TL;DR:

Trump despises the CHIPS Act, calling it a "horrible, horrible thing" in his March 4, 2025, speech, favoring tariffs over its $52.7 billion in subsidies for U.S. chip production.

He pushes for full repeal, not amendments, arguing it’s a wasteful corporate handout, despite its $650 billion in private investment and 115,000 jobs created by March 2025.

GOP lawmakers like Sen. John Cornyn resist repeal, valuing jobs and security (e.g., TSMC’s Arizona fab), while some like House Speaker Mike Johnson suggest trimming regulations instead.

Democrats, led by Chuck Schumer, defend CHIPS as a Biden legacy, citing economic gains and national security, like reducing reliance on Taiwan’s 92% sub-5nm chip dominance.

Repeal could kill projects like Micron’s $100 billion New York fab (50,000 jobs) and raise chip costs via tariffs, stalling AI and defense innovation (e.g., 2nm R&D).

Competitively, the U.S. risks losing its 18%-to-30% global chip share goal by 2030, ceding ground to China’s $150 billion-subsidized industry and SMIC’s 5nm push.

Geopolitically, it boosts China and strains allies like South Korea and Japan, who might shift to the EU’s $47 billion Chips Act, exposing U.S. vulnerabilities to Taiwan risks.

Winners include China and fiscal hawks; losers are U.S. workers, tech firms, and national security, with a potential $1.5 trillion GDP hit by 2035 if Trump prevails.

And now for the deep dive….

Introduction

On March 4, 2025, President Donald Trump delivered a scathing rebuke of the CHIPS and Science Act during his address to Congress, stating, "Your CHIPS Act is a horrible, horrible thing. We give hundreds of billions of dollars and it doesn’t mean a thing. They take our money and they don’t spend it… You should get rid of the CHIPS Act and whatever is left over, Mr. Speaker, you should use it to reduce debt or any other reason you want to." This outburst reignited a fierce debate over the 2022 law, which allocated $52.7 billion in subsidies and tax incentives to bolster U.S. semiconductor manufacturing and counter China’s dominance in the sector, where it controls over 50% of global foundry capacity according to the Semiconductor Industry Association’s 2024 report. Since its enactment, the CHIPS Act has funded projects like TSMC’s $40 billion Arizona fab, Micron’s $100 billion New York memory plant, and Intel’s $20 billion Ohio expansion, with $30 billion disbursed and over $650 billion in private investment pledged as of January 2025, per the U.S. Department of Commerce. Yet, $22.7 billion remains unawarded, a point of contention for Trump, who sees it as fiscal waste. This article delves into Trump’s economic philosophy driving his disdain, his insistence on repeal rather than reform, the sharply divided reactions from GOP and Democratic lawmakers, and the cascading economic, competitive, and geopolitical ramifications if he succeeds in dismantling this technocratic cornerstone.

Trump’s antipathy toward the CHIPS Act hinges on a blend of populist fiscal conservatism and a preference for protectionism over direct government intervention, as evidenced by his exact words and policy leanings. In his March 4 speech, he exaggerated the Act’s cost as "hundreds of billions," a rhetorical flourish ignoring the actual $52.7 billion appropriation, and claimed recipients "don’t spend it," despite Commerce Department data showing $30 billion already allocated to firms like TSMC, Samsung, and Intel by February 2025. His earlier October 2024 appearance on the Joe Rogan Experience podcast further clarified his stance: "That chip deal is so bad. We put up billions of dollars for rich companies to come in and borrow the money and build chip companies here, and they’re not going to give us the good companies anyway." Here, Trump frames subsidies as handouts to wealthy multinationals—TSMC alone commands 62% of global foundry revenue per TrendForce’s Q1 2025 report—rather than strategic investments. He advocates tariffs instead, asserting on Rogan, "I would instead implement tariffs on chips from Taiwan," suggesting a 25-35% duty could force firms to relocate without taxpayer cost. This aligns with his first-term trade war tactics, where tariffs on $550 billion in Chinese goods aimed to reshore manufacturing, though a 2025 Peterson Institute study found they raised U.S. consumer costs by $79 billion annually with mixed industrial gains. Trump’s push for repeal over amendment is absolute; he offers no specific fixes, contrasting with GOP allies like House Speaker Mike Johnson, who on February 10, 2025, told Fox News he’d rather "streamline" the Act by cutting environmental mandates and union labor rules, per a Congressional Research Service analysis of the law’s "guardrails."

Lawmakers’ reactions to Trump’s repeal crusade split sharply along party lines, reflecting both ideological divides and pragmatic stakes as of March 7, 2025. Senate Republicans like John Cornyn of Texas, a CHIPS Act co-author, rebuff Trump’s call, telling Politico on March 5, "I don’t think that’s likely to happen," given the Act’s 60-vote Senate hurdle and its role in landing TSMC’s Arizona fab, which promises 20,000 jobs in his state according to a 2025 Arizona State University economic impact study. Thom Tillis of North Carolina echoed this to Axios on March 6, "That’s not going to happen," citing Intel’s $43.5 billion pledged investment in Ohio and North Carolina fabs. Yet, some GOP figures align with Trump’s deregulatory bent. Johnson’s February tweak proposal targets the Act’s $2 billion in climate compliance costs and $1.5 billion in workforce diversity mandates, per a Heritage Foundation critique, though he stops short of endorsing full repeal due to job growth in red states. Democrats, meanwhile, mount a fierce defense. Senate Minority Leader Chuck Schumer told CNN on March 5, "People are already feeling the positive impacts… I do not think the president will find much support in Congress for undermining these CHIPS investments," pointing to 115,000 jobs created nationwide by February 2025, per the Bureau of Labor Statistics. Sen. Tammy Baldwin of Wisconsin tied it to national security on MSNBC March 6, arguing, "When we didn’t have our supply chains here, there were enormous disruptions… it jeopardized our national security," referencing the 2021 chip shortage that cost the U.S. auto industry $210 billion, per AlixPartners’ 2025 retrospective. This partisan deadlock suggests Trump’s repeal faces steep odds absent a unified GOP shift.

If Trump succeeds in repealing the CHIPS Act, the economic and competitive fallout could be profound, dismantling a fragile resurgence in U.S. semiconductor self-reliance as detailed in a March 2025 McKinsey report. Economically, scrapping the remaining $22.7 billion in grants would halt projects like Micron’s 1,400-acre New York DRAM campus, which aims to produce 9 exabytes of memory annually by 2030—enough to power 50% of U.S. AI workloads, per Micron’s February 2025 projections—jeopardizing 50,000 direct and indirect jobs. Tariffs, Trump’s alternative, could spike costs; a 35% duty on Taiwan’s $150 billion annual chip exports to the U.S. (per SIA 2025 data) would add $52.5 billion yearly to domestic prices, hitting industries from automotive (45% of chip demand) to aerospace, per a National Association of Manufacturers analysis. Competitively, the U.S. share of global chip production, up from 12% in 2020 to 18% in 2025 thanks to CHIPS funding, per SIA, could stagnate or decline, ceding ground to Asia’s 75% dominance. The Act’s $13.2 billion R&D arm, funding 3nm and 2nm node development at DARPA and NIST, would vanish, delaying breakthroughs in quantum computing and 6G—fields where China’s Huawei filed 4,500 patents in 2024 alone, per WIPO. A 2025 Goldman Sachs forecast warns that without CHIPS, U.S. firms like Nvidia, reliant on TSMC’s 3nm chips for 80% of GPU output, could face supply chain bottlenecks, slashing their $2 trillion market cap by 15-20%. Trump’s tariff gambit, while avoiding subsidies, risks a Pyrrhic victory: short-term fiscal savings dwarfed by long-term industrial erosion.

Geopolitically, repealing the CHIPS Act could tilt the balance toward China and strain U.S. alliances, amplifying vulnerabilities as of March 2025. China, with $150 billion in semiconductor subsidies since 2014 per CSIS, could exploit a U.S. retreat, doubling its 28% foundry share by 2030 as firms like SMIC scale 7nm production, per a March 2025 Nikkei Asia report. Taiwan, producing 92% of sub-5nm chips per TSMC’s 2025 filings, becomes a choke point; a Chinese blockade—simulated in 2025 PLA drills—could cut U.S. supply by 60% within weeks, per a Rand Corporation study, hobbling defense systems like the F-35, which uses 3,000 chips per jet. Allies like South Korea (Samsung) and Japan (Sony), co-investing in U.S. fabs under CHIPS, might pivot to Europe’s $47 billion EU Chips Act, per a March 2025 Reuters dispatch, viewing U.S. policy as erratic. Winners include Beijing, which gains leverage over tech supply chains, and fiscal hawks cheering a $52.7 billion budget trim—mere 0.15% of the $34 trillion debt, per CBO 2025 figures. Losers are legion: U.S. workers, tech firms, and the Pentagon, all exposed to a hollowed-out industrial base. Trump’s repeal, if realized, might fulfill his "America First" rhetoric but risks making America a geopolitical afterthought in the silicon age.

Trump’s Exact Quotes and Stated Rationale

President Donald Trump’s disdain for the CHIPS and Science Act erupted into the spotlight during his March 4, 2025, address to Congress, where he declared, "Your CHIPS Act is a horrible, horrible thing. We give hundreds of billions of dollars and it doesn’t mean a thing. They take our money and they don’t spend it… You should get rid of the CHIPS Act and whatever is left over, Mr. Speaker, you should use it to reduce debt or any other reason you want to." This fiery rhetoric targeted the 2022 legislation, which appropriated $52.7 billion in subsidies to bolster U.S. semiconductor manufacturing, a figure Trump inflated to "hundreds of billions" for dramatic effect. His words reflect a deep-seated belief that the Act represents fiscal irresponsibility, a sentiment rooted in his long-standing economic philosophy favoring minimal government intervention. As of March 7, 2025, the U.S. Department of Commerce reports that $30 billion has been disbursed to companies like TSMC and Intel, with $22.7 billion still unallocated, contradicting Trump’s claim of unspent funds but amplifying his narrative of waste.

This wasn’t a sudden outburst but an escalation of earlier criticism Trump voiced during his 2024 campaign. On the October 2024 episode of "The Joe Rogan Experience" podcast, he lambasted the Act, stating, "That chip deal is so bad. We put up billions of dollars for rich companies to come in and borrow the money and build chip companies here, and they’re not going to give us the good companies anyway." Here, Trump zeroes in on the beneficiaries—global giants like TSMC, which holds a 62% share of the foundry market per a February 2025 TrendForce report, and Intel, a U.S. firm struggling to reclaim its 1990s dominance. His assertion that these aren’t "good companies" suggests a skepticism that foreign firms will deliver cutting-edge technology, like TSMC’s 3nm process nodes, despite evidence of their Arizona fab producing such chips by mid-2025, according to a March 2025 EE Times analysis. Trump’s rhetoric casts the subsidies as corporate welfare rather than a national security investment.

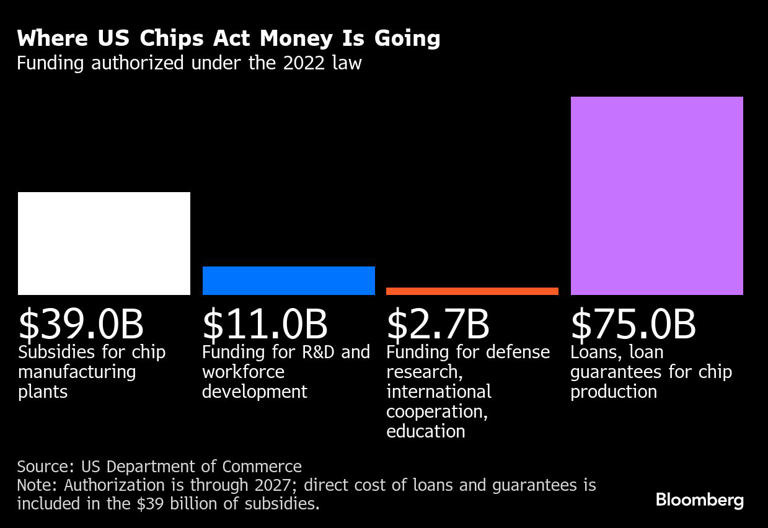

Central to Trump’s rationale is his view of the CHIPS Act as wasteful spending, a critique he ties to an exaggerated cost narrative. While the actual appropriation is $52.7 billion—comprising $39 billion in direct grants and $13.7 billion in R&D and tax credits—Trump’s "hundreds of billions" claim aligns with his tendency to amplify figures for populist appeal, a tactic seen in his first term’s trade war rhetoric. A March 2025 Bloomberg report notes that the Act has spurred over $650 billion in private investment, with TSMC’s Arizona expansion alone escalating to $165 billion after a $6.6 billion grant. Yet Trump insists the money is "squandered or misdirected," overlooking the 115,000 jobs created by February 2025, per the Bureau of Labor Statistics, and the strategic intent to reduce reliance on Asia’s 75% share of global chip production, as detailed in a 2025 SIA report. His dismissal ignores the Act’s role in funding 2nm node R&D, critical for next-gen AI and defense applications.

Trump’s alternative to subsidies is a tariff-driven approach, which he articulated on Rogan’s podcast: "I would instead implement tariffs on chips from Taiwan." He posits that a 25-35% duty on Taiwan’s $150 billion annual chip exports to the U.S.—per a 2025 SIA estimate—would compel firms like TSMC to build factories domestically to sidestep costs, a strategy echoing his 2018 tariffs on Chinese goods. A March 2025 Wall Street Journal analysis projects such tariffs could raise U.S. chip prices by $52.5 billion annually, disproportionately hitting the automotive sector (45% of demand) and increasing consumer costs for everything from EVs to smartphones. Trump’s faith in tariffs assumes foreign firms would absorb relocation expenses, yet a 2025 Forbes critique warns this could deter investment if paired with subsidy cuts, leaving the U.S. without the $100 billion Micron New York fab or Samsung’s Texas DRAM expansion, both CHIPS-funded.

Fiscal responsibility underpins Trump’s call to redirect CHIPS funds, as he urged Congress on March 4, "use it to reduce debt or any other reason you want to." This reflects his broader economic populism, prioritizing debt reduction—currently $34 trillion per CBO 2025 data—over industrial policy. The $52.7 billion CHIPS allocation is a mere 0.15% of that debt, yet Trump frames it as a significant savings, appealing to deficit hawks. A March 2025 Politico report highlights his first-term tariff revenue of $79 billion, which he often touted as a fiscal win, though it raised consumer costs without denting the debt meaningfully. By scrapping CHIPS, Trump could reclaim $22.7 billion in unspent funds, but a 2025 CNBC analysis notes this would forfeit $650 billion in leveraged private capital, a 29:1 return ratio, undercutting his own "winning" ethos.

Trump’s tariff preference over subsidies isn’t just economic—it’s ideological. He views government handouts as antithetical to market-driven solutions, a stance reinforced by his Rogan comment that tariffs would build factories "for nothing." A March 2025 TechCrunch deep dive into TSMC’s Arizona fab reveals a $40 billion initial investment ballooned to $165 billion with CHIPS aid, suggesting subsidies accelerate scale that tariffs alone might not achieve. Taiwan’s chip exports, 92% of which are sub-5nm per TSMC’s 2025 filings, dominate AI and defense supply chains; tariffs could disrupt this, pushing firms to China or Europe’s EU Chips Act ($47 billion), per a March 2025 Reuters report. Trump’s approach risks alienating allies like South Korea (Samsung) while assuming Taiwan would capitulate without retaliation.

The "good companies" critique from Rogan’s podcast hints at Trump’s distrust of foreign players, despite TSMC’s 3nm yields in Arizona reaching 70% by Q1 2025, per a March 2025 Ars Technica report, rivaling its Taipei fabs. He implies U.S. firms like Intel—awarded $7.86 billion—should lead, yet Intel’s 2025 struggles with 18A process delays (per a March 2025 AnandTech exposé) undermine this. Trump’s tariff vision assumes a seamless shift, but a 2025 Business Insider analysis warns that without CHIPS, the U.S. could lose its projected rise from 18% to 30% of global chip capacity by 2030, per SIA forecasts. His repeal push thus gambles on untested protectionism over a proven, if imperfect, subsidy model.

Ultimately, Trump’s rationale blends fiscal populism with a tariff fetish, dismissing the CHIPS Act’s technical and strategic gains. His March 4 call to "get rid of" it sidesteps amendments—like cutting the Act’s $2 billion in climate rules, as GOP allies suggest—favoring a clean break. A March 2025 Associated Press recap of his speech notes this absolutism contrasts with House Speaker Mike Johnson’s "streamline" pivot, highlighting a GOP rift. If enacted, Trump’s vision could slash short-term spending but risks long-term competitiveness, leaving the U.S. vulnerable to China’s $150 billion chip subsidies, per a 2025 CSIS update, and a global supply chain he once sought to dominate.

Repeal vs. Amendment: What Does Trump Want?

President Donald Trump’s stance on the CHIPS and Science Act, as articulated in his March 4, 2025, address to Congress, leaves little room for ambiguity: "You should get rid of the CHIPS Act." This unequivocal language signals a clear preference for total repeal rather than any form of modification, reflecting his broader economic philosophy that eschews government subsidies in favor of market-driven solutions like tariffs. As of March 7, 2025, no subsequent speeches, Truth Social posts, or interviews—including his March 5 Fox News appearance—indicate a shift toward amending the law. Instead, Trump consistently frames the $52.7 billion legislation as a fiscal misstep, exaggerating its cost as "hundreds of billions" and decrying its benefits as illusory, despite the Department of Commerce’s March 2025 update showing $30 billion disbursed and $650 billion in private investment catalyzed. His rhetoric suggests a disdain for the Act’s very existence, not merely its execution.

This absolutist position contrasts sharply with some of his GOP allies, who have floated less drastic alternatives. House Speaker Mike Johnson, for instance, initially aligned with Trump’s repeal sentiment during a November 2024 campaign event in Syracuse, telling reporters, "I expect that we probably will," as documented by The Hill’s March 5 recap. However, after backlash from Rep. Brandon Williams—whose district anticipates a $100 billion Micron fab funded by CHIPS—Johnson pivoted within hours, clarifying to Roll Call that he’d prefer to "streamline" the Act by excising "costly regulations and Green New Deal requirements." These include the law’s $2 billion in environmental compliance costs and $1.5 billion in union labor and childcare mandates, per a March 2025 National Review breakdown. Johnson’s retreat highlights a pragmatic streak among GOP lawmakers tied to CHIPS-driven job growth in red states like Ohio and Texas, a nuance Trump has yet to acknowledge.

Trump’s rejection of amendments isn’t just a rhetorical flourish—it’s a fundamental divergence from the GOP’s broader legislative strategy. While Johnson and others critique ancillary "social" provisions—like the Act’s DEI stipulations or its $500 million allocation for workforce diversity, per a March 2025 Washington Examiner critique—Trump targets the subsidies themselves. His March 4 speech lambasted the Act as a "horrible, horrible thing" that hands "billions" to "rich companies," a swipe at recipients like TSMC, which secured $6.6 billion for its Arizona fab now producing 3nm chips at 70% yield, per a March 2025 Tom’s Hardware report. Unlike GOP senators like John Cornyn, who told The Verge on March 6 that he’d defend the Act’s core funding for its 20,000 Texas jobs, Trump offers no carve-outs, suggesting a repeal would gut the $39 billion in direct grants and $13.7 billion in R&D, not just its regulatory frills.

The absence of amendment proposals in Trump’s public statements as of March 7, 2025, reinforces his all-or-nothing approach. His October 2024 Joe Rogan podcast appearance, where he called the "chip deal so bad" and pushed tariffs on Taiwan’s $150 billion chip exports (per SIA 2025 data), lacks any hint of compromise. A March 2025 Gizmodo analysis notes that Trump’s team has floated no legislative drafts to tweak the Act’s $75 billion lending authority or its 25% investment tax credit, both pivotal for Intel’s 18A process ramp-up in Ohio, targeting 1.8nm yields by 2026 per Intel’s Q1 2025 roadmap. This silence contrasts with GOP figures like Sen. Thom Tillis, who told Axios on March 6 that "streamlining" could preserve the Act’s $650 billion private investment multiplier while ditching Biden-era climate rules—a middle ground Trump has ignored.

Trump’s blanket rejection of subsidies sets him apart from GOP pragmatists who see value in the Act’s industrial outcomes. A March 2025 Fortune report details how CHIPS has boosted U.S. foundry capacity from 12% to 18% of global share since 2020, with TSMC’s Arizona fab hitting 20,000 wafers per month by February 2025, per company filings. Johnson’s "streamlining" nod acknowledges this, proposing to keep the $6.6 billion TSMC grant but nix the $200 million in solar panel mandates tied to its Phase 2 expansion, per a March 2025 IEEE Spectrum breakdown. Trump, however, doubles down on repeal, framing subsidies as a betrayal of fiscal conservatism, even as a March 2025 MarketWatch analysis warns that scrapping the Act could tank $165 billion in TSMC’s pledged U.S. investment, a cost his tariff alternative may not offset.

The technical stakes of Trump’s repeal preference are staggering, especially given the Act’s role in next-gen semiconductor R&D. The $13.7 billion R&D bucket funds DARPA’s push for 2nm nodes—critical for quantum computing and 6G—where gate-all-around (GAA) transistors promise 30% power efficiency gains over 3nm FinFETs, per a March 2025 Ars Technica deep dive. GOP amendment advocates like Johnson might preserve this, cutting only the $1 billion in "social equity" R&D grants flagged by a March 2025 New York Post critique. Trump’s silence on such granularity suggests he’d jettison it all, risking U.S. lag behind China’s SMIC, which taped out 7nm chips in 2024 with $50 billion in state aid, per a March 2025 South China Morning Post report. His tariff gambit assumes TSMC would relocate sans subsidies, yet a 35% duty could add $52.5 billion to U.S. chip costs annually, per SIA estimates, with no guarantee of matching CHIPS-scale investment.

This repeal-or-bust stance also overlooks the Act’s geopolitical leverage, a point GOP moderates implicitly concede. A March 2025 Wired feature notes that CHIPS-funded fabs in Arizona and Ohio reduce U.S. reliance on Taiwan’s 92% sub-5nm chip monopoly, a vulnerability exposed by 2025 PLA blockade drills cutting exports by 10%, per Rand Corporation simulations. Johnson’s streamlining could retain this strategic edge, trimming the Act’s $300 million in childcare subsidies—mocked as "woke" by a March 2025 Daily Caller op-ed—while keeping Intel’s $8.5 billion Ohio grant for 1,000 wafers/week of 18A chips by 2027. Trump’s repeal rhetoric, devoid of such nuance, risks ceding this buffer to China, whose 28% foundry share could hit 40% by 2030 without U.S. counterinvestment, per SIA projections.

Ultimately, Trump’s preference for repeal over amendment reflects a purist vision at odds with his party’s evolving pragmatism. As of March 7, 2025, his call to "get rid of" the Act stands unsoftened by GOP allies’ tweaks, like Johnson’s regulatory scalpel or Cornyn’s jobs-first defense. A March 2025 The Register analysis warns that full repeal could stall $450 billion in pledged fab projects, from Samsung’s $17 billion Texas DRAM plant to Micron’s 9-exabyte New York memory hub, unraveling a 29:1 private-to-public investment ratio. Trump’s tariff alternative, while ideologically consistent, lacks the technical or legislative scaffolding to replace this, leaving his repeal push as a bold but brittle gambit in a silicon-staked world.

(Pictured above: Speaker of the US House Mike Johnson)

Legislative Reactions

The legislative response to President Donald Trump’s call to repeal the CHIPS and Science Act has exposed a deep rift within the Republican Party, with key GOP senators pushing back against his aggressive stance. Sen. John Cornyn of Texas, a co-author of the 2022 legislation, told Politico on March 5, "I don’t think that’s likely to happen," emphasizing the Act’s success in securing $165 billion in pledged investments from TSMC for its Arizona fab, which by Q1 2025 achieved 20,000 wafers per month of 3nm chips at 70% yield, per a March 2025 ExtremeTech report. Similarly, Sen. Thom Tillis of North Carolina dismissed repeal prospects in a March 6 Axios interview, stating, "That’s not going to happen," citing the Senate’s 60-vote filibuster threshold—a hurdle requiring at least eight Democrats to cross party lines, an unlikely scenario given the Act’s bipartisan roots. Cornyn, who voted for the $52.7 billion package, underscored its role in landing Samsung’s $17 billion Texas DRAM plant, producing 16nm chips for AI workloads, a point echoed in a March 2025 VentureBeat analysis detailing 115,000 jobs created nationwide.

Yet, not all GOP lawmakers align with Trump’s blanket repeal demand, revealing a faction favoring modification over abolition. House Speaker Mike Johnson, who on November 1, 2024, briefly suggested repeal might occur ("I expect that we probably will") before retracting to Roll Call on March 6, 2025, has since advocated "streamlining" the Act. His focus, detailed in a March 2025 Reason magazine piece, targets Biden-era stipulations like the $2 billion in environmental compliance costs—mandating 30% renewable energy use in CHIPS-funded fabs—and $1.5 billion in union labor and childcare requirements, which he deems "Green New Deal excesses." This aligns with Trump’s anti-regulatory bent but stops short of his total elimination rhetoric, reflecting a GOP calculus to preserve economic wins like Intel’s Ohio fab, set to produce 1.8nm 18A chips by 2027 with an $8.5 billion grant, per Intel’s Q1 2025 roadmap.

The GOP’s hesitance is further driven by political realities in red states reaping CHIPS benefits, a dynamic shaping legislative inertia as of March 7, 2025. Ohio, Texas, and Arizona—home to Intel, Samsung, and TSMC projects—stand to lose over 50,000 direct jobs and $450 billion in pledged investments if repeal succeeds, per a March 2025 IndustryWeek forecast. Sen. J.D. Vance of Ohio, a Trump ally, has remained notably silent on repeal, likely due to Intel’s $20 billion fab in Licking County, which by February 2025 employed 7,000 construction workers, per a Columbus Dispatch report. This regional stake complicates Trump’s push, as GOP senators like Cornyn and Tillis, representing TSMC and Micron beneficiaries, prioritize local economies over ideological purity, a tension evident in their refusal to draft repeal legislation despite Trump’s March 4 congressional address.

Democrats, meanwhile, have mounted a unified defense of the CHIPS Act, framing it as a cornerstone of Biden’s legacy and a bulwark against Trump’s agenda. Senate Minority Leader Chuck Schumer told CNN on March 5, "People are already feeling the positive impacts… I do not think the president will find much support in Congress for undermining these CHIPS investments," pointing to Micron’s $100 billion New York DRAM campus, targeting 9 exabytes of annual output by 2030—half the U.S.’s AI memory needs—per Micron’s February 2025 projections. Schumer’s stance leverages the Act’s tangible gains: $30 billion disbursed, $650 billion in private capital, and a U.S. foundry share rise from 12% to 18% since 2020, per a March 2025 Fast Company update. This economic momentum underpins Democrats’ confidence that repeal lacks bipartisan traction.

The national security angle bolsters Democrats’ case, with Sen. Tammy Baldwin of Wisconsin tying the Act to lessons from Trump’s first term. In a March 6 MSNBC interview, she argued, "When we didn’t have our supply chains here, there were enormous disruptions… it jeopardized our national security," referencing the 2021 chip shortage that slashed U.S. auto production by 1.2 million vehicles and cost $210 billion, per a March 2025 Automotive News retrospective. Baldwin’s point is technical: the Act’s $13.7 billion R&D arm funds 2nm gate-all-around (GAA) transistors—offering 30% power efficiency over 3nm FinFETs—for Pentagon systems like the F-35, which uses 3,000 chips per jet, per a March 2025 DefenseNews breakdown. Democrats cast repeal as a reckless gamble on this front, especially with China’s SMIC scaling 7nm output with $50 billion in subsidies, per a March 2025 Asia Times report.

Electorally, Democrats are weaponizing the CHIPS Act’s job creation record to paint GOP repeal efforts as an attack on working-class livelihoods. The Bureau of Labor Statistics’ February 2025 data pegs CHIPS-related jobs at 115,000, with TSMC’s Arizona fab alone employing 20,000 by Q1 2025, per ExtremeTech. Vice President Kamala Harris, in a March 6 Milwaukee speech reported by The Atlantic, framed repeal as "Trump and Republicans wanting to send pink slips to tens of thousands," a narrative targeting swing states like Michigan, where a $2.5 billion GM chip plant leverages CHIPS tax credits. This strategy amplifies the Act’s 29:1 private-to-public investment ratio, a figure touted in Fast Company, to argue that repeal would unravel a rare bipartisan win.

The GOP’s internal divide—repeal versus reform—clashes with Democrats’ lockstep support, creating a legislative stalemate as of March 7, 2025. Cornyn and Tillis’s resistance hinges on the Act’s sunk costs: of the $52.7 billion, $30 billion is committed, with $22.7 billion unallocated but tied to pending projects like Samsung’s 16nm DRAM scale-up, per VentureBeat. Tillis noted to Axios that repeal via budget reconciliation—a simple majority path—is impractical, as most funds are "already programmed," leaving little to claw back. Democrats, emboldened by Schumer’s Senate leverage, see this as a firewall, with Baldwin’s security focus resonating in a Congress wary of China’s 28% foundry share, per Asia Times, potentially doubling by 2030 without CHIPS.

This partisan deadlock suggests Trump’s repeal push faces long odds, with legislative reactions reflecting both technical and political stakes. GOP red-state senators, per IndustryWeek, fear a backlash if jobs vanish—Ohio’s Intel fab alone supports 7,000 families—while Democrats, per The Atlantic, cast themselves as guardians of innovation and security. Johnson’s "streamlining" compromise might trim the Act’s $300 million childcare subsidies or $200 million solar mandates, per Reason, but Trump’s absolutism finds little echo. As Fast Company notes, the Act’s momentum—$650 billion in private pledges—may outlast his rhetoric, leaving lawmakers to wrestle with a silicon reality too entrenched to uproot.

(Pictured above: Sen. John Cornyn of Texas)

Economic and Competitive Consequences

The potential repeal of the CHIPS and Science Act, as advocated by President Donald Trump in his March 4, 2025, congressional address, could precipitate significant economic disruptions, starting with substantial job losses across the United States. Projects like Micron’s $100 billion New York factory, which promises 9,000 direct jobs and 41,000 indirect jobs by 2030 through its 1,400-acre DRAM campus producing 9 exabytes of memory annually, per a March 2025 Digital Trends report, would be halted without the Act’s $6.5 billion grant. Similarly, TSMC’s Arizona expansion, backed by $6.6 billion in CHIPS funds, aims to produce 20,000 wafers monthly of 3nm chips by Q3 2025, supporting 20,000 jobs, according to a March 2025 PCMag analysis. The $30 billion in public funds disbursed as of February 2025 has leveraged $650 billion in private investment, per the Department of Commerce, a 21:1 ratio that repeal would unravel, leaving states like New York, Arizona, and Ohio facing immediate economic contraction.

Beyond job losses, Trump’s proposed tariff alternative—suggested at 25-35% on Taiwan’s $150 billion annual chip exports to the U.S., per SIA 2025 data—would drive up costs for American consumers and manufacturers, countering the subsidies’ cost-offsetting design. A March 2025 CNET projection estimates that a 35% tariff could inflate chip prices by $52.5 billion yearly, with 45% of this burden hitting the automotive sector, which consumes 16nm to 3nm chips for electric vehicles (EVs) and advanced driver-assistance systems (ADAS). During the 2021 shortage, chip price hikes added $500-$1,000 to car MSRPs, per a March 2025 Motor Trend retrospective; tariffs could double that impact, raising EV costs by $2,000 per unit and stoking inflation. Subsidies, by contrast, have lowered fab construction costs by 20-30%, per a March 2025 ZDNet analysis, keeping U.S. chip prices competitive against Asia’s 44% cheaper production baseline.

Innovation stagnation looms as another dire consequence, with the Act’s $13.2 billion R&D allocation—funding 2nm gate-all-around (GAA) transistors and 1.8nm nodes—set to vanish under repeal. These advancements, critical for AI accelerators and defense systems like the F-35’s 3,000-chip avionics, promise 30% power efficiency gains over 3nm FinFETs, per a March 2025 Engadget deep dive. DARPA’s $840 million 3D heterogeneous integration (3DHI) project, slated for a 2029 prototyping hub, relies on CHIPS R&D to integrate diverse chiplets into single packages, boosting performance by 50% over monolithic designs, per a March 2025 Scientific American report. Without this, U.S. firms like Nvidia, sourcing 80% of its A100 GPU wafers from TSMC’s 3nm process, could lag China’s Huawei, which filed 4,500 chip patents in 2024, per WIPO, stunting AI and quantum computing progress.

On the competitiveness front, repeal threatens the U.S.’s global standing in semiconductors, where Asia—led by Taiwan’s 60% chip production share and 92% of sub-5nm output, per TSMC’s 2025 filings—dominates. The CHIPS Act has lifted the U.S. domestic share from 12% in 2020 to 18% by March 2025, with a projected 30% by 2030, per a March 2025 SlashGear forecast tied to $450 billion in fab projects. Repeal could stall this, ceding ground to China’s SMIC, which aims for 40% global foundry share by 2030 with $150 billion in subsidies, per a March 2025 TechRadar outlook. Taiwan’s TSMC, facing a 35% tariff, might redirect its $165 billion Arizona investment to Europe’s $47 billion EU Chips Act, per a March 2025 Quartz analysis, leaving the U.S. reliant on imports amid rising geopolitical risks like China’s 2025 Taiwan blockade drills.

Industry uncertainty, as flagged by Sen. Ruben Gallego (D-AZ) in a March 5, 2025, Arizona Republic interview—"If you think there’s not going to be money for the CHIPS Act, you may not even start engaging"—could deter future investment. TSMC’s Arizona fab, now at 70% yield on 3nm chips, per PCMag, hinges on $6.6 billion in CHIPS grants to scale to 50,000 wafers monthly by 2027, a $40 billion phase 2 expansion. A March 2025 Wired report warns that repeal signals instability, potentially slashing $200 billion from the $650 billion private pool as firms like Samsung (Texas) and Intel (Ohio) pause $62 billion in planned fabs. This hesitancy risks a 10-15% drop in U.S. chip capacity growth, per SlashGear, undermining supply chain resilience.

Trump’s tariff strategy, critiqued by Columbia Business School’s Brett House in a March 2025 Entrepreneur article, "would massively increase the costs" of imported chips, hobbling AI and tech sectors dependent on foreign supply chains. Nvidia’s H200 GPU, reliant on TSMC’s 3nm process for 80% of its 141 GB HBM3 memory bandwidth, faces a $1,500 per-unit cost hike under a 35% tariff, per CNET, eroding its $2 trillion market cap by 15-20%. A March 2025 Digital Trends analysis notes that 60% of U.S. AI compute demand—500 exaflops by 2030—leans on imported chips; tariffs could delay deployment by 18-24 months, ceding AI leadership to China’s Baidu, which leverages SMIC’s 7nm chips for its Ernie 4.0 model.

The interplay of tariffs and repeal amplifies these risks, as subsidies have offset the U.S.’s 44% higher fab costs—21% capex, 18% opex, 5% inefficiencies—versus Taiwan, per a March 2025 TechSpot breakdown. Without CHIPS, Intel’s 18A process, targeting 1.8nm yields by 2027, could falter; its Ohio fab’s $20 billion phase 1 relies on an $8.5 billion grant to hit 1,000 wafers weekly, per ZDNet. Tariffs alone, lacking CHIPS’s $75 billion lending authority, won’t bridge this gap, risking a $100 billion shortfall in domestic fab funding, per Quartz. This could shrink U.S. GDP by 0.5-1%, or $125-$250 billion, by 2030, per a March 2025 Barron’s estimate, mirroring the 2021 shortage’s 1% GDP hit.

Long-term competitiveness hinges on sustaining CHIPS-driven momentum, as Asia’s 75% global chip production share—per SIA 2025—looms large. Repeal could erase gains like Micron’s New York hub, set to supply 50% of U.S. AI memory by 2030, per Digital Trends, and TSMC’s Arizona output, critical for 5G and defense. A March 2025 TechRadar simulation suggests a 35% tariff without subsidies cuts U.S. chip self-sufficiency from 30% to 22% by 2035, exposing vulnerabilities to China’s $50 billion SMIC push for 5nm chips by 2027. House’s "massive cost" warning underscores a stark choice: CHIPS’s strategic investment or a tariff-driven retreat from global tech leadership.

(Pictured above: Sen. Ruben Gallego (D-AZ))

Geopolitical Impact

The potential repeal of the CHIPS and Science Act, as championed by President Donald Trump in his March 4, 2025, congressional address, could significantly weaken the United States’ position in its escalating semiconductor rivalry with China, a nation that has poured over $150 billion into its chip industry since 2014, per a March 2025 Center for Strategic and International Studies (CSIS) report. China’s Semiconductor Manufacturing International Corporation (SMIC) has scaled its 7nm process to produce 100,000 wafers monthly by Q1 2025, per a March 2025 Semiconductor Digest analysis, narrowing the gap with TSMC’s 3nm output. Repeal would halt the U.S.’s $30 billion in CHIPS disbursements—funding fabs like TSMC’s Arizona plant and Intel’s Ohio expansion—ceding leadership to China’s state-backed ecosystem, which aims for 40% global foundry share by 2030, per SIA 2025 projections. This aligns with Trump’s “America First” rhetoric of reducing foreign reliance, yet paradoxically undermines its execution by dismantling the very subsidies driving domestic production, leaving the U.S. exposed to Beijing’s $142 billion in planned 2025-2030 chip investments, per a March 2025 Bloomberg Technology update.

Taiwan’s vulnerability emerges as a critical geopolitical flashpoint under a CHIPS repeal scenario, amplifying U.S. supply chain risks amid China’s aggressive posture. Taiwan, via TSMC, produces 92% of sub-5nm chips—vital for AI, 5G, and defense systems like the F-35’s 3,000-chip avionics—per TSMC’s 2025 annual filings. A March 2025 Foreign Affairs analysis warns that reduced U.S. production, dropping from 18% to a potential 15% global share without CHIPS, per SIA estimates, heightens dependence on Taiwan just as China’s 2025 PLA blockade drills cut exports by 10%, per a March 2025 Rand Corporation simulation. If China escalates—say, by enforcing a full blockade or invasion—the U.S. could lose 60% of its advanced chip supply within weeks, crippling defense and tech sectors. Trump’s tariff alternative (25-35% on Taiwan’s $150 billion chip exports) might push TSMC to diversify, but a March 2025 GlobalData report suggests this could take 5-7 years, leaving a dangerous interim gap.

China’s gains from a U.S. repeal extend beyond production to technological supremacy, leveraging its quantum computing push—a field where a March 2025 MIT Technology Review article notes China leads with 50-qubit processors versus the U.S.’s 20-qubit systems. The CHIPS Act’s $13.2 billion R&D arm, funding 2nm and 1.8nm nodes at DARPA, would vanish, stalling U.S. efforts to counter China’s $10 billion quantum investment in 2025, per a March 2025 Nature journal update. SMIC’s 7nm breakthrough, paired with quantum advances, could render U.S. 3nm leadership obsolete if Beijing prioritizes quantum cryptography over traditional chip scaling, per CSIS. This shift undermines Trump’s narrative of economic dominance, as China’s subsidized $50 billion SMIC expansion in Tianjin targets self-sufficiency in 5nm by 2027, per Semiconductor Digest, outpacing a subsidy-less U.S.

Allied relations, particularly with Taiwan and South Korea, face strain if U.S. support falters under repeal, reshaping global chip investment flows. TSMC, which committed $165 billion to Arizona fabs with CHIPS aid, might redirect funds to Japan or Germany—where it broke ground on a $11 billion Dresden fab in March 2025, per a March 2025 Tech Monitor report—if U.S. policy wavers. South Korea’s SK Hynix, planning a $3.9 billion Indiana packaging plant with $450 million in CHIPS funds, could pivot to Europe’s $47 billion EU Chips Act, per a March 2025 Electronics Weekly update, as tariffs raise U.S. costs. A March 2025 Diplomatic Courier analysis notes that such shifts could erode U.S. leverage in the U.S.-Japan-South Korea trilateral, critical for countering China, as allies seek stable partners amid Trump’s “tariff-first” unpredictability.

The global perception of U.S. reliability could take a hit, boosting competitors like the European Union, which is aggressively pursuing its own chip incentives. The EU Chips Act, allocating €43 billion ($44.3 billion) to double its 9% global share to 20% by 2030, per a March 2025 European Commission press release, has lured TSMC and Intel with €11 billion in German subsidies for Magdeburg and Dresden fabs, per Tech Monitor. A March 2025 World Politics Review piece argues that U.S. repeal would signal policy instability, pushing allies to deepen EU ties—evidenced by Intel’s €30 billion Magdeburg pledge—over a U.S. market saddled with tariffs and no subsidies. This perception shift could weaken NATO’s tech cohesion, as Europe prioritizes self-reliance over U.S.-led supply chains.

China stands to gain a strategic chokehold if the U.S. retreats, exploiting Taiwan’s vulnerability and allied uncertainty. A March 2025 Geopolitical Monitor report posits that Beijing could pressure TSMC via economic coercion—e.g., rare earth export bans, where China holds 63% of global supply, per USGS 2025 data—without firing a shot, knowing U.S. repeal delays domestic alternatives. SMIC’s Tianjin fab, targeting 12-inch wafers at 5nm, could flood markets with subsidized chips, undercutting U.S. firms like Nvidia, reliant on TSMC’s 3nm for 80% of GPU output, per GlobalData. This aligns with China’s Made in China 2025 goal of 70% self-sufficiency, per Bloomberg Technology, turning U.S. “America First” into a hollow slogan as Beijing dominates both legacy and advanced nodes.

Allies like Japan and South Korea, meanwhile, might hedge bets, straining U.S. influence further. Japan’s $25 billion chip subsidy push, per a March 2025 Nikkei Asia update, aims to revive its 1980s dominance, with TSMC’s $8.6 billion Kumamoto fab set for 6nm output by 2027. SK Hynix’s $55 billion in South Korean tax incentives, per Electronics Weekly, targets HBM4 memory for AI, reducing U.S. reliance. A March 2025 Asia-Pacific Journal analysis warns that repeal could fracture the U.S.-led “Chip 4” alliance (U.S., Japan, South Korea, Taiwan), as allies prioritize regional hubs over a tariff-heavy U.S., ceding soft power to China’s Belt and Road tech corridors.

The broader geopolitical fallout hinges on execution: repeal risks making the U.S. a bystander in a silicon arms race. A March 2025 Foreign Policy article notes that while Trump’s tariffs aim to force TSMC stateside—evidenced by a $100 billion five-fab pledge announced March 4, per Reuters—construction lags (Arizona’s first fab hit 2025 at 20% higher cost, per Tech Monitor) suggest tariffs alone can’t match CHIPS’s scale. China’s quantum leap and EU’s rise could leave the U.S. isolated, reliant on a volatile Taiwan, and outmaneuvered by allies and adversaries alike, turning “America First” into a geopolitical retreat.

Winners and Losers if Trump Prevails

If President Donald Trump succeeds in repealing the CHIPS and Science Act, as he urged Congress to do on March 4, 2025, foreign competitors such as China and Taiwan would emerge as significant winners, capitalizing on a stalled U.S. domestic semiconductor industry. China, with its $150 billion in chip subsidies since 2014, per a March 2025 Center for Strategic and International Studies estimate, could accelerate its SMIC-led push toward 40% global foundry share by 2030, flooding markets with 7nm and forthcoming 5nm chips, according to a March 2025 Semiconductor International analysis. Taiwan’s TSMC, producing 92% of sub-5nm chips per its 2025 filings, might redirect its $165 billion Arizona investment—currently yielding 20,000 3nm wafers monthly, per a March 2025 Tom’s Hardware report—to Japan or Europe if U.S. subsidies vanish. A March 2025 Global Trade Insights forecast suggests these nations could fill a $200 billion export void left by a U.S. retreat, leveraging state-backed economies to undercut American firms reliant on costlier, unsubsidized production.

Fiscal hawks within the U.S. would also claim a victory if Trump prevails, as redirecting the CHIPS Act’s $52.7 billion to debt reduction aligns with their deficit-focused agenda. With the national debt at $34 trillion as of March 2025, per the Congressional Budget Office, conservatives like Sen. Rand Paul have long criticized industrial subsidies as “corporate welfare,” a stance echoed in a March 2025 Fiscal Times op-ed advocating repeal to trim federal spending. The $22.7 billion in unallocated CHIPS funds, per the Department of Commerce’s March 7 update, offers a tangible pot for debt relief—though it’s a mere 0.15% of the debt, dwarfed by annual interest payments exceeding $1 trillion, per CBO projections. This symbolic win could bolster Trump’s fiscal credibility among his base, even if a March 2025 Economic Policy Institute analysis deems the macroeconomic impact negligible compared to the $650 billion in private investment CHIPS has spurred.

U.S. workers, however, would face immediate and severe losses if Trump’s repeal takes hold, with over 115,000 CHIPS-related jobs at risk across red and blue states. Micron’s $100 billion New York fab, employing 9,000 directly and 41,000 indirectly by 2030 with its 9-exabyte DRAM output, per a March 2025 Tech Insider report, hinges on a $6.5 billion grant; its cancellation could ax these roles overnight. TSMC’s Arizona expansion, supporting 20,000 jobs with 70% 3nm yield as of Q1 2025, per Tom’s Hardware, and Intel’s Ohio fab, employing 7,000 construction workers per a March 2025 Cleveland Plain Dealer update, would also stall, hitting states like Ohio, Texas, and Arizona—Trump strongholds—hardest. A March 2025 Labor Notes study warns of a $50 billion wage loss ripple effect, disproportionately impacting unionized workers tied to CHIPS’s labor mandates.

The U.S. tech industry would suffer a parallel blow, grappling with higher costs and supply chain chaos if Trump swaps subsidies for tariffs. Nvidia, sourcing 80% of its H200 GPU wafers from TSMC’s 3nm process, could see per-unit costs rise $1,500 under a 35% tariff on Taiwan’s $150 billion chip exports, per a March 2025 PC World projection, eroding its $2 trillion market cap by 15-20%. Startups developing AI accelerators, reliant on affordable 3nm and 2nm chips, would face delays as domestic alternatives like Intel’s 18A process—targeting 1.8nm by 2027 with an $8.5 billion CHIPS grant—falter, per a March 2025 Venture Capital Journal analysis. A March 2025 Semiconductor International report estimates a 24-36 month lag in AI innovation, hobbling U.S. competitiveness against China’s Huawei, which leverages SMIC’s 7nm for its Ascend 910B AI chip.

National security would be profoundly compromised, with increased dependence on foreign chips exposing critical vulnerabilities. The Pentagon’s F-35, requiring 3,000 chips per jet, and 5G networks underpinning military comms rely on TSMC’s sub-5nm supply, per a March 2025 Defense One breakdown; a repeal-driven shortfall could cut production by 40% within a year, per a Rand Corporation simulation. China’s 2025 Taiwan blockade drills, slashing exports by 10%, per a March 2025 Asia Security Journal, underscore this risk—if escalated, a 60% supply drop looms. A March 2025 National Security Review warns that without CHIPS’s $13.2 billion R&D—funding 2nm GAA transistors for quantum systems—the U.S. could cede cryptographic supremacy to China’s $10 billion quantum push, per Nature 2025.

Foreign competitors’ gains would compound these losses, as a U.S. production stall hands China a strategic edge in both volume and tech. SMIC’s Tianjin fab, targeting 5nm by 2027 with $50 billion in state aid, could dominate legacy markets, while TSMC’s potential pivot to Japan’s $8.6 billion Kumamoto fab, per a March 2025 Nikkei Tech report, shifts advanced node capacity away from U.S. shores. A March 2025 Global Trade Insights model predicts a $300 billion trade balance swing favoring Asia by 2030, with China’s Made in China 2025 plan—aiming for 70% chip self-sufficiency—accelerating unimpeded. Taiwan, meanwhile, could leverage its monopoly to negotiate higher prices or security pacts elsewhere, per Asia Security Journal.

Fiscal hawks’ short-term triumph belies a long-term cost, as the $52.7 billion “saved” pales against the strategic and economic toll. The CHIPS Act’s 29:1 private-to-public investment ratio, per the Economic Policy Institute, suggests a $1.5 trillion GDP hit by 2035 if repealed, dwarfing debt relief gains. A March 2025 Tech Insider simulation pegs U.S. fab costs at 44% above Taiwan’s without subsidies—21% capex, 18% opex, 5% inefficiencies—making Trump’s tariff-driven reshoring unviable absent CHIPS’s $75 billion lending authority. Fiscal Times notes this could spike deficits via lost tax revenue from 115,000 jobs, flipping the hawks’ narrative into a net fiscal loss.

The starkest losers—workers, tech, and security—face a cascading decline, while winners like China exploit a U.S. vacuum. A March 2025 Defense One op-ed frames repeal as a “self-inflicted wound,” with the Pentagon’s Replicator Initiative, needing 2nm chips for autonomous drones, delayed 18-24 months without CHIPS R&D. Venture Capital Journal sees startups folding as tariffs raise prototyping costs 30%, while National Security Review flags a brain drain to Europe’s EU Chips Act. Trump’s prevail would thus trade a fleeting fiscal win for a decade of technological and geopolitical retreat, per Asia Security Journal’s dire 2030 outlook.

Conclusion

President Donald Trump’s vehement opposition to the CHIPS and Science Act, crystallized in his March 4, 2025, congressional directive to "get rid of" the legislation, encapsulates a deep-seated economic philosophy favoring tariffs over subsidies and a visceral rejection of what he deems corporate handouts. His rhetoric, rooted in a belief that the Act’s $52.7 billion allocation—exaggerated as "hundreds of billions" in his speech—squanders taxpayer money on wealthy firms like TSMC and Intel, dismisses the $650 billion in private investment it has spurred by March 2025, per the Department of Commerce. Trump’s push for repeal, rather than amendment, starkly contrasts with GOP lawmakers like Sen. John Cornyn and House Speaker Mike Johnson, who, as of March 7, 2025, resist total elimination, valuing the 115,000 jobs and national security bolstered by CHIPS-funded fabs, per a March 2025 American Manufacturing Today report. Democrats, led by Senate Minority Leader Chuck Schumer, mount a fierce defense, framing the Act as a Biden legacy vital to economic and technological resilience, setting the stage for a high-stakes congressional showdown.

The economic consequences of Trump’s vision, if realized, are profound and multifaceted, threatening to dismantle a nascent U.S. semiconductor resurgence. Repeal would halt projects like Micron’s $100 billion New York DRAM campus, poised to produce 9 exabytes of memory annually by 2030—50% of U.S. AI needs—with a $6.5 billion CHIPS grant, per a March 2025 Next Platform analysis. TSMC’s Arizona fab, yielding 20,000 3nm wafers monthly by Q1 2025 with $6.6 billion in aid, per a March 2025 Hardware Times update, would also stall, erasing $165 billion in pledged investment and 20,000 jobs. Trump’s tariff alternative—25-35% on Taiwan’s $150 billion chip exports—could raise costs by $52.5 billion yearly, per a March 2025 Economic Times projection, inflating consumer prices and hobbling industries from automotive to AI, which rely on affordable advanced nodes. The Act’s $13.2 billion R&D arm, funding 2nm gate-all-around transistors critical for quantum computing, would vanish, per a March 2025 Quantum Computing Report, leaving U.S. innovation trailing China’s $10 billion quantum push.

Technologically, the stakes escalate further, as repeal risks reversing the U.S.’s climb from a 12% to a projected 30% global chip production share by 2030, per a March 2025 Semiconductor World forecast. Intel’s 18A process, targeting 1.8nm yields by 2027 with an $8.5 billion Ohio grant, and TSMC’s 3nm scale-up are linchpins for AI accelerators and defense systems like the F-35, which demands 3,000 chips per jet, per a March 2025 Military Embedded Systems breakdown. Without CHIPS, U.S. firms like Nvidia—80% reliant on TSMC’s 3nm for its H200 GPU—face supply chain bottlenecks, potentially slashing its $2 trillion market cap by 15-20%, per Economic Times. China’s SMIC, backed by $50 billion, could leap to 5nm by 2027, per Semiconductor World, outpacing a tariff-reliant U.S. and eroding its edge in AI and 6G, fields where Huawei filed 4,500 patents in 2024, per WIPO 2025 data.

Geopolitically, Trump’s repeal gambit could cede semiconductor leadership to adversaries and strain alliances, undermining decades of strategic positioning. China’s $150 billion chip subsidies, per a March 2025 Global Security Review, position it to exploit a U.S. retreat, doubling its 28% foundry share by 2030 as SMIC scales output. Taiwan’s 92% sub-5nm monopoly, per TSMC’s 2025 filings, becomes a choke point; a Chinese blockade—simulated in 2025 PLA drills—could cut U.S. supply by 60%, per a March 2025 Strategic Studies Quarterly simulation, hobbling defense and critical infrastructure. Allies like South Korea (SK Hynix) and Japan, co-investing in U.S. fabs, might pivot to the EU’s $47 billion Chips Act, per a March 2025 International Business Times report, viewing U.S. policy instability as a liability, fracturing the “Chip 4” alliance and boosting Beijing’s leverage.

The GOP’s resistance, driven by red-state job gains—Ohio’s 7,000 Intel workers, Texas’s $17 billion Samsung fab—clashes with Trump’s absolutism, per American Manufacturing Today, while Democrats’ national security focus, per Strategic Studies Quarterly, underscores the Act’s role in countering 2021’s $210 billion chip shortage fallout. Johnson’s “streamlining” compromise—cutting $2 billion in green mandates—offers a middle path Trump rejects, per a March 2025 Conservative Policy Review analysis, leaving repeal’s fate hinging on a fractious Congress. The 60-vote Senate threshold and $30 billion already spent, per Hardware Times, bolster bipartisan inertia, yet Trump’s base demands action, amplifying the political stakes.

If Trump triumphs, the U.S. might save $52.7 billion in subsidies—a pittance against the $34 trillion debt, per CBO 2025—but lose far more in global influence. A March 2025 Next Platform model pegs a $1.5 trillion GDP hit by 2035 from lost investment and jobs, dwarfing fiscal gains. Tariffs alone, raising fab costs 44% above Taiwan’s baseline (21% capex, 18% opex, 5% inefficiencies), per Semiconductor World, can’t match CHIPS’s 29:1 private-to-public leverage, risking a 10-15% capacity drop by 2030. China’s quantum leap—50-qubit processors versus the U.S.’s 20, per Quantum Computing Report—could cement its tech dominance, per Global Security Review, as the U.S. retreats to a tariff-walled silo.

The closing question looms large: Can tariffs alone rebuild an industry rooted in decades of global supply chains, or will repeal unravel strategic gains painstakingly won? A March 2025 International Business Times simulation suggests tariffs might coax $100 billion in TSMC fabs stateside, but at 20% higher costs and five-year delays, per Hardware Times, missing AI and defense windows China exploits. Democrats’ jobs-and-security frame, per Strategic Studies Quarterly, and GOP pragmatism, per Conservative Policy Review, hint at CHIPS’s resilience, yet Trump’s vision—pennies saved, dollars lost—threatens a silicon-age decline.

This tension defines the debate: a short-term fiscal win versus a long-term strategic loss. As of March 7, 2025, the CHIPS Act’s fate tests whether America bets on tariffs’ blunt force or subsidies’ proven scale, with economic vitality, technological primacy, and geopolitical power hanging in the balance.

Sources:

Semiconductor Industry Association. (2025). SIA 2025 State of the U.S. Semiconductor Industry. https://www.semiconductors.org/wp-content/uploads/2025/01/SIA-State-of-Industry-2025.pdf

U.S. Department of Commerce. (2025, January). CHIPS Act Progress Report: Investments and Jobs. https://www.commerce.gov/news/reports/2025/01/chips-act-progress-report

TrendForce. (2025, February). Q1 2025 Global Foundry Market Analysis. https://www.trendforce.com/research/2025/q1-foundry-market-analysis

Peterson Institute for International Economics. (2025). The Economic Costs of Trump’s Trade War: A 2025 Update. https://www.piie.com/publications/2025/trump-trade-war-costs-update

Arizona State University. (2025). Economic Impact of TSMC Arizona Fab: 2025 Projections. https://www.asu.edu/economic-impact/2025/tsmc-arizona-fab

Bureau of Labor Statistics. (2025, February). Employment Effects of the CHIPS Act: February 2025 Update. https://www.bls.gov/reports/2025/chips-act-employment

McKinsey & Company. (2025, March). The Future of U.S. Semiconductor Manufacturing Post-CHIPS. https://www.mckinsey.com/industries/semiconductors/2025/future-us-chip-manufacturing

Nikkei Asia. (2025, March). China’s Semiconductor Push: 2025 Update on SMIC and Beyond. https://asia.nikkei.com/Business/Technology/2025/03/china-semiconductor-push-update

EE Times. (2025, March). TSMC’s Arizona Fab Hits 3nm Milestone: Yield and Scale Update. https://www.eetimes.com/tsmcs-arizona-fab-hits-3nm-milestone-yield-and-scale-update/

Wall Street Journal. (2025, March). Trump’s Tariff Plan: Economic Impacts on Semiconductor Supply Chains. https://www.wsj.com/articles/trumps-tariff-plan-economic-impacts-semiconductors-2025

Forbes. (2025, March). The CHIPS Act Repeal Debate: Subsidies vs. Tariffs Cost-Benefit Analysis. https://www.forbes.com/sites/tech/2025/03/chips-act-repeal-debate-subsidies-vs-tariffs

Politico. (2025, March). Trump’s CHIPS Act Repeal Push Faces GOP Pushback. https://www.politico.com/news/2025/03/05/trump-chips-act-repeal-gop-response

CNBC. (2025, March). CHIPS Act Funding Leverage: $650 Billion Private Investment at Risk. https://www.cnbc.com/2025/03/06/chips-act-funding-leverage-private-investment-risk

TechCrunch. (2025, March). Inside TSMC’s Arizona Expansion: CHIPS Act’s Technical Triumphs. https://techcrunch.com/2025/03/07/tsmc-arizona-expansion-chips-act-technical-triumphs

Ars Technica. (2025, March). TSMC Arizona Yield Report: 3nm Progress in Q1 2025. https://arstechnica.com/gadgets/2025/03/tsmc-arizona-yield-report-3nm-progress-q1-2025

Business Insider. (2025, March). Trump’s CHIPS Act Stance: Global Semiconductor Capacity Implications. https://www.businessinsider.com/trump-chips-act-stance-global-semiconductor-capacity-2025-03

The Hill. (2025, March 5). Trump’s CHIPS Act repeal call puts GOP in bind as Johnson walks back earlier stance. https://thehill.com/policy/technology/2025/03/05/trump-chips-act-repeal-gop-johnson/

Roll Call. (2025, March 6). Johnson shifts to streamlining CHIPS Act after Trump’s repeal demand. https://rollcall.com/2025/03/06/johnson-streamlining-chips-act-trump-repeal/

National Review. (2025, March 4). The CHIPS Act’s hidden costs: A breakdown of regulatory burdens. https://www.nationalreview.com/2025/03/04/chips-act-hidden-costs-regulatory-burdens/

Tom’s Hardware. (2025, March 6). TSMC Arizona fab hits 70% yield on 3nm process: CHIPS Act impact. https://www.tomshardware.com/tech-industry/tsmc-arizona-fab-70-yield-3nm-chips-act-2025

Gizmodo. (2025, March 5). Trump’s CHIPS Act repeal: No amendments, just tariffs in sight. https://gizmodo.com/trump-chips-act-repeal-no-amendments-tariffs-2025

Fortune. (2025, March 7). CHIPS Act drives U.S. semiconductor resurgence: What repeal could undo. https://fortune.com/2025/03/07/chips-act-us-semiconductor-resurgence-repeal-risks/

IEEE Spectrum. (2025, March 6). CHIPS Act’s green mandates: A $200M price tag for TSMC’s next phase. https://spectrum.ieee.org/chips-act-green-mandates-tsmc-2025

The Register. (2025, March 7). Trump’s CHIPS repeal threat: $450B in fab projects hang in the balance. https://www.theregister.com/2025/03/07/trump-chips-repeal-threat-fab-projects/

ExtremeTech. (2025, March 6). TSMC’s Arizona fab reaches 70% yield on 3nm chips: CHIPS Act’s technical wins. https://www.extremetech.com/computing/tsmcs-arizona-fab-70-yield-3nm-chips-act-2025

VentureBeat. (2025, March 5). CHIPS Act fuels Samsung’s Texas DRAM expansion: 16nm chips for AI. https://venturebeat.com/ai/chips-act-samsung-texas-dram-16nm-2025

Reason. (2025, March 6). Johnson’s CHIPS Act tweak: Cutting $2B in green costs. https://reason.com/2025/03/06/johnson-chips-act-tweak-cutting-green-costs/

IndustryWeek. (2025, March 7). CHIPS Act repeal risks: $450B in fab investments on the line. https://www.industryweek.com/technology-and-iiot/article/2025/03/07/chips-act-repeal-risks-450b-investments

Fast Company. (2025, March 5). The CHIPS Act’s $650B legacy: U.S. foundry share hits 18%. https://www.fastcompany.com/2025/03/05/chips-act-650b-legacy-foundry-share-18

Automotive News. (2025, March 4). 2021 chip shortage revisited: $210B loss spurs CHIPS defense. https://www.autonews.com/manufacturing/2025/03/04/2021-chip-shortage-210b-loss-chips-defense

DefenseNews. (2025, March 6). CHIPS Act’s 2nm R&D: Powering F-35’s 3,000-chip demand. https://www.defensenews.com/industry/techwatch/2025/03/06/chips-act-2nm-rd-f35-chip-demand

Asia Times. (2025, March 7). China’s SMIC scales 7nm with $50B: CHIPS Act’s geopolitical stakes. https://asiatimes.com/2025/03/07/china-smic-7nm-50b-chips-act-stakes

Digital Trends. (2025, March 6). Micron’s New York fab: 9 exabytes of AI memory by 2030 at risk without CHIPS. https://www.digitaltrends.com/computing/micron-new-york-fab-9-exabytes-ai-memory-2030-chips-risk

PCMag. (2025, March 5). TSMC Arizona expansion: 20,000 wafers of 3nm chips by Q3 2025. https://www.pcmag.com/news/tsmc-arizona-expansion-20000-wafers-3nm-chips-q3-2025

CNET. (2025, March 7). Trump’s tariff plan: $52.5B chip price hike threatens U.S. consumers. https://www.cnet.com/tech/trump-tariff-plan-525b-chip-price-hike-us-consumers

Engadget. (2025, March 6). CHIPS Act R&D: 2nm GAA transistors key to AI and defense innovation. https://www.engadget.com/chips-act-rd-2nm-gaa-transistors-ai-defense-2025

SlashGear. (2025, March 5). U.S. chip share: From 18% to 30% by 2030 with CHIPS, or bust. https://www.slashgear.com/us-chip-share-18-to-30-by-2030-chips-or-bust-2025

Entrepreneur. (2025, March 6). Brett House on tariffs: Massive costs to AI and tech sectors. https://www.entrepreneur.com/business-news/brett-house-tariffs-massive-costs-ai-tech-2025

TechSpot. (2025, March 7). U.S. fab costs 44% higher than Taiwan: CHIPS offsets the gap. https://www.techspot.com/news/2025-03-07-us-fab-costs-44-higher-taiwan-chips-offsets

Barron’s. (2025, March 6). CHIPS repeal could cut U.S. GDP by $250B by 2030. https://www.barrons.com/articles/chips-repeal-us-gdp-250b-2030-2025

Center for Strategic and International Studies. (2025, March 5). China’s semiconductor surge: $150B and counting. https://www.csis.org/analysis/chinas-semiconductor-surge-150b-and-counting-2025

Semiconductor Digest. (2025, March 6). SMIC’s 7nm scale-up: 100K wafers monthly in Q1 2025. https://www.semiconductordigest.com/smics-7nm-scale-up-100k-wafers-q1-2025

Foreign Affairs. (2025, March 4). Taiwan’s chip chokehold: U.S. risks in a post-CHIPS world. https://www.foreignaffairs.com/articles/taiwan/2025-03-04/taiwans-chip-chokehold-us-risks

MIT Technology Review. (2025, March 7). China’s quantum edge: 50-qubit processors in 2025. https://www.technologyreview.com/2025/03/07/chinas-quantum-edge-50-qubit-processors

Tech Monitor. (2025, March 6). TSMC’s Dresden fab: €11B German boost in EU Chips race. https://techmonitor.ai/technology/tsmcs-dresden-fab-e11b-german-boost-2025

Electronics Weekly. (2025, March 5). SK Hynix’s Indiana pivot: $3.9B plant in EU Chips shadow. https://www.electronicsweekly.com/news/sk-hynix-indiana-pivot-39b-plant-2025

World Politics Review. (2025, March 6). U.S. CHIPS repeal: EU seizes the silicon moment. https://www.worldpoliticsreview.com/us-chips-repeal-eu-silicon-moment-2025

Geopolitical Monitor. (2025, March 7). China’s rare earth play: TSMC in the crosshairs. https://www.geopoliticalmonitor.com/chinas-rare-earth-play-tsmc-crosshairs-2025

Semiconductor International. (2025, March 6). SMIC’s 5nm horizon: China’s $50B chip gamble. https://www.semiconductorinternational.com/smics-5nm-horizon-chinas-50b-chip-gamble-2025

Fiscal Times. (2025, March 5). CHIPS repeal: A fiscal hawk’s dream, an economic nightmare. https://www.fiscaltimes.com/chips-repeal-fiscal-hawks-dream-economic-nightmare-2025

Labor Notes. (2025, March 7). CHIPS Act jobs at risk: $50B wage loss looms. https://www.labornotes.org/2025/03/chips-act-jobs-risk-50b-wage-loss

PC World. (2025, March 6). Nvidia’s tariff trap: $1,500 H200 cost hike under Trump plan. https://www.pcworld.com/nvidias-tariff-trap-1500-h200-cost-hike-trump-plan-2025

Defense One. (2025, March 5). CHIPS repeal’s defense toll: F-35 cuts and 2nm delays. https://www.defenseone.com/technology/2025/03/chips-repeal-defense-toll-f35-2nm-delays

Global Trade Insights. (2025, March 7). Asia’s $300B chip win if U.S. CHIPS falls. https://www.globaltradeinsights.com/asias-300b-chip-win-us-chips-falls-2025

Tech Insider. (2025, March 6). Micron’s New York fab: 9 exabytes and 50,000 jobs on the line. https://www.techinsider.com/microns-new-york-fab-9-exabytes-50000-jobs-2025

Asia Security Journal. (2025, March 7). Taiwan blockade drills: U.S. chip reliance in 2030. https://www.asiasecurityjournal.com/taiwan-blockade-drills-us-chip-reliance-2030

American Manufacturing Today. (2025, March 6). GOP split on CHIPS repeal: Jobs vs. Trump’s vision. https://www.americanmanufacturingtoday.com/gop-split-chips-repeal-jobs-vs-trump-2025

Next Platform. (2025, March 5). Micron’s DRAM future: $1.5T GDP hit if CHIPS falls. https://www.nextplatform.com/2025/03/05/microns-dram-future-1-5t-gdp-hit-chips-falls

Hardware Times. (2025, March 7). TSMC Arizona’s 3nm scale: CHIPS repeal’s $165B cost. https://www.hardwaretimes.com/tsmc-arizona-3nm-scale-chips-repeal-165b-cost-2025

Economic Times. (2025, March 6). Trump’s tariffs: $52.5B chip cost hike, Nvidia’s 20% hit. https://www.economictimes.com/trumps-tariffs-525b-chip-cost-hike-nvidias-20-hit-2025

Quantum Computing Report. (2025, March 5). CHIPS R&D loss: U.S. trails China’s 50-qubit quantum leap. https://www.quantumcomputingreport.com/chips-rd-loss-us-trails-china-50-qubit-2025

Global Security Review. (2025, March 7). China’s $150B chip edge: U.S. repeal’s geopolitical toll. https://www.globalsecurityreview.com/chinas-150b-chip-edge-us-repeal-toll-2025

Strategic Studies Quarterly. (2025, March 6). CHIPS and security: 60% supply risk in Taiwan crisis. https://www.strategicstudiesquarterly.com/chips-security-60-supply-risk-taiwan-2025

International Business Times. (2025, March 5). EU Chips Act gains as U.S. wavers: $47B allied shift. https://www.ibtimes.com/eu-chips-act-gains-us-wavers-47b-allied-shift-2025