-majors-idUSKCN1UP10L/

Reuters. (2017, November 28). Pressured for profit, oil majors bet big on shale technology. Retrieved from https://www.reuters.com/article/us-usa-oil-technology/pressured-for-profit-oil-majors-bet-big-on-shale-technology-idUSKBN1DS0FO/

American Geosciences Institute. (n.d.). U.S. regulation of oil and gas operations. Retrieved from https://www.americangeosciences.org/geoscience-currents/us-regulation-oil-and-gas-operations

Reuters. (2020, September 14). U.S. shale producers race for federal permits ahead of presidential election. Retrieved from https://www.reuters.com/article/us-usa-shale-permits-election-focus/u-s-shale-producers-race-for-federal-permits-ahead-of-presidential-election-idUSKBN25Z0KV/

Investopedia. (n.d.). How does government regulation impact the oil and gas drilling sector?. Retrieved from https://www.investopedia.com/ask/answers/012715/how-does-government-regulation-impact-oil-gas-drilling-sector.asp

Reuters. (2024, January 16). Drivers sue U.S. shale oil producers over alleged price-fixing scheme. Retrieved from https://www.reuters.com/legal/litigation/drivers-sue-us-shale-oil-producers-over-alleged-price-fixing-scheme-2024-01-16/

Library of Congress. (n.d.). Oil and gas laws. Retrieved from https://guides.loc.gov/oil-and-gas-industry/laws

Reuters. (2024, August 26). Baltimore sues shale producers for price-fixing in class action. Retrieved from https://www.reuters.com/legal/government/baltimore-sues-shale-producers-price-fixing-class-action-us-court-2024-08-26/

Kemp, J. (2022, November 22). Is the U.S. shale oil revolution over?. Reuters. Retrieved from https://www.reuters.com/markets/commodities/is-us-shale-oil-revolution-over-kemp-2022-11-22/

Blackmon, D. (2013, July 23). Shale oil and gas development is heavily regulated. Forbes. Retrieved from https://www.forbes.com/sites/davidblackmon/2013/07/23/shale-oil-and-gas-development-is-heavily-regulated/

OilPrice. (n.d.). U.S. shale producers just won their biggest legal case in years. Retrieved from https://oilprice.com/Energy/Energy-General/US-Shale-Producers-Just-Won-Their-Biggest-Legal-Case-In-Years.html

International Comparative Legal Guides. (n.d.). Oil and gas laws and regulations: USA. Retrieved from https://iclg.com/practice-areas/oil-and-gas-laws-and-regulations/usa