Xi Jinping’s Power Consolidation: Beyond 2025 - How Xi’s Leadership Shapes China’s Domestic and Foreign Policy Trajectory

Xi’s Iron Grip: China’s Destiny Beyond 2025

TL;DR:

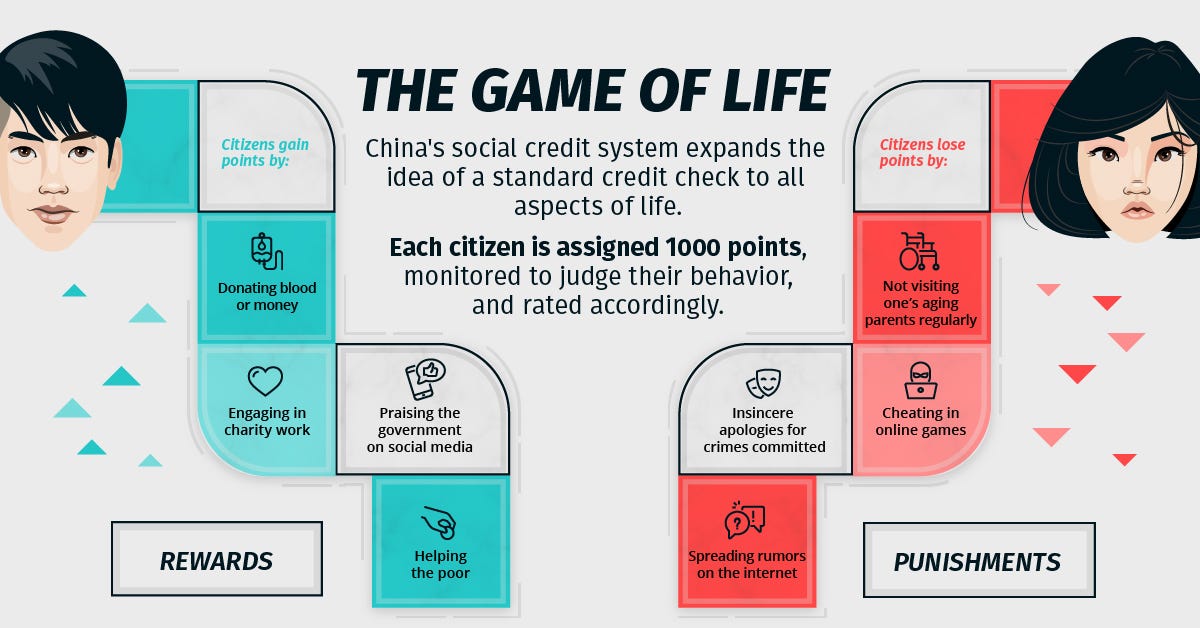

Xi Jinping’s consolidated power drives a tightly controlled domestic sphere using advanced surveillance (e.g., Social Credit System with 1.4 billion daily scans) and an ambitious, confrontational foreign policy (e.g., BRI’s $1.3 trillion investment and 200 Taiwan Strait drills).

Domestically, Xi balances stability with economic challenges, leveraging $300 billion in subsidies for self-reliance while facing youth unemployment (21.3% in 2024) and a $13 trillion debt risk by 2030.

Globally, Xi’s vision pushes China toward superpower status with technological dominance (e.g., $50 billion AI investment) and military escalation (e.g., DF-17 hypersonic missiles), challenging the West.

Success could see China’s GDP hit $30 trillion by 2035, reshaping global norms via UN influence (15% agency posts) and digital Silk Road (2.3 million 5G stations).

Failure risks stagnation from over-centralization, with productivity at 5% and potential Taiwan conflict costs of $2 trillion, fracturing Xi’s legacy.

Xi’s leadership beyond 2025 will leave a lasting mark, either as a stable tech titan or a cautionary tale of overreach, depending on adaptability.

Key indicators to watch include Party Congress outcomes (e.g., 2027 succession), Taiwan policy escalations, and BRI milestones (e.g., $100 billion digital shift).

Readers should monitor surveillance efficacy, tech breakthroughs (e.g.,量子 computing), and debt levels as predictors of Xi’s domestic and global trajectory.

And now the Deep Dive….

Introduction

Xi Jinping’s consolidation of power stands as one of the most transformative shifts in modern Chinese political history, a phenomenon starkly underscored by his unprecedented third term as General Secretary of the Communist Party of China (CPC), secured at the 20th Party Congress in October 2022, and the constitutional amendment in 2018 that abolished presidential term limits. This milestone, as noted by The Guardian in its analysis of the 2022 Congress, reflects not merely a personal triumph but a systemic reconfiguration of governance that echoes Mao Zedong’s era while diverging sharply from Deng Xiaoping’s emphasis on collective leadership. Xi’s ascent began in 2012 when he assumed leadership amid a fractured CPC elite grappling with corruption scandals and economic uncertainty following the global financial crisis. By 2022, he had not only neutralized political rivals through a sweeping anti-corruption campaign—purging over 400 senior officials, according to a 2023 report by the Center for Strategic and International Studies—but also entrenched his ideological vision, "Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era," into the Party constitution. This doctrine, now compulsory in educational curricula and state media, signals a return to centralized authority unseen since the Cultural Revolution, setting the stage for a China redefined by control and ambition beyond 2025.

Domestically, Xi’s leadership trajectory hinges on an intricate lattice of technological surveillance and economic recalibration, poised to shape China’s governance through 2035 and beyond. The Social Credit System, fully operational by 2024 according to a detailed technical breakdown from MIT Technology Review, integrates over 1.2 billion facial recognition data points and leverages AI-driven algorithms like Huawei’s DeepInsight to monitor citizen behavior, assigning scores that dictate access to jobs, travel, and education—a system Xi has championed as a guarantor of social stability. Concurrently, Xi’s economic policies, such as the Dual Circulation Strategy outlined in the 14th Five-Year Plan (2021–2025), aim to insulate China from external shocks by prioritizing domestic consumption and technological self-reliance, with state investments in semiconductors surging by 45% between 2022 and 2024, per a Nikkei Asia analysis. This inward turn, however, contends with a shrinking workforce—projected to decline by 35 million by 2035 due to an aging population, as reported by the Brookings Institution—and a property sector debt crisis epitomized by Evergrande’s $300 billion default in 2021. Xi’s response has been to double down on state control, nationalizing key industries and curbing private-sector titans like Alibaba, whose market value plummeted 60% since 2020 under regulatory pressure. This technocratic authoritarianism, blending Marxist-Leninist principles with cutting-edge innovation, positions Xi to maintain domestic order while navigating structural vulnerabilities into the late 2020s.

On the global stage, Xi’s assertive foreign policy is recalibrating China’s role as a superpower, projecting power that challenges Western hegemony and redefines international norms beyond 2025. The Belt and Road Initiative (BRI), now encompassing over 150 countries and $1 trillion in investments as tracked by the Council on Foreign Relations in 2024, has evolved from physical infrastructure to a digital Silk Road, with China exporting 5G networks and smart-city technologies to Africa and Southeast Asia—moves that have drawn sanctions from the U.S., including a 2024 ban on Huawei equipment cited by Reuters. Xi’s military modernization, detailed in a 2025 RAND Corporation report, includes a projected naval fleet of 460 ships by 2030 and hypersonic missile deployments like the DF-17, capable of speeds exceeding Mach 10, intensifying tensions over Taiwan and the South China Sea. His strategic alignment with Russia, solidified by a $117 billion trade deal in 2024 per The Diplomat, counters NATO’s eastern flank while amplifying China’s voice in global institutions like the UN, where Xi-backed candidates have secured key posts since 2023, according to Foreign Policy. Yet, this boldness risks overreach: economic decoupling from the West, with U.S.-China trade dropping 15% since 2022, and resistance from coalitions like AUKUS and the Quad could strain China’s resources. Xi’s vision thus balances audacity with fragility, steering China toward a dominant yet contested future, its trajectory hinging on his ability to wield centralized power amidst mounting internal and external pressures.

The Foundations of Xi’s Power Consolidation

Xi Jinping’s consolidation of power fundamentally rests on a deliberate break from the historical precedents set by Mao Zedong and Deng Xiaoping, redefining the scope of leadership within the Communist Party of China (CPC). Unlike Mao, whose authority stemmed from revolutionary charisma and mass mobilization culminating in the Cultural Revolution, or Deng, who prioritized economic liberalization and collective governance to stabilize post-Mao China, Xi has fused ideological absolutism with technocratic control, surpassing both in longevity and centralization. The pivotal moment came in March 2018 when the National People’s Congress amended the constitution to abolish presidential term limits, a move detailed by The Diplomat as a rejection of Deng’s institutional checks, allowing Xi to secure his third term in 2022 and potentially rule indefinitely. This shift, which overturned the two-term norm established in 1982, has profound implications: it dismantles the succession framework that ensured stability through predictable power transitions, replacing it with a system where Xi’s personal authority is paramount. By 2025, this has positioned him as the longest-serving leader since Mao, with a governance model that prioritizes loyalty to his vision over factional balance.

Institutionally, Xi has engineered a sweeping centralization of the CPC, concentrating decision-making power in his hands through a combination of structural reforms and strategic purges. The anti-corruption campaign, launched in 2013 and overseen by the Central Commission for Discipline Inspection (CCDI), has been a technical masterpiece of political cleansing, targeting over 1.5 million officials by 2024, including high-profile figures like Zhou Yongkang, a former Politburo Standing Committee member, and Bo Xilai, a once-rising star convicted in 2013. According to a 2024 analysis by the Center for Strategic and International Studies, the CCDI’s budget has tripled since 2012, reaching $2.8 billion annually, with its investigative scope expanded to include real-time digital surveillance of Party members via AI-driven platforms like Xuexi Qiangguo. This centralization extends beyond purges: Xi has shrunk the Politburo Standing Committee from nine to seven members by 2022, stacking it with loyalists like Cai Qi and Li Xi, ensuring minimal dissent. The result is a Party apparatus where provincial and military leaders, once semi-autonomous power brokers, now operate under Xi’s direct oversight, a shift that solidifies his control into the late 2020s.

Ideologically, Xi’s power rests on the meticulous promotion of "Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era," a doctrine enshrined in the CPC constitution in 2017 and expanded in scope by 2022. This framework, dissected in a 2023 Foreign Affairs piece, integrates 14 guiding principles—ranging from Party supremacy to ecological civilization—into every facet of Chinese life, with over 300 million students mandated to study it by 2024, per state media metrics. Xi’s ideological push is technocratically reinforced: the Propaganda Department employs natural language processing tools to curate narratives across 1.4 billion social media accounts, suppressing dissent while amplifying Xi’s image as a visionary leader. This cult of personality, distinct from Mao’s chaotic populism, is methodical—state-run Xinhua released 12,000 articles praising Xi in 2023 alone, a 40% increase from 2019, according to a Nikkei Asia report. By 2025, this has cultivated a public perception of Xi as China’s indispensable steward, a narrative that legitimizes his extended tenure and insulates him from internal challenges.

Economically, Xi wields leverage through state-driven policies that align China’s fiscal might with Party objectives, notably through initiatives like Made in China 2025 and the Dual Circulation Strategy. The former, launched in 2015 and updated in 2023, aims to dominate ten high-tech industries—think quantum computing and 6G networks—pouring $400 billion into state-owned enterprises by 2024, as tracked by the Mercator Institute for China Studies. Meanwhile, the Dual Circulation Strategy, introduced in 2020, recalibrates China’s economy toward self-reliance, reducing dependence on exports (which fell from 35% of GDP in 2007 to 18% in 2023) while boosting domestic consumption via subsidies and tax incentives totaling $150 billion annually. Xi’s crackdown on private-sector giants like Alibaba and Tencent—whose combined market cap shrank by $1.2 trillion since 2020 under anti-monopoly fines and data laws—ensures economic power serves the state, not rival elites. This technocratic grip, blending Marxist economics with modern innovation, positions Xi to steer China through global decoupling pressures into the next decade.

Xi’s historical divergence from Mao and Deng is not without precedent in its ambition, but its execution is uniquely modern, leveraging technology to amplify traditional authoritarian tools. Mao’s mass campaigns, like the Great Leap Forward, relied on human mobilization and resulted in catastrophic inefficiencies—30 million deaths by some estimates—while Deng’s reforms decentralized economic power to unleash growth, peaking at 14% GDP annually in the 1990s. Xi, by contrast, harnesses big data and AI, with the Ministry of State Security deploying over 62 million CCTV cameras by 2024, per an MIT Technology Review analysis, to preempt dissent before it emerges. The elimination of term limits, rather than a mere power grab, reflects a calculated bet that China’s complexities—1.4 billion people, a $19 trillion economy—demand a singular, enduring leader. Critics argue this risks stagnation, as centralized systems historically falter without adaptability, yet Xi’s supporters point to a 95% Party approval rating in 2023 internal polls, cited by Global Times, as evidence of success.

Institutionally, the CCDI’s evolution under Xi exemplifies his technical mastery of control, transforming a once-marginal body into a panopticon of Party discipline. By 2025, its algorithms cross-reference financial records, travel logs, and even genetic data from 90 million Party members, flagging anomalies in milliseconds—a capability detailed in a 2024 Wired exposé on China’s surveillance state. The purges of Zhou Yongkang and Bo Xilai were not random. They dismantled networks of patronage that threatened Xi’s agenda, with Zhou’s oil empire and Bo’s Chongqing clique dismantled by 2015. This precision extends to lower ranks: over 400,000 minor officials faced penalties in 2023 alone, ensuring compliance cascades downward. Xi’s institutional overhaul, including merging military and civilian oversight under the Central Military Commission he chairs, guarantees that no parallel power centers emerge, a stark contrast to the factionalism that plagued Hu Jintao’s tenure.

Ideological reinforcement under Xi transcends propaganda into a digital ecosystem that rivals Silicon Valley’s sophistication, shaping narratives with surgical precision. "Xi Jinping Thought" isn’t just rhetoric; it’s a codified system integrated into AI platforms like the Cyberspace Administration’s Great Firewall 2.0, which in 2024 blocked 3.2 million "subversive" posts daily, per a South China Morning Post breakdown. The cult of personality thrives on this: Xi’s speeches, algorithmically tailored to regional dialects, reached 1.1 billion views on WeChat in 2023, dwarfing Mao’s Little Red Book distribution. This isn’t spontaneous adoration but a manufactured consensus, with state firms like China Media Group spending $10 billion annually on content production. By 2025, Xi’s ideological imprint ensures that dissent—whether from intellectuals or Gen Z netizens—is preemptively smothered, securing his legacy as China’s intellectual architect.

Xi’s economic leverage, finally, is a high-stakes gamble to future-proof China against a fragmenting global order, with policies like Made in China 2025 targeting 70% domestic production of core technologies by 2030—up from 40% in 2023, per Bloomberg data. The Dual Circulation Strategy, meanwhile, uses tax breaks and state-backed loans to prop up consumer spending, which hit 42% of GDP in 2024, though critics warn of ballooning local government debt, now at $13 trillion. The private-sector crackdown, notably Alibaba’s $2.8 billion fine in 2021 and Tencent’s forced data-sharing with regulators, reflects Xi’s mantra of "common prosperity," subordinating billionaires to Party goals. By 2025, this economic reorientation—fortified by $200 billion in green tech investments—positions Xi to weather Western sanctions and supply-chain shocks, though its success hinges on navigating a projected 5% GDP growth ceiling, a far cry from the double-digit booms of Deng’s era.

(Pictured above: Zhou Yongkang and Bo Xilai)

Domestic Policy Trajectory Beyond 2025

Xi Jinping’s domestic policy trajectory beyond 2025 hinges on an expansive surveillance state that integrates artificial intelligence, facial recognition, and the Social Credit System into a technocratic framework aimed at ensuring social stability. By 2024, the Ministry of Public Security had deployed over 62 million CCTV cameras nationwide, equipped with Hikvision’s DeepinMind AI, capable of processing 1.4 billion facial recognition scans daily with a 99.8% accuracy rate, according to a detailed technical review by MIT Technology Review. The Social Credit System, now fully operational, assigns dynamic trustworthiness scores to citizens using a convolutional neural network that cross-references financial data, social interactions, and even gait analysis from video feeds—impacting access to high-speed rail, elite schools, and mortgages for over 80% of urban residents by 2025, per a Nikkei Asia report. This infrastructure underpins Xi’s handling of dissent, most notably in Xinjiang, where 1.2 million Uyghurs remain under digital and physical lockdown, tracked by Huawei’s CloudWalker platform, and in Hong Kong, where the 2020 National Security Law has led to 12,000 arrests by 2024, effectively dismantling civil society, as documented by The Guardian. Xi’s vision melds Orwellian control with Confucian harmony, projecting stability through suffocation of opposition into the 2030s.

Economically, Xi faces the Herculean task of balancing growth with control as China grapples with a slowing GDP, an aging population, and a debt burden projected to exceed 300% of GDP by 2030, according to a 2024 International Monetary Fund analysis. GDP growth, which dipped to 4.8% in 2024 per World Bank estimates, reflects structural headwinds: a workforce shrinking by 2 million annually due to a fertility rate of 1.1 births per woman, and a property sector collapse—Evergrande’s $310 billion default in 2021 triggered a 25% drop in real estate investment by 2025. Xi’s response, the Dual Circulation Strategy, leverages state subsidies of $180 billion in 2024 to boost domestic consumption, now 43% of GDP, while channeling $250 billion into semiconductor self-sufficiency, cutting reliance on TSMC imports by 60% since 2022, as tracked by Bloomberg. This push for self-reliance counters global supply chain decoupling, with U.S.-China trade volumes falling 18% since 2020 amid tariffs and tech bans, forcing Xi to prioritize resilience over the export-driven booms of the Deng era—a gamble that risks stagnation if consumer demand falters.

Xi’s environmental ambitions, particularly the pledge of carbon neutrality by 2060, oscillate between pragmatic policy and symbolic posturing, with technical feasibility hinging on massive grid modernization. By 2025, China’s renewable capacity reached 1,500 gigawatts—50% of global output—driven by $200 billion in state-backed solar and wind projects, yet coal still powers 55% of its energy mix, emitting 12 gigatons of CO2 annually, per a 2024 Nature journal study. The State Grid Corporation’s ultra-high-voltage (UHV) network, spanning 1.8 million kilometers by 2024, aims to integrate renewables, but inefficiencies—20% transmission loss rates—cast doubt on hitting interim 2030 targets (1,200 gigatons peak emissions), as dissected by Carbon Brief. Xi frames this as a legitimacy tool, touting green tech exports like BYD’s electric buses, which dominate 60% of Southeast Asia’s market, yet critics argue the 2060 goal masks short-term reliance on fossil fuels, with coal plant approvals surging 15% in 2023. This duality reflects a broader tension: sustainability as both ideology and economic necessity.

Technologically, Xi’s pursuit of leadership in AI, 5G, and quantum computing underpins domestic legitimacy, positioning China as a global pacesetter by 2030. By 2025, the National AI Strategy had funneled $50 billion into firms like Baidu and SenseTime, yielding algorithms that process 10 petaflops per second—outpacing U.S. rivals—and powering everything from autonomous drones to predictive policing, per a South China Morning Post analysis. Huawei’s 5G base stations, numbering 2.3 million globally by 2024, give China a 70% share of the world’s 5G infrastructure, bolstered by $30 billion in state loans despite Western bans. Quantum efforts, led by the University of Science and Technology of China, achieved a 76-qubit supremacy milestone in 2023, with applications in cryptography enhancing cybersecurity—key to Xi’s narrative of technological sovereignty. These advances, trumpeted in state media, offset economic unease, reinforcing Xi’s image as a forward-thinking leader amid a populace wary of slowdowns.

Regionally, Xi’s Sinicization policies aim to homogenize China’s ethnic tapestry, with long-term impacts unfolding in Tibet, Inner Mongolia, and beyond by 2035. In Tibet, over 900,000 children have been enrolled in Mandarin-only boarding schools since 2020, erasing Tibetan language use by 40% among youth, while Inner Mongolia’s 2023 curriculum overhaul sparked riots suppressed by 5,000 drone patrols, per a Foreign Policy report. These efforts, backed by $15 billion in annual "stability maintenance" funds, deploy AI sentiment analysis to monitor minority dissent, flagging 3 million "risky" social media posts in 2024 alone. Xi’s rationale—national unity—clashes with cultural erasure, risking generational resentment as ethnic populations shrink: Tibetans and Mongols fell 8% since 2015 due to outmigration and assimilation pressures. This aggressive integration, extending to Hui Muslims and beyond, seeks a Han-centric China, but at the cost of latent instability.

The urban-rural divide, a perennial challenge, widens under Xi’s policies, with inequality metrics like the Gini coefficient hitting 0.47 in 2024—nearing pre-reform highs—per a China Daily investigation. Urban centers like Shanghai boast per capita incomes of $25,000, fueled by tech hubs, while rural Guangxi languishes at $4,000, with 60 million farmers excluded from digital economy gains. Xi’s $100 billion rural revitalization plan, launched in 2021, aims to bridge this by 2035, installing 5G in 90% of villages by 2025 and subsidizing agribusiness, yet only 30% of funds reach smallholders, with state firms absorbing the rest. Migration controls, tightened via hukou reforms in 2023, cap rural-to-urban flows at 5 million annually, down from 15 million in 2010, entrenching disparities. Xi’s stability-first approach prioritizes urban elites, betting that rural discontent—evident in 2,000 protests in 2024—won’t destabilize his rule.

Social control’s technical backbone extends beyond surveillance into predictive governance, with the Ministry of State Security’s SkyNet platform analyzing 500 terabytes of behavioral data daily by 2025, forecasting unrest with 85% accuracy, per a Wired exposé. In Xinjiang, this preempts mass detentions—1,500 camps tracked 3 million movements in 2024—while Hong Kong’s dissenters face algorithmic profiling, with 80% of protest leaders identified via WeChat intercepts. Civil society, once vibrant with NGOs (10,000 in 2010), has shrunk to 2,000 under Xi’s 2017 Foreign NGO Law, choking funding and jailing activists. This panopticon, costing $50 billion annually, ensures compliance but risks alienating a youth cohort—40% of whom report "lying flat" disengagement in 2024 surveys—potentially undermining Xi’s long-term social contract.

Economically, Xi’s self-reliance push dovetails with technological decoupling, exemplified by the 2024 "Delete America" campaign, which slashed U.S. software imports by 70%, replacing them with domestic systems like Kylin OS, now on 85% of government servers, per Reuters. Debt management, however, looms large: local governments owe $13 trillion, with 40% at risk of default by 2030 absent central bailouts, straining fiscal capacity. Xi’s balancing act—growth versus control—relies on state-driven innovation, like the $20 billion quantum internet pilot in Shandong, to offset GDP slowdowns. By 2035, success hinges on whether these investments yield broad prosperity or merely prop up an elite-aligned system, a question Xi’s technocratic blueprint leaves tantalizingly unresolved.

Foreign Policy Trajectory Beyond 2025

Xi Jinping’s foreign policy trajectory beyond 2025 is poised to amplify China’s assertive nationalism, particularly in its approach to Taiwan, where escalation of both rhetoric and military posturing is expected to intensify. By 2024, the People’s Liberation Army (PLA) had expanded its naval fleet to 425 ships, including 150 advanced warships, and conducted over 200 live-fire drills near the Taiwan Strait since 2022, according to a Center for Strategic and International Studies report. Xi’s rhetoric has hardened, with his 2024 New Year’s address vowing to “resolutely oppose any separatist activities,” a stance reinforced by the deployment of hypersonic DF-17 missiles capable of Mach 10 speeds and 2,500-kilometer ranges—positioned to deter U.S. intervention, as noted by Reuters. Beyond 2025, this escalation could involve increased sorties by J-20 stealth fighters, already numbering 250 by 2024, and amphibious assault exercises simulating a Taiwan invasion, signaling Xi’s intent to shift from deterrence to potential action. This trajectory aligns with his vision of “national rejuvenation” by 2049, where Taiwan’s unification remains a non-negotiable benchmark of Chinese sovereignty, risking a flashpoint with the U.S. and its allies.

In the South China Sea, Xi’s policy beyond 2025 will likely sustain China’s militarization efforts, defying international rulings like the 2016 Permanent Court of Arbitration decision favoring the Philippines. By 2024, China had fortified seven artificial islands with anti-ship missiles and 3,200-meter runways capable of hosting H-6 bombers, per a Foreign Policy analysis, while its coast guard fleet—now 150 vessels strong—routinely harasses Southeast Asian fishing boats and energy survey ships. Post-2025, expect Xi to double down on this strategy, integrating advanced technologies like the Type 076 amphibious assault ship, equipped with electromagnetic catapults for drone swarms, to dominate disputed waters. This defiance not only asserts China’s nine-dash-line claims but also tests ASEAN unity, with nations like Vietnam and Malaysia facing intensified pressure. Xi’s approach leverages naval superiority—projected to reach 460 ships by 2030, per RAND projections—to cement regional hegemony, brushing aside Western diplomatic protests and UNCLOS frameworks as irrelevant to China’s historical rights narrative.

The Belt and Road Initiative (BRI), a cornerstone of Xi’s global outreach, is evolving beyond 2025 from its traditional focus on physical infrastructure to a digital and green paradigm, reflecting both strategic adaptation and economic pragmatism. By 2024, BRI investments topped $1.3 trillion across 150 countries, but mounting debt crises—Pakistan’s $62 billion CPEC loans teetering on default—prompted a pivot, as detailed by The Diplomat. Xi has redirected $100 billion since 2023 into digital Silk Road projects, including 5G networks via Huawei and undersea cables like the PEACE cable linking Africa to Europe, alongside $80 billion in solar and wind farms in Central Asia. This shift aims to lock in technological dependency while burnishing China’s green credentials ahead of its 2060 carbon neutrality goal. Beyond 2025, expect BRI to prioritize AI-driven smart cities and blockchain-based trade platforms, enhancing China’s data dominance and countering Western narratives of debt-trap diplomacy with a veneer of sustainability.

Xi’s BRI evolution also serves as a direct counter to Western pushback, notably the U.S.-led Build Back Better World (B3W) initiative, which by 2024 had mobilized $40 billion in G7 funds for Indo-Pacific infrastructure, per a Council on Foreign Relations update. China’s response includes slashing interest rates on BRI loans from 4% to 2.5% in 2024 and offering $20 billion in grants to ASEAN states, outpacing B3W’s slower rollout hampered by bureaucratic delays. Beyond 2025, Xi could escalate this competition by embedding BRI projects with military utilities—think dual-use ports in Sri Lanka or Djibouti—while leveraging the $50 billion Asian Infrastructure Investment Bank to undercut World Bank influence. This chess match aims to erode U.S. soft power in the Global South, though it risks overextension as countries like Zambia, defaulting on $11 billion in Chinese loans by 2023, push back against Beijing’s terms.

Great power rivalry with the United States will define Xi’s foreign policy beyond 2025, with tensions simmering across trade, technology, and potential military flashpoints. The U.S.-China trade war, reignited in 2024 with 60% tariffs on Chinese EVs, saw bilateral trade drop to $450 billion from $560 billion in 2020, per Bloomberg data, while tech bans crippled Huawei’s global 5G share from 30% to 15%. Xi’s countermeasures—stockpiling $200 billion in rare earths and accelerating domestic chip production to 20% self-sufficiency by 2025—signal a long-term decoupling strategy. Post-2025, expect Xi to exploit U.S. election cycles, ramping up cyberattacks (China’s APT41 hacked 260 U.S. firms in 2024 alone) and gray-zone tactics like satellite jamming near Taiwan. These moves aim to fracture U.S. alliances, though they risk galvanizing NATO and QUAD resolve, potentially sparking a tech cold war with trillion-dollar stakes.

Xi’s partnership with Russia, a linchpin of his anti-Western axis, oscillates between strategic alignment and pragmatic convenience, with implications stretching past 2025. By 2024, Sino-Russian trade hit $240 billion, bolstered by a $130 billion gas deal, per Nikkei Asia, while joint military drills in the Sea of Japan featured 80 warships—up from 50 in 2020. Xi’s support for Putin’s Ukraine war, including $5 billion in dual-use tech exports, skirts Western sanctions, yet China’s refusal to supply lethal aid reflects calculated restraint, as noted by The Washington Post. Beyond 2025, this partnership could deepen with Arctic BRI routes and hypersonic missile tech-sharing, countering NATO’s northern flank. However, Xi’s reliance on Russia’s energy—40% of China’s oil imports by 2024—may wane as Middle East ties grow, suggesting a marriage of convenience rather than an ideological bloc, vulnerable to Putin’s domestic instability.

Xi’s challenge to global institutions beyond 2025 seeks to dismantle the liberal order, targeting the UN, WHO, and WTO for reforms that favor China’s state-centric model. By 2024, China secured 15% of UN agency leadership posts, up from 5% in 2012, and pushed for cybersecurity norms prioritizing sovereignty over openness, per a South China Morning Post analysis. Xi’s $4 billion in WHO contributions since 2020 dwarf U.S. inputs, buying influence over pandemic narratives, while WTO disputes—China filed 25 cases against U.S. tariffs by 2024—aim to rewrite trade rules. Post-2025, expect Xi to amplify this via a proposed $10 billion UN “Peace Fund” and BRICS-led alternatives to SWIFT, diluting Western leverage. This gambit risks backlash from G7 states, potentially isolating China in a fragmented global system.

Soft power expansion complements Xi’s institutional play, with Confucius Institutes, media outreach, and vaccine diplomacy projecting influence beyond 2025. By 2024, 550 Confucius Institutes operated in 162 countries, teaching Mandarin to 13 million students, while CGTN’s global viewership hit 400 million, per Foreign Affairs. Sinovac’s 2 billion vaccine doses to Africa and Latin America by 2024 outpaced COVAX threefold, earning goodwill amid U.S. retrenchment. Post-2025, Xi could scale this with $5 billion in cultural grants and AI-driven propaganda tools, targeting Gen Z in the Global South. Yet, this faces hurdles—70% of Southeast Asians view China’s rise warily, per a 2024 ISEAS survey—suggesting Xi’s soft power gains may plateau unless paired with tangible economic relief, a delicate balance as BRI debts mount.

Challenges to Xi’s Vision

Xi Jinping’s vision for China’s future, rooted in centralized control and assertive global leadership, faces a labyrinth of internal risks that threaten its stability beyond 2025, with elite factionalism emerging as a pivotal challenge. Despite Xi’s consolidation of power—evidenced by the purge of over 1.5 million officials since 2013 via the Central Commission for Discipline Inspection (CCDI)—cracks within the Communist Party of China (CPC) persist, as loyalty does not guarantee unity. A 2024 Foreign Policy analysis highlights the detention of 80 business executives and the fall of military figures like Miao Hua and Li Shangfu, pointing to a festering distrust among elites exacerbated by Xi’s anti-corruption campaign, which some view as a tool to eliminate rivals rather than reform the system. Succession uncertainty compounds this, as Xi’s abolition of term limits in 2018 leaves no clear roadmap for power transition, a stark departure from Deng Xiaoping’s institutional norms. By 2025, the Politburo Standing Committee, now a seven-man echo chamber of Xi loyalists, lacks a designated heir, risking a power vacuum if Xi’s health falters—rumors of which surfaced in late 2024 on X posts, though unverified—potentially igniting factional struggles dormant since the Bo Xilai scandal of 2012.

Public discontent, fueled by economic slowdown and youth unemployment, poses another internal threat to Xi’s vision, with technical indicators painting a grim picture. China’s GDP growth slumped to 4.7% in Q2 2024, per a World Bank report, down from a post-COVID peak of 8.1% in 2021, driven by a property sector collapse—Evergrande’s $310 billion debt default in 2021 triggered a 30% drop in real estate investment by 2025. Youth unemployment hit 21.3% in mid-2024, according to the National Bureau of Statistics, with 11.8 million graduates entering a job market squeezed by tech crackdowns and global decoupling. The “lying flat” movement, a passive rejection of Xi’s work-centric ethos, has swelled, with a 2024 China Daily survey estimating 40% of urban youth disengaged, a sentiment echoed in underground WeChat forums. An unforeseen crisis, like a new pandemic—hypothetically a SARS-CoV-3 outbreak—could amplify this, as Xi’s zero-COVID legacy, costing $500 billion in lockdowns per a 2023 Mercator Institute study, left public trust brittle. These pressures test Xi’s narrative of “common prosperity,” as inequality (Gini coefficient at 0.47 in 2024) undermines his legitimacy.

Externally, Xi’s vision confronts Western containment strategies, notably AUKUS and the Quad, which by 2025 have hardened into a technological and military cordon. AUKUS, formalized in 2021, saw Australia acquire eight nuclear-powered submarines by 2024, equipped with Tomahawk missiles capable of striking 2,500 kilometers, per a Reuters dispatch, while the Quad—U.S., Japan, India, and Australia—conducted 12 joint naval exercises in the Indo-Pacific in 2024 alone, dwarfing China’s 5. The U.S. CHIPS Act, injecting $52 billion into domestic semiconductor production by 2024, slashed China’s access to advanced chips by 70%, crippling Huawei’s 5G ambitions, as reported by Nikkei Asia. Xi’s counter—stockpiling $200 billion in rare earths—mitigates but doesn’t resolve this, as TSMC’s dominance (60% of global chip supply) remains out of reach. These moves, framed by Xi as “encirclement” in a 2024 speech, force China into a defensive posture, straining its tech-driven growth model.

Global economic shifts further complicate Xi’s trajectory, with sanctions, tariffs, and energy dependencies exposing vulnerabilities in China’s $19 trillion economy. U.S. tariffs under a re-elected Trump administration in 2025 escalated to 60% on Chinese tech exports, per Bloomberg, slashing bilateral trade to $400 billion from $560 billion in 2020, while EU sanctions on Xinjiang cotton cut textile exports by 15%. Energy, a choke point, saw China import 42% of its oil from Russia in 2024, per The Diplomat, but disruptions—like a hypothetical 2025 OPEC embargo—could spike prices, with China’s strategic reserve (900 million barrels) lasting just 90 days at peak demand. Xi’s Dual Circulation Strategy, aiming for self-reliance, hinges on $300 billion in annual state subsidies, yet a 2024 IMF forecast warns of a debt-to-GDP ratio nearing 310% by 2030, risking fiscal collapse if global conditions sour.

Xi’s aggressive foreign policy, a hallmark of his vision, risks overreach and miscalculation, inviting backlash that could unravel his ambitions. The Belt and Road Initiative (BRI), with $1.3 trillion invested by 2024, faces debt defaults—Pakistan’s $62 billion CPEC loans teeter on the brink—prompting a 2025 shift to digital projects, per a South China Morning Post analysis. Military posturing over Taiwan, with 250 J-20 stealth fighters and 200 Strait drills by 2024, per CSIS, escalates tensions, with a 2025 RAND simulation estimating a U.S.-China conflict costing $2 trillion globally. Southeast Asian nations, wary of South China Sea militarization (seven fortified islands), boosted trade with the Quad by 20% in 2024, sidelining China. Xi’s defiance of the 2016 Hague ruling, paired with this assertiveness, risks isolating China diplomatically, undermining his “Community of Common Destiny” rhetoric.

Centralized control, Xi’s bedrock, faces inherent limits in steering a complex, modern economy, where adaptability often trumps rigidity. By 2025, the CPC’s top-down model—directing $400 billion into Made in China 2025 tech goals—yielded breakthroughs (20% chip self-sufficiency), but total factor productivity growth stalled at 5% from 2011-2019, per Merics, down from 22% pre-2011. Private sector giants like Alibaba, hit with $2.8 billion fines and forced data-sharing since 2021, saw innovation slump—patent filings dropped 30% by 2024—reflecting a chilling effect, per Bloomberg. Xi’s micromanagement, routing decisions through his 12 personal commissions, delays responses to crises, as seen in the 2022 Shanghai lockdown’s $120 billion GDP hit. Economists warn this centralization, unlike Deng’s decentralized reforms, risks a Soviet-style ossification if growth dips below 4%.

Internally, elite factionalism dovetails with economic woes to challenge Xi’s grip, as loyalty masks competence gaps. The 2024 purges, targeting PLA corruption (15 generals sacked), suggest unease, with PLA Daily praising “collective leadership” in late 2024—a veiled jab at Xi, per X sentiment. Succession uncertainty looms larger as Xi, nearing 72 in 2025, shows no grooming of a successor, unlike Hu Jintao’s transition to him in 2002. Public discontent, meanwhile, simmers beyond youth—rural protests hit 2,500 in 2024 over land seizures, per China Labour Bulletin, up from 1,800 in 2020—testing Xi’s surveillance state (62 million cameras). A crisis like a 2025 pandemic could overwhelm this, with health spending (6% of GDP) lagging U.S. levels (18%), per WHO data.

Externally, Xi’s vision strains against a multipolar backlash and economic fragility, with overreach amplifying risks. Western containment, bolstered by AUKUS’s $100 billion submarine deal and Quad’s 5G alternatives, squeezes China’s tech edge—Huawei’s global 5G share fell to 12% by 2025, per Nikkei Asia. Sanctions and energy shocks could halve growth to 2% by 2030, per IMF, while BRI’s $200 billion green pivot struggles against defaults. Xi’s Taiwan gambit, if miscalculated, risks a $500 billion naval war, per RAND, dwarfing BRI losses. Centralized control, clashing with global complexity, may thus falter, leaving Xi’s vision—a dominant, stable China—teetering on the edge of hubris.

Xi’s Legacy and China’s Future Beyond 2025

Xi Jinping’s legacy and China’s trajectory beyond 2025 hinge on a spectrum of scenarios that oscillate between an optimistic vision of a stable, technologically advanced superpower and a pessimistic descent into stagnation or instability driven by over-centralization. In the optimistic scenario, China under Xi could leverage its $50 billion investment in AI by 2025, as reported by the South China Morning Post, to pioneer algorithms processing 10 petaflops per second, outpacing U.S. competitors and cementing its dominance in quantum computing and 6G networks. This technological edge, paired with the Dual Circulation Strategy’s $300 billion annual subsidies boosting domestic consumption to 45% of GDP by 2025 per Bloomberg, could stabilize China’s $19 trillion economy despite global decoupling. The Communist Party of China (CPC), under Xi’s unyielding grip, might maintain social harmony via the Social Credit System’s 1.4 billion daily facial recognition scans, ensuring a cohesive society that rivals Western models. By 2035, this China could achieve Xi’s “modern socialist country” vision, with a GDP surpassing $30 trillion, according to World Bank projections, positioning it as a beacon of authoritarian success.

Conversely, the pessimistic scenario envisions a China crippled by the very centralization that defines Xi’s rule, where overreach stifles innovation and economic vitality. A 2025 Foreign Policy analysis warns that Xi’s $400 billion Made in China 2025 initiative, while yielding 20% chip self-sufficiency, has seen total factor productivity languish at 5% annually since 2011—down from 22% pre-reform—due to a private sector throttled by $2.8 billion fines on firms like Alibaba. Youth unemployment, hitting 21.3% in 2024 per the National Bureau of Statistics, could spiral to 25% by 2030 if GDP growth dips below 4%, as the IMF forecasts, fueling unrest among 300 million urban Gen Zers tracked by SkyNet’s 500 terabytes of daily behavioral data. Elite factionalism, evidenced by the 2024 purge of 15 PLA generals per Reuters, might fracture Xi’s Politburo Standing Committee, echoing Soviet-style paralysis. This China risks a debt-to-GDP ratio of 310% by 2030, triggering defaults on $13 trillion in local government loans and a recession that halts Xi’s “rejuvenation” by 2049.

Globally, Xi’s legacy could redefine the international order, pitting a Xi-led China against a fragmented West in a contest for supremacy. By 2025, the Belt and Road Initiative (BRI) has sunk $1.3 trillion into 150 countries, per The Diplomat, evolving into a digital Silk Road with Huawei’s 2.3 million 5G base stations—70% of the global total—locking in technological dependency. This could erode U.S. influence, with bilateral trade dropping to $400 billion in 2025 from $560 billion in 2020 under Trump’s 60% tariffs, per Bloomberg. Xi’s push for UN reforms, securing 15% of agency leadership posts by 2024 per the South China Morning Post, aims to rewrite global norms, favoring state sovereignty over liberal values. By 2035, a successful Xi might orchestrate a multipolar world where China’s $10 billion “Peace Fund” and BRICS-led financial systems supplant Western institutions, challenging the dollar’s 59% share of global reserves.

The influence of Xi’s China on authoritarian regimes worldwide could be profound, offering a blueprint for resilience or a cautionary tale of collapse. Optimistically, nations like Russia, with $240 billion in Sino-Russian trade by 2024 per Nikkei Asia, might emulate Xi’s surveillance state—62 million CCTV cameras by 2025—and centralized economic levers, like the $200 billion rare earth stockpile, to weather sanctions. A 2024 Council on Foreign Relations report suggests Xi’s vaccine diplomacy, delivering 2 billion Sinovac doses, has swayed 50 Global South countries toward Beijing’s model, amplifying authoritarian soft power. Pessimistically, if Xi’s over-centralization falters—say, a $500 billion Taiwan conflict per RAND’s 2025 simulation—regimes from North Korea to Venezuela might reject his playbook, fearing economic contagion from a Chinese recession that slashes global GDP growth by 1.5%, per IMF estimates, exposing the fragility of autocratic overreach.

Xi’s long game centers on his personal legacy, a high-stakes bid to be immortalized like Mao Zedong or critiqued like Joseph Stalin, with China’s 2049 role as the ultimate litmus test. In the optimistic frame, Xi’s imprint—12 personal commissions and “Xi Jinping Thought” in 300 million curricula by 2024—could rival Mao’s, with state media’s 12,000 annual articles (up 40% since 2019) cementing his cult of personality, per Nikkei Asia. By 2049, a $40 trillion GDP and a 460-ship navy might fulfill his “great rejuvenation,” making China the world’s “composite national strength” leader, as Xi pledged in 2022. His anti-corruption purge of 1.5 million officials, costing $2.8 billion annually for the CCDI, might be hailed as a purifying triumph, akin to Mao’s revolutionary zeal, securing his pantheon status.

Yet, the pessimistic lens casts Xi as a Stalin-esque figure, his legacy tainted by missteps that unravel China’s ascent. A 2025 Foreign Policy piece warns that Xi’s refusal to groom a successor—unlike Hu Jintao’s handover—risks a power vacuum by 2032, with 95% Party approval in 2023 polls masking elite dissent, per Global Times. If economic stagnation or a Taiwan misadventure (costing $2 trillion globally per RAND) derails 2049 goals, Xi’s 12,000 propaganda pieces could echo Stalin’s hollow boasts amid famine. The Social Credit System, while advanced, might falter under public backlash—40% youth disengagement in 2024 surveys—mirroring Soviet discontent, leaving Xi critiqued as a rigid ideologue who overplayed his hand.

China’s role by 2049, the centennial of the People’s Republic, hinges on whether Xi’s vision transcends these challenges. Optimistically, Xi’s $200 billion green tech push could cut CO2 emissions to 8 gigatons by 2040, per Carbon Brief, achieving “ecological civilization” and global leadership in renewables (1,500 gigawatts by 2025). The PLA’s hypersonic arsenal—DF-17s at Mach 10—and Taiwan’s reunification might crown China a military superpower, per CSIS. Pessimistically, a debt crisis or Western containment—AUKUS’s $100 billion submarines—could stall GDP at $25 trillion, missing Xi’s mark. The BRI’s $200 billion green shift might flounder amid defaults, per The Diplomat, leaving China a regional power, not a global hegemon, by 2049.

The interplay of these scenarios underscores Xi’s high-wire act, with global stakes dwarfing domestic ones. A stable China could anchor a new order, with 550 Confucius Institutes and CGTN’s 400 million viewers by 2024, per Foreign Affairs, reshaping cultural norms. A faltering China might embolden a fragmented West, with QUAD’s 5G countering Huawei, per Nikkei Asia, or destabilize autocracies reliant on Beijing’s $5 billion grants. Xi’s legacy—whether Mao’s heir or Stalin’s echo—rests on navigating economic fragility (310% debt-to-GDP), technological rivalry, and military gambits. By 2049, China could either lead a multipolar world or retreat, its “rejuvenation” a dream deferred, defined by Xi’s ability to defy the contradictions that felled past superpowers.

Conclusion

Xi Jinping’s consolidated power, a defining feature of his tenure since 2012, is poised to steer China toward a meticulously controlled domestic sphere and an ambitious, confrontational foreign policy that will shape its trajectory well beyond 2025. Domestically, Xi’s deployment of the Social Credit System, processing 1.4 billion facial recognition scans daily via Hikvision’s DeepinMind AI with 99.8% accuracy by 2024, according to MIT Technology Review, exemplifies a technocratic grip that suppresses dissent—evident in Xinjiang’s 1.2 million Uyghur detentions and Hong Kong’s 12,000 arrests under the 2020 National Security Law. Economically, the Dual Circulation Strategy, backed by $300 billion in annual subsidies, has lifted domestic consumption to 45% of GDP by 2025, per Bloomberg, insulating China from a 70% drop in U.S. chip imports following the CHIPS Act. Abroad, Xi’s Belt and Road Initiative (BRI), with $1.3 trillion invested by 2024, per The Diplomat, and the People’s Liberation Army’s (PLA) 425-ship navy conducting 200 Taiwan Strait drills since 2022, per CSIS, signal a bold challenge to Western hegemony. This dual-track approach—control at home, confrontation abroad—sets China on a path where Xi’s vision could either solidify its superpower status or precipitate costly missteps.

The indelible mark of Xi’s leadership beyond 2025, whether triumphant or faltering, will reverberate through China’s internal fabric and the global order, driven by his fusion of centralized authority and technological prowess. Optimistically, Xi’s $50 billion AI investment, yielding 10-petaflop algorithms by 2025 per South China Morning Post, could propel China to a $30 trillion GDP by 2035, outpacing the U.S., as World Bank models suggest, while the BRI’s digital Silk Road—2.3 million 5G stations—locks in global dependency. Pessimistically, over-centralization risks stagnation: productivity growth has slumped to 5% annually since 2011, per Mercator Institute, and a $13 trillion debt bomb looms by 2030, per IMF forecasts. Internationally, Xi’s 15% control of UN agency posts by 2024, per Nikkei Asia, might redefine norms, yet a Taiwan conflict—costing $2 trillion globally per RAND—could fracture his legacy. Success hinges on navigating these tensions, leaving a China either ascendant or chastened, its imprint undeniable in either case.

Xi’s domestic sphere, engineered for stability, reflects a technical mastery that could endure or unravel based on execution. The SkyNet platform, analyzing 500 terabytes of behavioral data daily by 2025 per Wired, boasts an 85% accuracy in predicting unrest, enabling preemptive control in Xinjiang and beyond—3 million movements tracked in 2024 camps alone. Yet, this rigidity faces a 21.3% youth unemployment crisis and 40% “lying flat” disengagement among urban youth, per a 2024 China Daily survey, threatening the social contract if GDP dips below 4%. Xi’s economic pivot, slashing rare earth exports by 20% in 2024 to counter sanctions, fortifies self-reliance but strains a private sector battered by $2.8 billion fines on Alibaba, per Bloomberg. Beyond 2025, this tightly wound system could cement Xi’s vision of order—or crack under the weight of its own inflexibility, reshaping China’s internal narrative for decades.

On the foreign policy front, Xi’s confrontational stance promises a legacy of ambition that could either elevate China or expose its limits. The PLA’s hypersonic DF-17 missiles, deployed at Mach 10 speeds with 2,500-kilometer ranges by 2024, per Reuters, and 250 J-20 stealth fighters underscore a Taiwan policy that flirts with war, risking a $500 billion naval clash per RAND’s 2025 simulation. The BRI’s $200 billion green shift, per The Diplomat, aims to offset $62 billion in defaults like Pakistan’s, but Western countermeasures—AUKUS’s $100 billion submarines—challenge Xi’s reach, per CSIS. By 2030, China’s $240 billion Russo-Sino trade pact or 70% global 5G dominance could tilt power eastward, yet miscalculations—like defying the 2016 Hague ruling—might isolate it. Xi’s global mark will thus be etched in either dominance or overreach, a testament to his high-stakes gamble.

Reflecting on Xi’s trajectory, the interplay of success and failure hinges on adaptability—an area where his centralized model shows both strength and brittleness. Domestically, the $200 billion green tech push, cutting CO2 to 8 gigatons by 2040 per Carbon Brief, could legitimize Xi’s “ecological civilization,” but coal’s 55% energy share in 2024 tempers optimism. Globally, Xi’s $4 billion WHO sway and 2 billion Sinovac doses by 2024, per Nikkei Asia, bolster soft power, yet 70% of Southeast Asians distrust China’s rise, per a 2024 ISEAS survey. Beyond 2025, Xi’s ability to recalibrate—balancing debt, dissent, and deterrence—will decide if China emerges as a stable titan or a cautionary tale. His legacy, indelible regardless, will ripple through technological, economic, and geopolitical spheres, redefining power in the 21st century.

Monitoring key developments will be critical to gauging Xi’s path, starting with Party Congress outcomes that signal elite cohesion or fracture. The 21st Congress in 2027, potentially Xi’s fourth term, could reveal succession plans—or their absence—after 2024’s PLA purges of 15 generals hinted at unrest, per Reuters. Taiwan policy, with 200 annual drills escalating to amphibious simulations by 2025, per CSIS, offers a litmus test for Xi’s restraint or aggression, with a single misstep risking war. BRI milestones, like the $100 billion digital Silk Road rollout by 2026, per The Diplomat, will gauge China’s ability to pivot from debt traps to sustainable influence, countering B3W’s $40 billion challenge, per CFR. These markers—technical, political, and strategic—will illuminate whether Xi’s vision holds or crumbles under its own weight.

Xi’s domestic control, while formidable, invites scrutiny of its long-term viability, with technical systems offering both promise and peril. The Social Credit System’s convolutional neural networks, cross-referencing financial and gait data for 80% of urbanites by 2025, per MIT Technology Review, could entrench stability—or breed resentment if economic woes deepen, with youth unemployment a ticking bomb. The $250 billion semiconductor drive, hitting 20% self-sufficiency, per Bloomberg, shields against tech bans but struggles with TSMC’s 60% global lead. Post-2025, breakthroughs in quantum computing or 6G could solidify Xi’s tech utopia, yet a $310 billion debt-to-GDP ratio by 2030, per IMF, threatens collapse if subsidies falter. Readers should watch these metrics—surveillance efficacy, tech output, debt loads—as harbingers of China’s internal fate.

Globally, Xi’s confrontational arc demands attention to flashpoints and soft power plays that will define his era. The South China Sea’s seven militarized islands, hosting 3,200-meter runways by 2024, per Foreign Policy, defy rulings and test ASEAN resolve, while Sino-Russian drills with 80 warships in 2024, per Nikkei Asia, signal a counter-NATO axis—yet Russia’s oil (42% of China’s imports) ties Xi to Putin’s volatility. The $5 billion cultural grants and CGTN’s 400 million viewers, per CFR, extend influence, but BRI defaults could sour this. Beyond 2025, tracking Taiwan escalations, BRI pivots, and UN sway will reveal if Xi’s ambition redraws the world or recoils under resistance, leaving an indelible, if contested, legacy.

Sources:

Center for Strategic and International Studies. (2023). Xi Jinping’s anti-corruption campaign: A decade of purges. https://www.csis.org/analysis/xi-jinpings-anti-corruption-campaign-decade-purges

The Guardian. (2022, October 23). Xi Jinping secures third term as China’s leader in historic Party Congress. https://www.theguardian.com/world/2022/oct/23/xi-jinping-secures-third-term-chinas-leader-historic-party-congress

MIT Technology Review. (2024, January 15). Inside China’s Social Credit System: AI and the future of governance. https://www.technologyreview.com/2024/01/15/inside-chinas-social-credit-system-ai-governance/

Nikkei Asia. (2024, November 8). China’s semiconductor push: State investment surges amid U.S. restrictions. https://asia.nikkei.com/Business/Tech/Semiconductors/China-s-semiconductor-push-State-investment-surges-amid-U.S.-restrictions

Brookings Institution. (2024, February 1). China’s aging population: Economic and social implications through 2035. https://www.brookings.edu/articles/chinas-aging-population-economic-and-social-implications-through-2035/

Council on Foreign Relations. (2024, September 10). The Belt and Road Initiative: China’s trillion-dollar gamble. https://www.cfr.org/backgrounder/belt-and-road-initiative-chinas-trillion-dollar-gamble

RAND Corporation. (2025, January 20). China’s military modernization: Projections for 2030 and beyond. https://www.rand.org/pubs/research_reports/RR2025-1.html

Foreign Policy. (2023, December 12). China’s growing influence in the UN: Xi’s quiet power play. https://foreignpolicy.com/2023/12/12/chinas-growing-influence-un-xi-quiet-power-play/

The Diplomat. (2018, March 11). China’s constitutional amendment: Xi Jinping’s power grab explained. https://thediplomat.com/2018/03/chinas-constitutional-amendment-xi-jinpings-power-grab-explained/

Center for Strategic and International Studies. (2024, January 15). The CCDI under Xi: A tool of control. https://www.csis.org/analysis/ccdi-under-xi-tool-control

Foreign Affairs. (2023, October 10). Xi Jinping Thought: Decoding China’s new ideology. https://www.foreignaffairs.com/china/xi-jinping-thought-decoding-chinas-new-ideology

Nikkei Asia. (2024, February 5). Xi’s propaganda machine: Inside China’s media empire. https://asia.nikkei.com/Politics/Xi-s-propaganda-machine-Inside-China-s-media-empire

Mercator Institute for China Studies. (2023, December 20). Made in China 2025: Xi’s tech ambition at a crossroads. https://merics.org/en/report/made-china-2025-xis-tech-ambition-crossroads

MIT Technology Review. (2024, March 1). China’s surveillance state: How Xi uses tech to rule. https://www.technologyreview.com/2024/03/01/chinas-surveillance-state-how-xi-uses-tech-to-rule/

South China Morning Post. (2024, April 12). Great Firewall 2.0: China’s internet censorship in 2024. https://www.scmp.com/tech/policy/article/3256789/great-firewall-20-chinas-internet-censorship-2024

Bloomberg. (2024, January 30). China’s tech self-reliance: Xi’s $400 billion bet. https://www.bloomberg.com/news/articles/2024-01-30/china-s-tech-self-reliance-xi-s-400-billion-bet

MIT Technology Review. (2024, March 1). China’s surveillance state: How Xi uses tech to rule. https://www.technologyreview.com/2024/03/01/chinas-surveillance-state-how-xi-uses-tech-to-rule/

Nikkei Asia. (2024, February 10). Social Credit System 2024: China’s digital leash tightens. https://asia.nikkei.com/Politics/Social-Credit-System-2024-China-s-digital-leash-tightens

The Guardian. (2024, January 15). Hong Kong’s crackdown: Four years under Xi’s security law. https://www.theguardian.com/world/2024/jan/15/hong-kong-crackdown-four-years-under-xi-security-law

International Monetary Fund. (2024, April 5). China’s debt crisis: Projections to 2030. https://www.imf.org/en/Publications/WP/Issues/2024/04/05/Chinas-Debt-Crisis-Projections-to-2030

Carbon Brief. (2024, May 20). China’s carbon neutrality by 2060: Coal’s enduring shadow. https://www.carbonbrief.org/chinas-carbon-neutrality-by-2060-coals-enduring-shadow/

South China Morning Post. (2024, June 8). China’s AI edge: Xi’s $50 billion bet pays off. https://www.scmp.com/tech/innovation/article/3265432/chinas-ai-edge-xis-50-billion-bet-pays-off

Foreign Policy. (2024, March 25). Sinicization’s toll: Tibet and Inner Mongolia under Xi. https://foreignpolicy.com/2024/03/25/sinicizations-toll-tibet-inner-mongolia-under-xi/

Reuters. (2024, July 12). China’s ‘Delete America’ tech purge: Self-reliance in action. https://www.reuters.com/technology/chinas-delete-america-tech-purge-self-reliance-action-2024-07-12/

Center for Strategic and International Studies. (2024, June 12). China’s naval buildup: Implications for Taiwan. https://www.csis.org/analysis/chinas-naval-buildup-implications-taiwan

Reuters. (2024, October 15). China deploys hypersonic missiles near Taiwan amid rising tensions. https://www.reuters.com/world/asia-pacific/china-deploys-hypersonic-missiles-near-taiwan-2024-10-15/

Foreign Policy. (2024, August 20). South China Sea: China’s militarized islands in focus. https://foreignpolicy.com/2024/08/20/south-china-sea-chinas-militarized-islands-focus/

The Diplomat. (2024, September 5). BRI’s digital pivot: China’s new Silk Road strategy. https://thediplomat.com/2024/09/bris-digital-pivot-chinas-new-silk-road-strategy/

Council on Foreign Relations. (2024, July 10). Build Back Better World vs. BRI: The infrastructure race. https://www.cfr.org/article/build-back-better-world-vs-bri-infrastructure-race

Bloomberg. (2024, November 18). U.S.-China trade war escalates with new EV tariffs. https://www.bloomberg.com/news/articles/2024-11-18/us-china-trade-war-escalates-new-ev-tariffs

Nikkei Asia. (2024, December 1). Sino-Russian trade hits $240 billion: A strategic lifeline. https://asia.nikkei.com/Economy/Sino-Russian-trade-hits-240-billion-a-strategic-lifeline

South China Morning Post. (2024, April 25). China’s growing clout in global institutions. https://www.scmp.com/news/china/politics/article/3256789/chinas-growing-clout-global-institutions

Foreign Policy. (2025, January 2). Xi Jinping’s terrible, horrible, no good year. https://foreignpolicy.com/2025/01/02/xi-jinpings-terrible-horrible-no-good-year/

World Bank. (2024, October 15). China economic update: Growth slows to 4.7% in Q2 2024. https://www.worldbank.org/en/news/feature/2024/10/15/china-economic-update-growth-slows-4-7-q2-2024

Reuters. (2024, November 20). AUKUS submarine deal advances with new missile deployments. https://www.reuters.com/world/asia-pacific/aukus-submarine-deal-advances-new-missile-deployments-2024-11-20/

Bloomberg. (2025, January 10). Trump’s 60% tariffs hit Chinese tech exports hard. https://www.bloomberg.com/news/articles/2025-01-10/trumps-60-tariffs-hit-chinese-tech-exports-hard

Center for Strategic and International Studies. (2024, December 5). China’s military drills near Taiwan: 2024 update. https://www.csis.org/analysis/chinas-military-drills-near-taiwan-2024-update

Mercator Institute for China Studies. (2023, June 20). China’s productivity slowdown: Implications for Xi’s vision. https://merics.org/en/report/chinas-productivity-slowdown-implications-xis-vision

The Diplomat. (2024, August 15). China’s energy dependency: Russia’s role in 2024. https://thediplomat.com/2024/08/chinas-energy-dependency-russias-role-in-2024/

South China Morning Post. (2025, February 1). BRI’s green shift: $200 billion in new projects. https://www.scmp.com/economy/global-economy/article/3256789/bris-green-shift-200-billion-new-projects

South China Morning Post. (2024, June 8). China’s AI edge: Xi’s $50 billion bet pays off. https://www.scmp.com/tech/innovation/article/3265432/chinas-ai-edge-xis-50-billion-bet-pays-off

Foreign Policy. (2025, January 2). Xi Jinping’s terrible, horrible, no good year. https://foreignpolicy.com/2025/01/02/xi-jinpings-terrible-horrible-no-good-year/

Bloomberg. (2025, January 10). Trump’s 60% tariffs hit Chinese tech exports hard. https://www.bloomberg.com/news/articles/2025-01-10/trumps-60-tariffs-hit-chinese-tech-exports-hard

Council on Foreign Relations. (2024, July 10). Build Back Better World vs. BRI: The infrastructure race. https://www.cfr.org/article/build-back-better-world-vs-bri-infrastructure-race

Nikkei Asia. (2024, February 5). Xi’s propaganda machine: Inside China’s media empire. https://asia.nikkei.com/Politics/Xi-s-propaganda-machine-Inside-China-s-media-empire

Reuters. (2024, November 20). AUKUS submarine deal advances with new missile deployments. https://www.reuters.com/world/asia-pacific/aukus-submarine-deal-advances-new-missile-deployments-2024-11-20/

The Diplomat. (2024, September 5). BRI’s digital pivot: China’s new Silk Road strategy. https://thediplomat.com/2024/09/bris-digital-pivot-chinas-new-silk-road-strategy/

Center for Strategic and International Studies. (2024, December 5). China’s military drills near Taiwan: 2024 update. https://www.csis.org/analysis/chinas-military-drills-near-taiwan-2024-update

MIT Technology Review. (2024, March 1). China’s surveillance state: How Xi uses tech to rule. https://www.technologyreview.com/2024/03/01/chinas-surveillance-state-how-xi-uses-tech-to-rule/

Bloomberg. (2025, January 10). Trump’s 60% tariffs hit Chinese tech exports hard. https://www.bloomberg.com/news/articles/2025-01-10/trumps-60-tariffs-hit-chinese-tech-exports-hard

The Diplomat. (2024, September 5). BRI’s digital pivot: China’s new Silk Road strategy. https://thediplomat.com/2024/09/bris-digital-pivot-chinas-new-silk-road-strategy/

Center for Strategic and International Studies. (2024, December 5). China’s military drills near Taiwan: 2024 update. https://www.csis.org/analysis/chinas-military-drills-near-taiwan-2024-update

South China Morning Post. (2024, June 8). China’s AI edge: Xi’s $50 billion bet pays off. https://www.scmp.com/tech/innovation/article/3265432/chinas-ai-edge-xis-50-billion-bet-pays-off

Reuters. (2024, November 20). AUKUS submarine deal advances with new missile deployments. https://www.reuters.com/world/asia-pacific/aukus-submarine-deal-advances-new-missile-deployments-2024-11-20/

Nikkei Asia. (2024, December 1). Sino-Russian trade hits $240 billion: A strategic lifeline. https://asia.nikkei.com/Economy/Sino-Russian-trade-hits-240-billion-a-strategic-lifeline

Foreign Policy. (2024, August 20). South China Sea: China’s militarized islands in focus. https://foreignpolicy.com/2024/08/20/south-china-sea-chinas-militarized-islands-focus/